Defence aircraft manufacturing giant Hindustan Aeronautics Ltd. is being awarded order wins at a fast pace, and its cumulated revenue growth is consistently moving towards double-digit growth, said brokerage firm Jefferies in its latest note.

The brokerage is keen on the defence sector, with HAL as its standout pick in the space. Jefferies has a 'buy' call on the counter with a target price of Rs 6,475, implying a potential 30% upside from the previous close.

HAL has five-year earnings growth visibility with a projected 19% EPS CAGR, backed by indigenisation efforts, stated Jefferies, noting that HAL has witnessed a 28% yearly increase in fiscal 2025 order inflows and 214% annual growth.

HAL, alongside fellow defence player Bharat Electronics Ltd., beat margin expectations with expansions of 831 basis points and 385 basis points on an annual basis, respectively, noted the brokerage. Both companies guided for sustaining or improving margins in fiscal 2026, buoyed by scale and cost efficiency, as per the note.

Jefferies also notes HAL's efforts in the sustainability space, mentioning the company's goal of sustainable sourcing, development projects and prioritising health in industrial operations.

Bull Case, Bear Case: What Jefferies Expects

Starting with the base case, Jefferies set its target price at Rs 6,475, indicating a 30% potential upside on the counter. The company has a visible pipeline of Rs 1.5-Rs 1.7 lakh crore, which Jefferies states offers enough visibility for medium-term revenue. "Rising indigenisation helps HAL on order flow growth," explained Jefferies.

On the flip side, the brokerage has a price target of Rs 3,750, seeing a potential dip of 25% if defence spending were to face roadblocks and the ordering process slows. Margin pressures may arise on execution due to indigenous manufacturing moving higher than expected, noted Jefferies.

However, Jefferies sees a whopping 50% upside potential for HAL in its bull case, with a price target of Rs 7,500 per share. This scenario may come into play if the Make in India programme gains momentum, propelling a higher number of domestic orders. Clearing the orders at a faster pace and gaining new tenders in the near future would be a further catalyst, as per the brokerage.

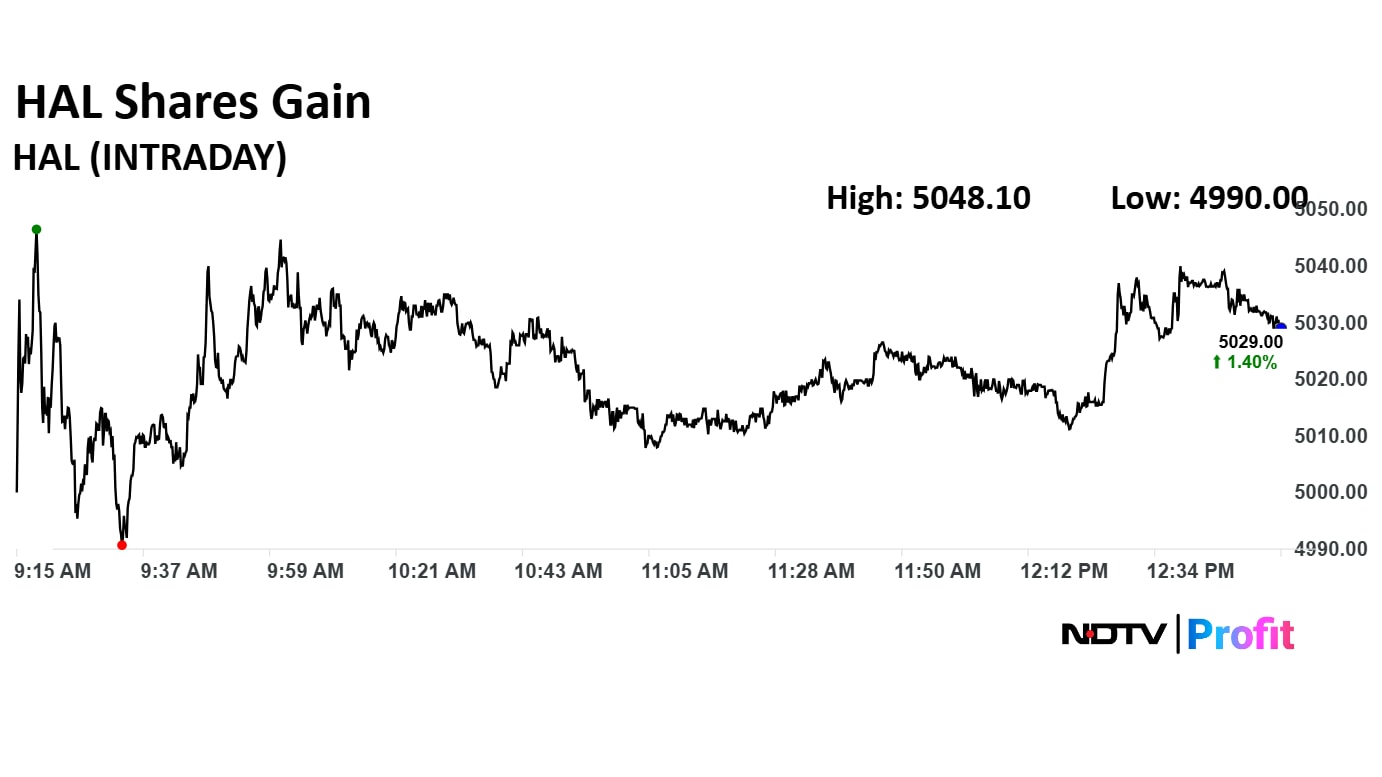

Hindustan Aeronautics Share Price

HAL has offered whopping returns of 1,789% in its journey over the past five years, with an upside of 20.3% year-to-date.

On Thursday, the scrip rose as much as 1.78% to Rs 5,048.10 apiece, the highest level since June 4, 2025. It pared gains to trade 1.44% higher at Rs 5,031.10 apiece, as of 12:56 p.m. This compares to a 0.79% advance in the NSE Nifty 50 Index.

Share price has risen 20.45% on a year-to-date basis, and is up 15.40% in the last 12 months. The relative strength index was at 61.61.

Out of 20 analysts tracking the company, 15 maintain a 'buy' rating, three recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 12.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.