- JBM ECOLIFE Mobility secured a $100 million investment from IFC, a World Bank Group entity

- The investment will fund around 1,455 electric buses in Maharashtra, Gujarat and Assam

- JBM Auto operates one of the world's largest e-bus plants with a 20,000-unit annual capacity

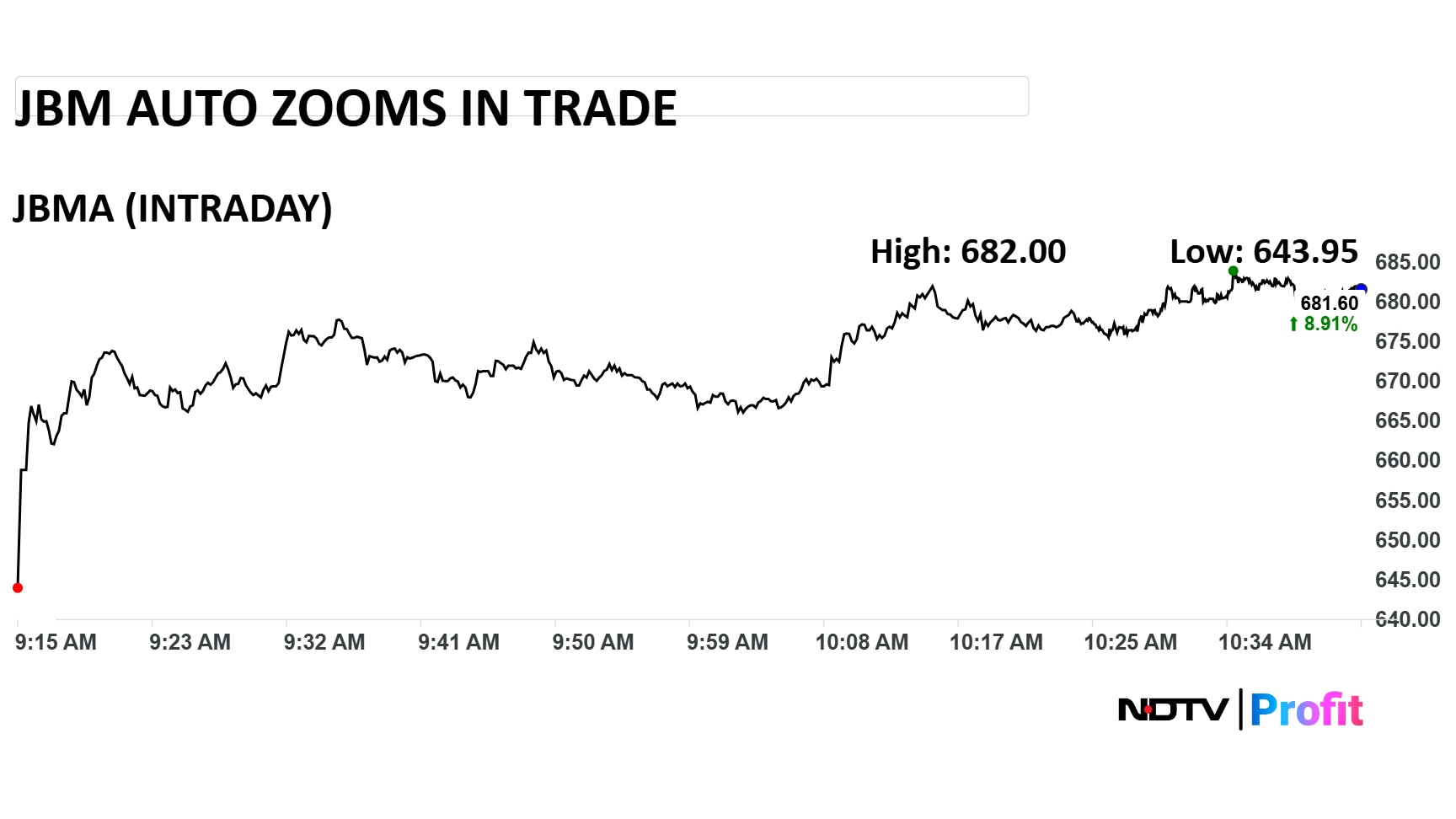

Shares of JBM Auto Ltd. rallied more than 8% in trade on Friday, buoyed by the news of its subsidiary, JBM ECOLIFE Mobility, securing a landmark $100 million long-term investment from the International Finance Corporation, a World Bank Group.

JBM Auto is currently trading at Rs 677 and had reached an intraday high of 682, making it one of the highest-gaining auto ancillary stocks in trade on Friday.

The investment from IFC is a key trigger for JBM Auto, as it will accelerate the deployment of modern, air-conditioned electric buses across key public transport networks in Maharashtra, Gujarat and Assam.

This also marks the first time IFC has invested in the electric bus sector in Asia. Funds from the investment will be used to finance the purchase and operation of around 1,455 electric buses, the company revealed in an exchange filing.

Photo: NDTV Profit

JBM Auto: A Key Player In India's E-Bus Story

JBM Auto share price rallied from the IFC investment as the company is a key player in India's e-Bus story. In a country which operates two million e-buses, JBM Auto plays the role of a key manufacturer.

Its Delhi-MCR manufacturing unit, in fact, is one of the world's largest e-Bus plants and has a capacity of 20,000 units annually.

To date, JBM Auto has delivered over 2,500 e-Buses across 10 states and 15 airports, the company added in the exchange filing.

Since 2018, JBM's e-buses have clocked in 200 million electric kilometres, serving over one billion passengers in the process. As India eyes 40% e-bus penetration by FY30, JBM Auto could likely play a key role in meeting this goal.

Currently trading at a relative strength index of 46.55, which suggests neutral market sentiment, shares of JBM Auto have fallen more than 30% over a 12-month period.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.