Jindal Steel & Power Ltd.'s share price hit its 11-month-low on Friday, after the company reported an over 50% year-on-year fall in its consolidated net profit for the quarter ended December.

Despite this, its net profit beat consensus analysts estimates of Rs 877 crore and came in at Rs 950.5 crore. Revenue, however, rose 0.4% to Rs 11,751 crore, lower than Rs 11,847 crore expected.

Along with lower revenue and margin, the net profit was hit by higher current tax of Rs 361.99 crore, compared to Rs 42.37 crore last year.

Morgan Stanley has maintained its 'overweight' rating for the stock with target of Rs 1,200. It said that overall opex/t was slightly better than expected and there were no delays in the earlier discussed expansion plans. News of an additional capex plan over fiscal 2026-28 surprised the brokerage.

Motilal Oswal has cut its Ebitda estimates by 6%/17%/10% for FY25/FY26/FY27 to factor in a weaker-than-expected volume growth outlook. "We also await further clarity on the new capex plans to assess its specific implications on earnings," it said.

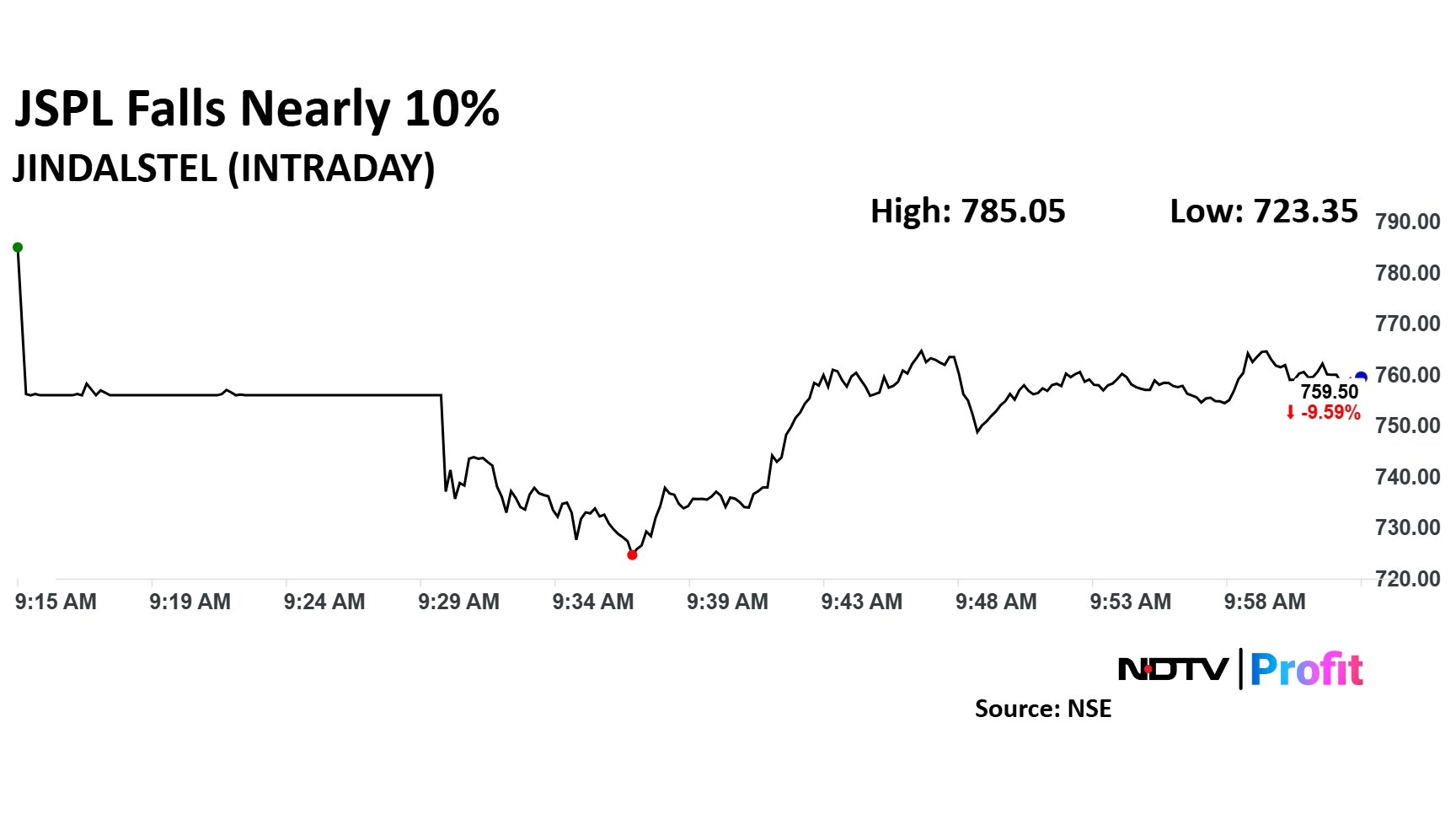

Jindal Steel Share Price Today

The scrip fell as much as 13.9% to Rs 723.35 apiece, the lowest level since Feb. 14, 2024. It pared losses to trade 10.05% lower at Rs 753 apiece, as of 10:14 a.m. This compares to a 0.3% advance in the NSE Nifty 50.

It has risen 0.2% in the last 12 months. Total traded volume so far in the day stood at 8.12 times its 30-day average. The relative strength index was at 21.3, indicating that the stock may be oversold.

Out of 28 analysts tracking the company, 20 maintain a 'buy' rating, four recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 34.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.