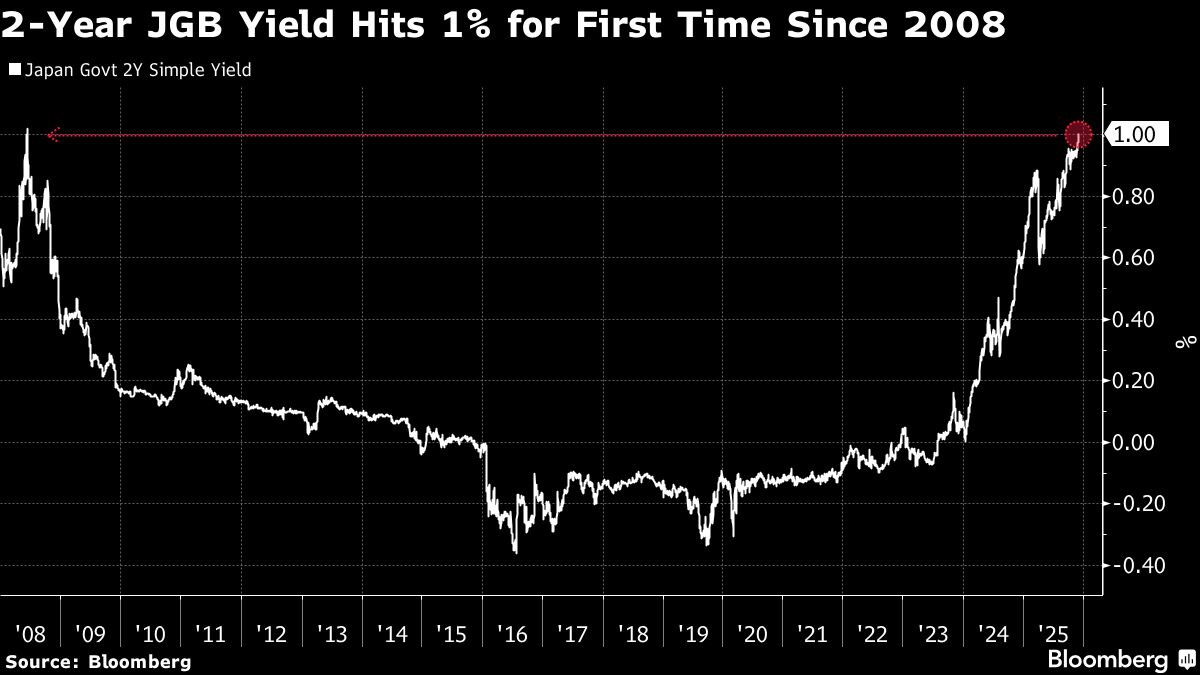

- Japan’s two-year note yield rose to 1%, highest since 2008, ahead of BOJ speech

- The yen strengthened 0.3% to 155.71 against the dollar on rate hike speculation

- Swap market prices a 62% chance of BOJ rate hike in December, 90% by January

Japan's two-year note yield rose to its highest level since 2008 and the yen gained against the dollar on growing speculation an interest-rate increase by the Bank of Japan is getting closer.

The two-year rate, which is sensitive to monetary policy expectations, increased 1 basis point to 1% ahead of a speech by BOJ Governor Kazuo Ueda in Nagoya. Japan's currency strengthened as much as 0.3% to 155.71 against the dollar.

“Growing expectations of a BOJ rate hike are helping the yen appreciate and putting upward pressure on the two-year JGB yield,” said Hirofumi Suzuki, chief FX strategist at Sumitomo Mitsui Banking Corp. “Governor Ueda's comments today should be most important catalyst. If he sounds more hawkish than expected I would expect this trend to continue.”

The swap market is now pricing in about a 62% chance of a rate hike when BOJ delivers its next policy decision on Dec. 19, with the likelihood rising to almost 90% by its January gathering. That compares with 30% for a December move just two weeks ago.

Separately, the Ministry of Finance plans to increase its issuance of short-term debt to help finance Prime Minister Sanae Takaichi's economic package, adding issuance of two- and five-year notes by ¥300 billion ($1.92 billion) each and Treasury bills by ¥6.3 trillion. That's set to weigh on shorter-end sovereign bonds.

It's “prudent to remain cautious” about bonds right now, said Ryutaro Kimura, senior fixed-income strategist at AXA Investment Managers. The market has to take into account “the anticipated re-acceleration of inflation under the fiscal expansion of the Takaichi administration and the deterioration in the supply-demand balance due to a substantial increase in medium-term JGB issuance.”

The mounting speculation of a December hike comes as the yen has slumped 5% against the dollar this quarter, making it the worst performer among Group-of-10 currencies. Japan's inflation has been consistently running above the BOJ's 2% target, fueling criticism that the central bank is behind the curve in raising rates.

A two-year note auction late last week met weak demand, indicating how investors are cautious given the increasing rate hike risk.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.