ITC Ltd. is in the spotlight on Friday as it marks the last trading day for investors to qualify for receiving shares of ITC Hotels Ltd. before the stock goes ex-demerger. The record date will determine the eligible shareholders who will receive shares in ITC Hotels, the newly separated entity.

After the demerger became effective on Jan. 1, as per the company's earlier disclosures to the stock exchanges, the ITC stock will go ex-demerger on Jan. 6. This means that investors wishing to receive shares of ITC Hotels must hold ITC shares in their demat accounts till this date. For those wishing to qualify, the last day to acquire ITC shares is Jan. 3, 2025, Friday. Under the terms of the demerger, ITC shareholders will receive one share of ITC Hotels for every 10 shares of the parent they hold.

The demerger has been structured as part of ITC's strategy to separate its hotels business, with ITC Hotels poised to become India's second-largest hotel chain with a portfolio of 140 hotels and 12,965 keys.

Additionally, the company has a robust expansion pipeline, which will bring the total number of properties to 186, offering a total of 17,265 keys by March 2030.

On Jan. 6, 2025, a special trading session will take place to determine the share price of ITC after the adjustment for the demerger. Investors should note that the price of ITC shares will adjust to reflect the intrinsic value of ITC Hotels, and the shares of ITC Hotels will be credited to the demat accounts of eligible shareholders after this date.

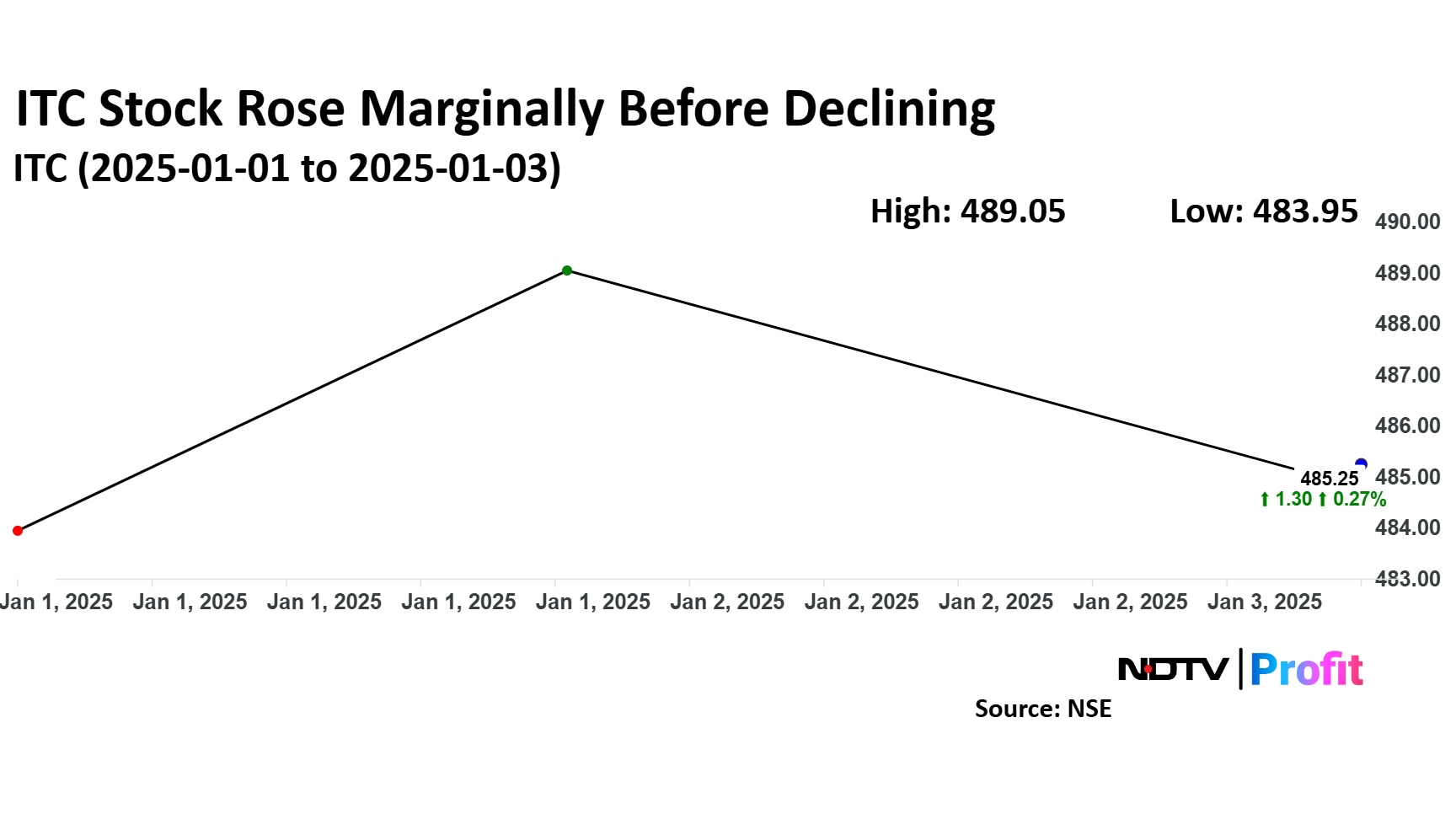

In last three days since the demerger came into effect the stock has risen 0.02%. On Friday, the final day to acquire ITC shares, the scrip was down 1.12% at Rs 483.55, the scrip pared losses to trade at 1.04% lower at Rs 483.95 at 10:34.

It has risen 1.40% in the last 12 months. Total traded volume so far in the day stood at 1.9 times its 30-day average. The relative strength index was at 58.5.

Out of 38 analysts tracking the company, 33 maintain a 'buy' rating, three recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.3%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.