Shares of Jubilant Pharmova Ltd. hit a three-year high on Monday after its Singapore-based step-down subsidiary, Jubilant Biosys Innovative Research Services, agreed to buy France-based Pierre Fabre's R&D Centre.

The company said it has issued a "put option offer" to Pierre Fabre Laboratories, offering to acquire 80% equity capital worth approximately 4.4 million euro over a period of two years, according to an exchange filing. The company will incorporate a new company in France, which will acquire Pierre Fabre's R&D Centre, including R&D site and R&D activities at Saint Julien, France.

Jubilant Biosys Innovative Research Services, Singapore, is a subsidiary of Jubilant Biosys Ltd, a wholly owned subsidiary of Jubilant Pharmova.

In addition, Pierre Fabre Laboratories may invest 20% equity capital worth 1.1 million euro over a period of 2 years in the above-mentioned new company for a maximum period of five years, during which time they may continue to provide support to the new company, the filing said.

Further, Pierre Fabre Laboratories may also hire services from Jubilant Biosys, aggregating to €7 million for the first four years post-closing date.

"This transaction will enable Jubilant Biosys to establish a centre of excellence in Europe for biologics and antibody drug conjugates, which opens up a total addressable market of $500 million," the company said.

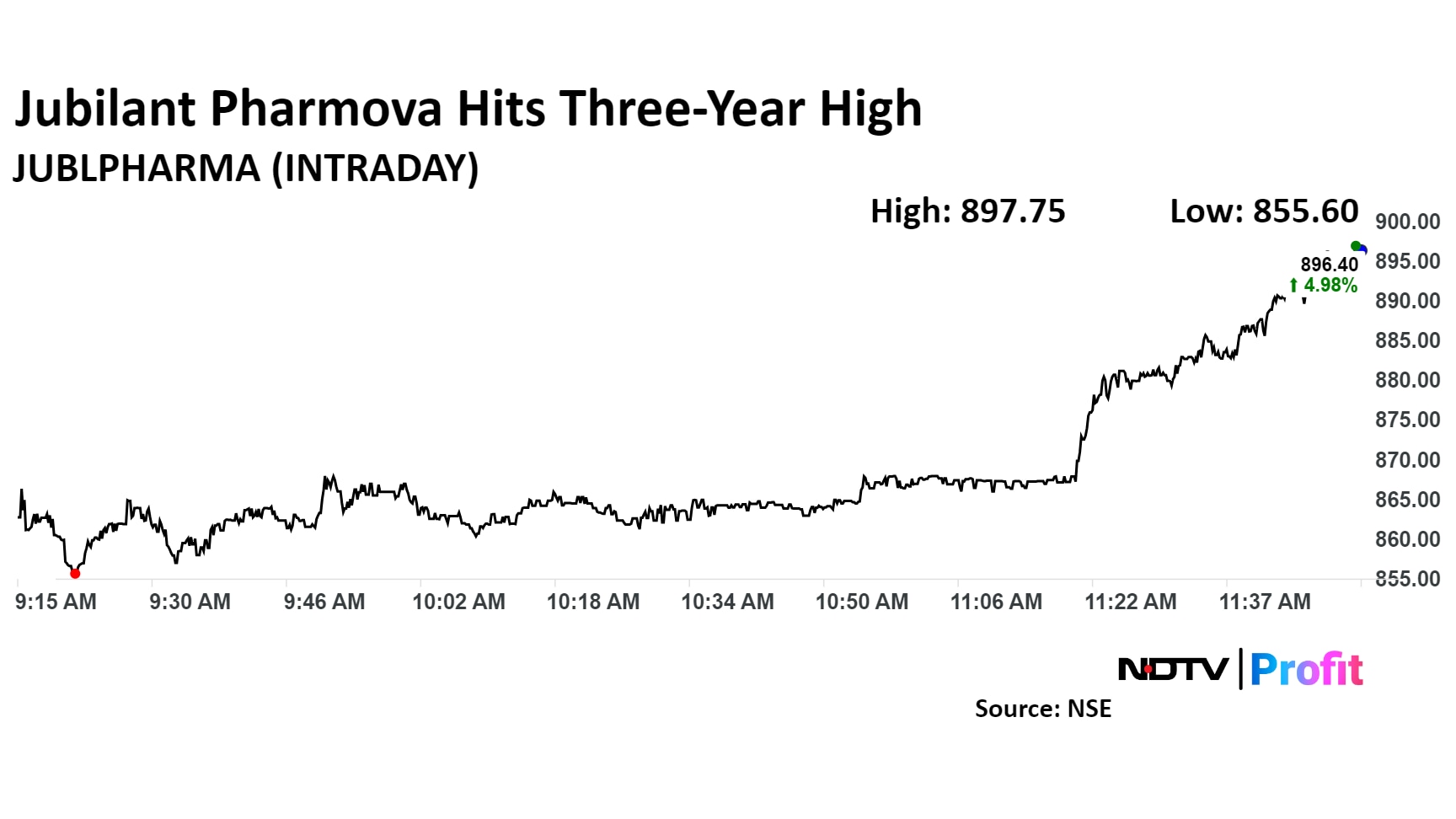

Shares of the company rose as much as 6.6% to Rs 910.25 apiece, the highest level since May 28, 2021. It pared gains to trade 5.34% higher at Rs 899.50 apiece as of 12:30 p.m. This compares to a flat NSE Nifty 50 Index.

The stock has risen 65% on a year-to-date basis and 92% in the last 12 months. Total traded volume so far in the day stood at 0.65 times its 30-day average. The relative strength index was at 73.93, indicating that the stock may be overbought.

Both the analysts tracking the company have a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies a downside of 1.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.