Shares of Jindal Stainless Ltd. rose to an over four-month high after Jefferies initiated coverage with a 'buy' rating and a price target of Rs 800, its second-highest ever, citing the company's dominant position in India's stainless steel market and its robust financial profile.

The brokerage expects Jindal Stainless to deliver 10% volume and 21% compound growth in earnings per share with 17% return on equity over fiscals 2025 to 2027, calling the stock's valuation reasonable, especially given the 25% stainless steel premium over carbon steel globally.

Jindal Stainless is India's largest stainless steel producer, holding a 40% market share. With a 3mtpa capacity and a strong presence in construction, mobility, and premium segments, the company sells 85–90% of its volumes domestically and exports the rest, mainly to Europe and North America.

India is emerging as a global bright spot in stainless steel demand, said Jefferies, with consumption growing at 8% CAGR over fiscals 2009 to 2024, twice the global rate. On a per-capita basis, India still lags at 5 kg compared to 15–30 kg in the US and China, which Jefferies believes indicates strong growth potential. Elevated Chinese exports and weak global demand pose some risks, but the brokerage believes India's long-term consumption growth story remains intact.

Jindal Stainless' margin is tied closely to the China stainless steel price spread, currently at a 10-year low. While this is a near-term headwind, any recovery could lift margins. Meanwhile, global nickel prices have softened and demand is shifting from nickel-intensive NMC to LFP in EV batteries.

JDSL also boasts lower Ebitda per ton volatility than Indian peers like Tata Steel and Jindal Steel & Power, with a better balance sheet. Jefferies sees potential rerating, driven by volume growth, margin recovery, and sector tailwinds.

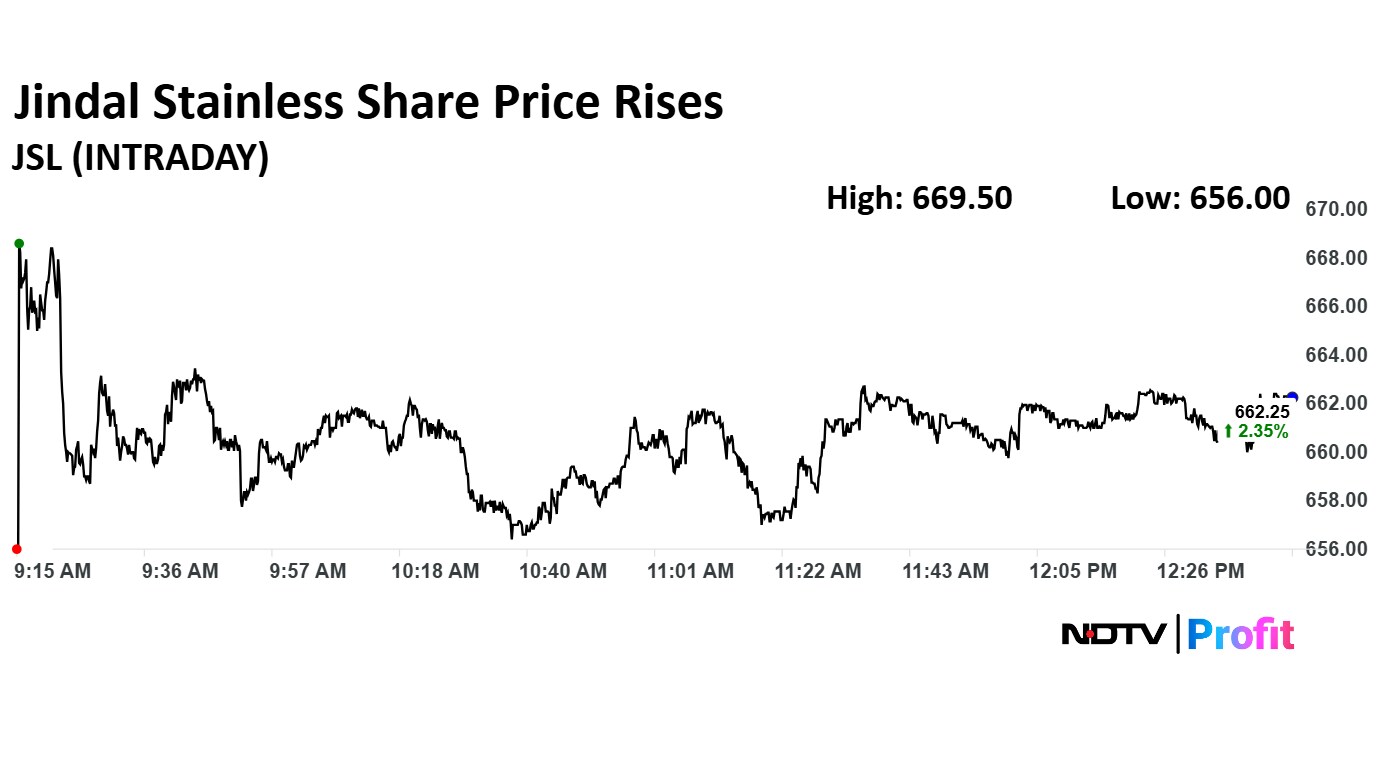

Jindal Stainless Share Price Today

The scrip rose as much as 3.47% to Rs 669.50 apiece, the highest level since Jan. 7, 2025. It pared gains to trade 2.34% higher at Rs 662.20 apiece, as of 12:30 p.m. This compares to a 0.23% decline in the NSE Nifty 50.

It has fallen 5.31% on a year-to-date basis, and 6.91% in the last 12 months. The relative strength index was at 68.74.

All 14 analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 10.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.