Jefferies Takes $30 Million Hit On First Brands As Profit Drops

Net earnings for the fiscal fourth quarter declined 7.2% from a year earlier to $191 million, Jefferies said in a statement Wednesday.

Jefferies Financial Group Inc. posted a drop in quarterly profit as the bank took a $30 million pre-tax loss tied to the collapse of auto-parts supplier First Brands Group.

Net earnings for the fiscal fourth quarter declined 7.2% from a year earlier to $191 million, Jefferies said in a statement Wednesday.

While results were buoyed by a comeback in dealmaking and trading activity, the company’s asset-management operation incurred losses tied to First Brands, which filed for bankruptcy last year. Jefferies owns a 6% interest in a fund called Point Bonita, which had more than $700 million invested in receivables due by First Brands customers.

Jefferies has previously disclosed its exposure to First Brands through Point Bonita, which is managed by the bank’s Leucadia Asset Management arm.

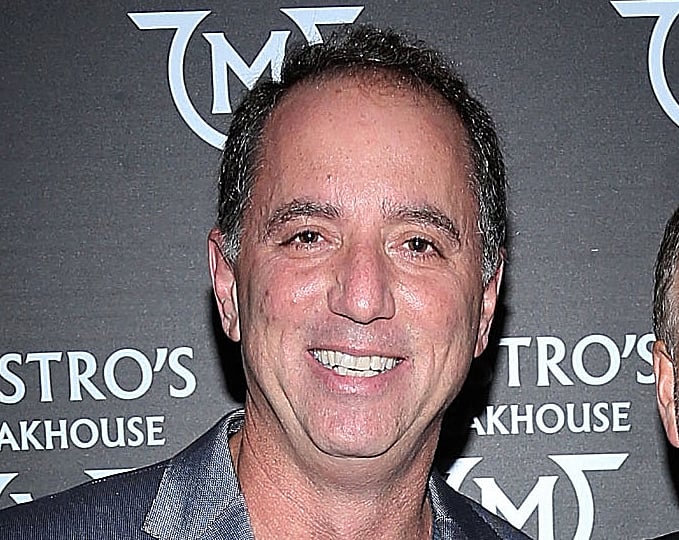

Most indicators for Jefferies are “upward and to the right,” Chief Executive Officer Rich Handler and President Brian Friedman wrote in a shareholder letter accompanying the results. But the pair acknowledged the “serious disappointment with the fraud and bankruptcy of First Brands substantially impacting Point Bonita.”

“We continue to adjust and improve our control regime,” Friedman said in an interview.

It was a stronger quarter overall for some of the bank’s other business. Revenue for the three months through November rose 5.7% from a year earlier to a fourth-quarter record of $2.07 billion, Jefferies said in the statement.

The firm’s investment-banking business built momentum in the period, with revenue surging 20% from a year earlier to $1.19 billion, Jefferies said.

Somewhere between May and June, “momentum began to build,” Friedman said.

Jefferies offers the first glimpse into how Wall Street navigated the last months of 2025 amid President Donald Trump’s trade wars and ongoing geopolitical tensions. The bank’s results signal that the nation’s biggest banks, scheduled to report earnings next week, may also see upticks in their investment-banking revenues.

The company saw a “stronger overall market” for the bank’s services, Friedman and Handler said in the shareholder letter. Advisory revenue was the second-highest on record, up 6.2% to $634 million. Debt and equity underwriting revenue also increased to about $556 million, due to market-share gains and increased activity in equity underwriting specifically, Jefferies said.

Trading Results

The biggest US banks have also benefited from market swings under Trump. That has been good news for trading desks.

Jefferies’ capital-markets unit generated about $692 million in revenue, up 6.2% from a year earlier. The bank touted growth in equities, where revenue jumped 18%. That helped offset a 14% decline in fixed-income trading revenue, Jefferies said.

While the firm doesn’t give earnings guidance, Jefferies said in the statement that the bank sees an “increasingly favorable environment.”

“All signs are that momentum will carry over into 2026, and absent a meaningful intervening event, 2026 should be a strong year of M&A and capital markets activity,” Friedman said in the interview.

Shares of Jefferies dropped 1% to $64 in extended trading at 4:18 p.m. in New York Wednesday. The stock had dropped 19% in the past 12 months.