A rally in some of the largest technology companies fueled gains in stocks, with the market extending its advance as President Donald Trump said he reached a trade deal with Vietnam. Treasuries joined a slide in global bonds amid a UK market rout. The dollar rose.

Following earlier losses driven by weak labor-market data, the S&P 500 rebounded. Nike Inc. climbed alongside other apparel and footwear companies amid hopes that a the latest US trade deal will avert a potential supply-chain catastrophe across the industry. Tech megacaps led gains on Wednesday, with Tesla Inc. jumping 3.5% after a drop in sales was seen as better than feared. Apple Inc. gained 2% on an analyst upgrade.

Tech drives stock bounce.

Treasuries fell across most maturities as UK markets sank sharply, with investors worried about the state of Britain's finances as speculation swirled over a possible exit by Chancellor of the Exchequer Rachel Reeves. US two-year yields, which are more sensitive to Fed monetary policy, were little changed.

Just 24 hours ahead of the jobs report, data showed employment at US companies fell for the first time in more than two years, raising concerns about a labor-market cooldown. Data Thursday is expected to show the slowest payrolls growth in four months and a slight increase in the unemployment rate to 4.3%.

“One of the reasons the Fed has been able to be patient before cutting rates was because the job market was holding up so well, so if that were to change then the Fed may be forced to move earlier than they would like,” said Chris Zaccarelli at Northlight Asset Management.

Despite signs of a downshift, Federal Reserve Chair Jerome Powell has repeated that the labor market remains solid. Fed officials have refrained from lowering interest rates this year as they wait to see the impact of tariffs on inflation.

While stock buyers have stormed back into the market over the past couple of months, Zaccarelli says he'd be cautious right now because valuations are high, the economy is slowing its pace of expansion and it's possible that we've reached full employment.

US stocks have snapped back from the throes of April's tariff selloff, hovering near record highs, the pipeline of new SPACs is rebounding and Cathie Wood's flagship fund is on a historic tear.

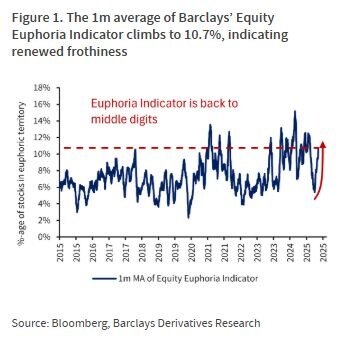

That's sparked a swift jump in a Barclays Plc measure of the market's “irrational exuberance” — a phrase coined by former Federal Reserve Chair Alan Greenspan for when prices exceed assets' fundamental values. The one-month average on the proprietary gauge has swung back into the double-digits for the first time since February — reaching levels that have signaled extreme frothiness in the past.

Corporate Highlights

Microsoft Corp. began job cuts that will impact about 9,000 workers, its second major wave of layoffs this year as it seeks to control costs while ramping up on artificial intelligence spending.

Intel Corp. slid after Reuters reported CEO Lip-Bu Tan is exploring a potential strategy shift in its foundry business that would entail no longer marketing certain chipmaking technology to external customers, citing people familiar.

Wall Street's largest lenders boosted their dividends after passing this year's Federal Reserve stress tests, a hurdle that regulators made easier to clear by softening some of the requirements laid out in previous years.

Health insurer Centene Corp. shocked investors when it withdrew its profit outlook on precipitously rising risks from Affordable Care Act plans, sending shares plummeting.

Foxconn Technology Group has asked hundreds of Chinese engineers and technicians to return home from its iPhone factories in India, dealing a blow to Apple Inc.'s manufacturing push in the South Asian countr

Cava Group Inc., the Mediterranean restaurant chain, received an overweight recommendation at KeyBanc Capital Markets, which cited growth opportunities

Rivian Automotive Inc. produced about half as many electric vehicles as Wall Street expected in the second quarter prior to the launch of 2026 model year vehicles later this month.

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.2% as of 11:01 a.m. New York time

The Nasdaq 100 rose 0.6%

The Dow Jones Industrial Average was little changed

The Stoxx Europe 600 rose 0.1%

The MSCI World Index rose 0.2%

Bloomberg Magnificent 7 Total Return Index rose 1.1%

The Russell 2000 Index rose 0.7%

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.3% to $1.1768

The British pound fell 1.1% to $1.3593

The Japanese yen fell 0.4% to 143.98 per dollar

Cryptocurrencies

Bitcoin rose 2.2% to $108,229.23

Ether rose 2.3% to $2,471.25

Bonds

The yield on 10-year Treasuries advanced four basis points to 4.28%

Germany's 10-year yield advanced eight basis points to 2.66%

Britain's 10-year yield advanced 13 basis points to 4.58%

Commodities

West Texas Intermediate crude rose 0.4% to $65.72 a barrel

Spot gold rose 0.1% to $3,343.33 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.