- Japan's yen rose up to 0.7% against the US dollar after the upper house election setback

- Ruling coalition faced a historic defeat in Sunday's upper house election

- Prime Minister Ishiba to govern without a majority in one legislative body for first time since 1955

The start of a busy week for Corporate America saw stocks climbing to fresh all-time highs, with traders looking for signs of resilience in earnings amid tariff risks. Treasury yields fell alongside the dollar.

In the absence of relevant economic data, Wall Street remains squarely focused on company outlooks. The S&P 500 topped 6,300. Two members of the “Magnificent Seven” megacaps — Tesla Inc. and Google parent Alphabet Inc. — are due to report results this week. The stakes will again be high as traders look for updates on artificial-intelligence spending.

Stocks hit fresh record.

Gains in Treasuries were led by longer maturities, with the 30-year yield falling seven basis points to 4.92%. The greenback dropped against all of its developed-world peers. The yen climbed as Japan's Prime Minister Shigeru Ishiba said he would carry on after an election setback.

Investors will also keep a close eye on tariff headlines. European Union and US negotiators are heading into another week of intensive talks, as they seek to clinch a trade deal by Aug. 1, when US President Donald Trump has threatened to hit most EU exports with 30% tariffs.

To Matt Maley at Miller Tabak, it is becoming more evident that the Trump Administration is going to be tougher on the tariff issue going forward. So, it's important to decide whether this is something the stock market is pricing in right now.

“Earnings season will move into full swing this week, and the guidance will be more important than usual,” he said. “This guidance is going to have create a very large increase in earnings estimates if the market is going to reach some of the targets that exist on Wall Street right now.”

The second-quarter earnings season is off to a ripping start, with consumer strength powering resilient corporate profits. Yet after hitting a series of all-time highs, the S&P 500 is trading at 22 times expected 12-month profits, leaving little room for error.

“While stocks may be due for a breather, we believe the bull market remains intact,” said Ulrike Hoffmann-Burchardi at UBS Global Wealth Management. “We maintain our June 2026 S&P 500 price target of 6,500, and recommend using volatility as an opportunity to phase into markets.”

Morgan Stanley strategists led by Michael Wilson advise investors to stay bullish on US stocks, as earnings momentum, positive operating leverage and cash tax savings are under-appreciated tailwinds.

Recent dollar weakness should provide a small tailwind to S&P 500 earnings, partially offsetting the tariff earnings pressure, Goldman Sachs Group Inc. strategists led by David Kostin said.

“Although valuations are elevated, a large component of the S&P 500 consists of large cap tech stocks which command higher multiples due to their consistent growth, incredibly strong cash flows and profit margins,” said Richard Saperstein at Treasury Partners. “Valuation isn't a reliable indicator for future market direction.”

The combination of declining inflation, continued growth and stable interest rates is a trifecta of positives that supports current stock market valuations, he noted.

“Most of the Magnificent Seven should continue leading the market due to impressive earnings growth, copious levels of cash flow and continued demand for their businesses,” he said. “The AI tailwinds are in the early innings, and are set to benefit the biggest players in tech the most.”

Deutsche Bank AG strategists including Parag Thatte see resilient earnings growth suggesting room for equity positioning to keep rising.

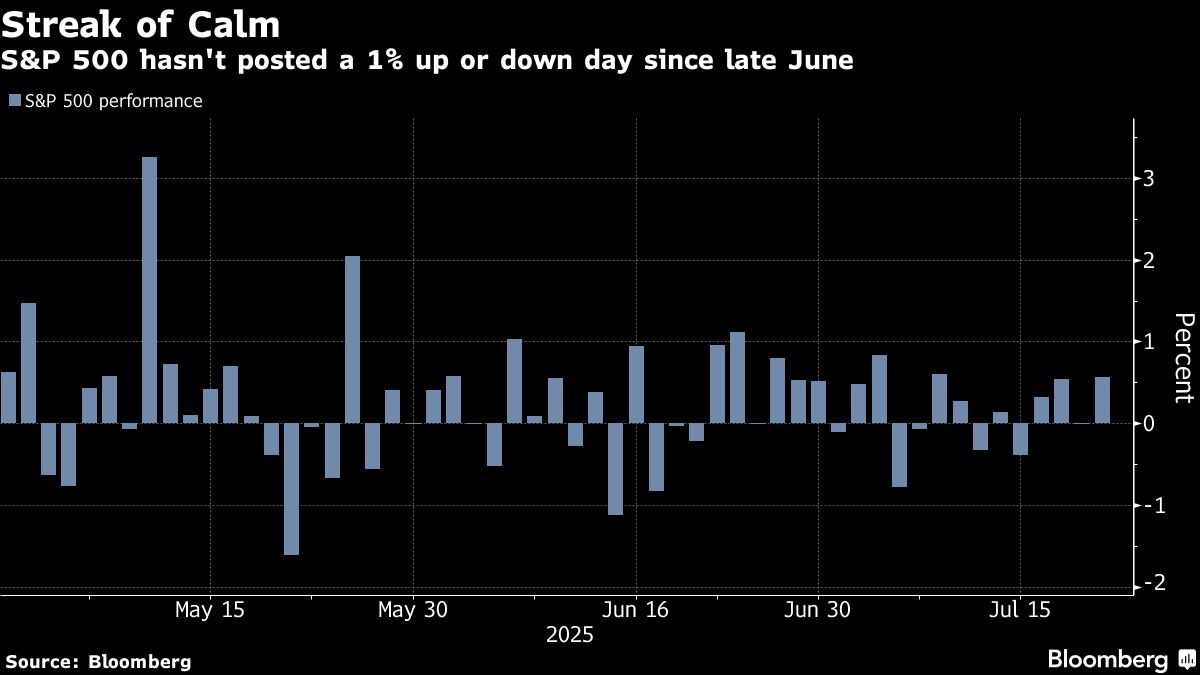

Mark Hackett at Nationwide noted we haven't seen a 1% move in nearly a month, and volatility gauges remain “suspiciously quiet.”

“This calm is unusual and may reflect both investor fatigue and institutional hesitation to fight the current trend,” he said. “We're in a window where calm can quickly turn to complacency. While a break in either direction is possible, current positioning suggests we'd bet on a rally before a drop.”

Corporate Highlights:

Microsoft Corp. warned that hackers are actively targeting customers of its document management software SharePoint, with security researchers flagging the risk of potentially widespread breaches around the world.

Verizon Communications Inc. posted second-quarter revenue that surpassed analysts' estimates and raised its profit outlook, buoyed by wireless price increases and recent tax legislation.

Sarepta Therapeutics Inc. has refused to pause all shipments of its Elevidys treatment after three deaths were linked to the company's gene therapies, the Food and Drug Administration said Friday.

Figma Inc. and some of its investors are seeking to raise as much as $1.03 billion in a US initial public offering, as the app design and collaboration software company readies what could be one of the biggest listings of the year.

Elliott Investment Management has built up its stake in Equinix Inc. and is pushing the data center operator to take steps to boost its share price, people with knowledge of the matter said.

Elliott Investment Management, which is one of BP Plc's largest shareholders, wants the energy giant's incoming chairman to urgently improve the firm's cost base and capital allocation, citing a weak turnaround plan.

GE Vernova Inc. is acquiring French software company Alteia SAS as the maker of power generation equipment looks to use artificial intelligence for ways to strengthen the electric grid.

The S&P 500 rose 0.5% as of 12 p.m. New York time

The Nasdaq 100 rose 0.7%

The Dow Jones Industrial Average rose 0.6%

The Stoxx Europe 600 was little changed

The MSCI World Index rose 0.5%

Bloomberg Magnificent 7 Total Return Index rose 0.6%

The Russell 2000 Index rose 0.6%

The Bloomberg Dollar Spot Index fell 0.6%

The euro rose 0.7% to $1.1703

The British pound rose 0.6% to $1.3495

The Japanese yen rose 1% to 147.29 per dollar

Bitcoin rose 0.2% to $118,374.72

Ether rose 1.9% to $3,811.87

The yield on 10-year Treasuries declined six basis points to 4.35%

Germany's 10-year yield declined eight basis points to 2.61%

Britain's 10-year yield declined seven basis points to 4.60%

West Texas Intermediate crude fell 0.7% to $66.87 a barrel

Spot gold rose 1.5% to $3,398.93 an ounce

Some of the main moves in markets:

Stocks

Currencies

Cryptocurrencies

Bonds

Commodities

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.