(Bloomberg) --

Janus Henderson Investors has trimmed some of its exposure to Indian stocks in favor of South Korea on expectations of higher dividend returns.

“We have taken a reasonable amount off the total India allocation as we don't want to miss out on the value rally in Korea,” Sat Duhra, a Singapore-based portfolio manager, said in an interview. South Korea's high dividend yields and corporate reforms are seen boosting returns, he said.

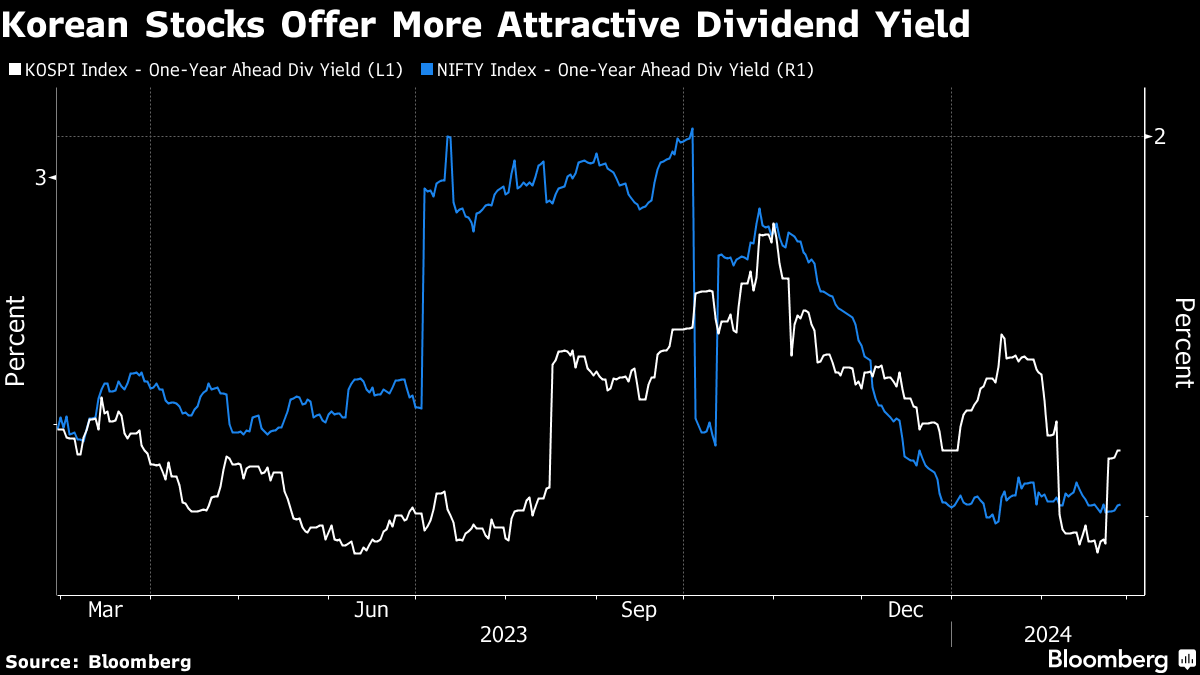

South Korean authorities unveiled a “Corporate Value-Up Program” on Monday that seeks to incentivize companies that will prioritize shareholder returns. Korea's Kospi benchmark offers a dividend yield of 2.45% based on one-year forward earnings, higher than the 1.5% yield offered by India's Nifty 50 Index, according to data compiled by Bloomberg.

Foreigners have plowed $7.7 billion into Korean stocks this year, more than any other emerging Asian markets, according to data compiled by Bloomberg. They withdrew more than $3 billion from Indian stocks in the period.

Still, Duhra sees India as a “superior” macro-economic theme in comparison to any other Asian market, and said he will continue to keep his exposure to sectors such as utilities, information technology and banks.

We “just felt that if we're going to play the dividends and reform theme, then we might as well do it in Korea, where the next six-to-12 months are far more compelling,” he said.

Read more: Investors Are Turning Wary of Crowded India Trade: Taking Stock

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.