.jpg?downsize=773:435)

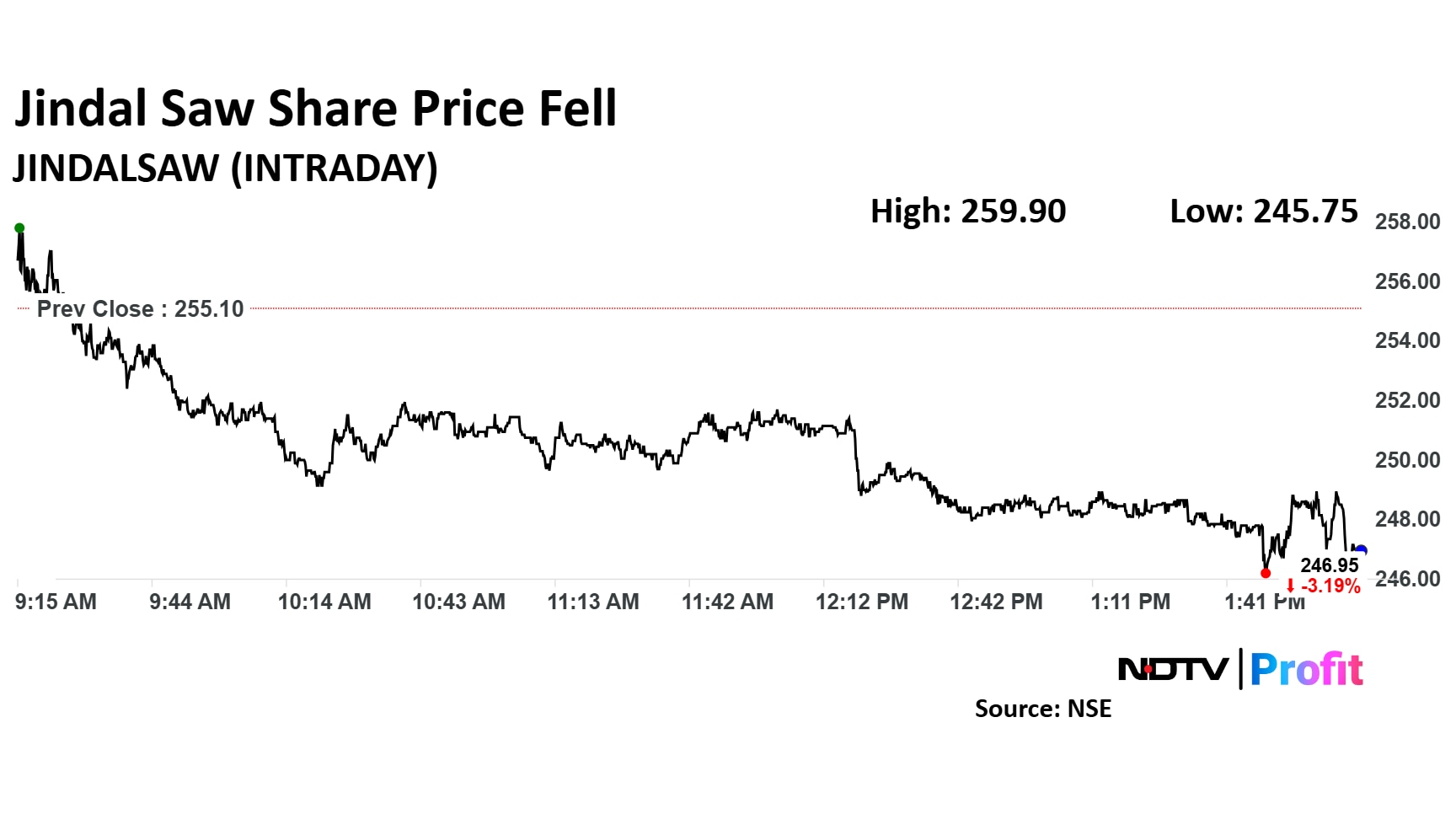

Jindal Saw Ltd.'s share price declined by 3.67% following the company's report of disappointing earnings for the third quarter of fiscal year 2024-25. Despite a slight increase in net profit, the company's overall performance showed signs of weakness as revenues and Ebitda both declined.

For the quarter ending December 31, 2024, Jindal Saw reported a 6.8% drop in revenue, which stood at Rs 5,271 crore compared to Rs 5,651 crore in the same period last year.

On a positive note, the company saw a marginal increase of 0.2% in the net profit, which rose to Rs 527 crore from Rs 526 crore in the previous year. However, this slight profit growth could not offset the overall weakness in other key financial metrics.

The company's earnings before interest, taxes, depreciation, and amortisation also showed a decline of 5%, falling to Rs 939 crore from Rs 987 crore in the corresponding quarter last year. The Ebitda margin saw a modest improvement, rising to 17.8% from 17.5% in the previous year.

The decline in sales and muted profit growth contributed to the drop in Jindal Saw's share price, signaling investor concern over the company's short-term performance amidst a fluctuating market environment.

Jindal Saw Ltd. is an Indian manufacturer and supplier of iron and steel pipes and pellets. It is a subsidiary of the O.P. Jindal Group, a prominent steel producer and exporter in India.

The scrip fell as much as 3.67% to Rs 245.75 apiece. It pared losses to trade 2.59% lower at Rs 248.50 apiece, as of 2:07 p.m.

It has risen 0.50% in the last 12 months. Total traded volume so far in the day stood at 0.6 times its 30-day average. The relative strength index was at 33.

The three analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 82.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.