ITC Share Price Hits Three-Year Low As Brokerages Turn Cautious — Details Inside

With cigarettes being a crucial revenue driver for ITC - 41% of the company's total topline as of Q2FY26, there is much uncertainty surrounding the expected rate hikes for cigarette prices.

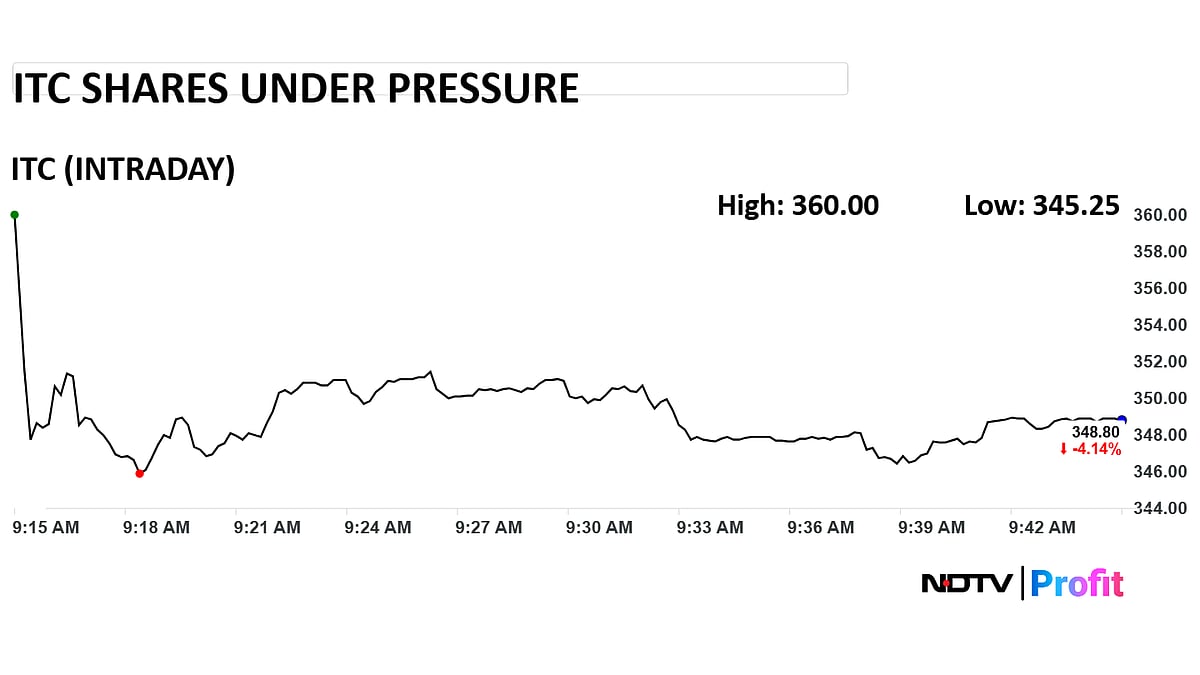

After falling nearly 10% on Thursday, shares of ITC Ltd. are under pressure once again on Friday, trading with cuts of more than 4%, following the government's announcement of higher excise duty on cigarettes.

The stock is currently trading at Rs 348, reaching an intraday low of Rs 345. This compares to Thursday's closing price of Rs 363. On a 12-month basis, the stock has fallen as much as 28%, though a large part of it is led by the recent drawdown.

The rapid fall in ITC shares have led to the stock hitting a relative strength index of 23, which suggests the scrip is currently in an oversold territory.

This kind of pressure in ITC can be directly linked to the government's announcement of fresh excise duties, which could attract 40% taxes on cigarettes vs 28% now. The new rates are applicable Feb. 1.

With cigarettes being a crucial revenue driver for ITC - 45% of the company's total topline as of Q2FY26 (inclusive of excise), there is much uncertainty surrounding the expected rate hikes for cigarette prices.

ITC shares under pressure. (Photo: NDTV Profit)

ALSO READ

ITC, Godfrey Phillips And Other Cigarette Stocks Under Pressure Today On Higher Excise Duties

On account of this uncertainty, a slew of brokerages have cut the target price on ITC, citing direct impact on volumes.

Brokerages have further stated that ITC shares will make a comeback only when market gets convinced that the volume slowdown has bottomed out.

ITC, for its part, is likely to pass on the impact of the tax change, according to JPMorgan, meaning consumers will have to bear brunt of the higher cost in cigarette prices.

JPMorgan has also indicated that any upside on ITC will likely be restricted over the course of next six to nine months, as investors await cigarette volume slowdown to bottom out.