The demerger of ITC Hotels Ltd. from its parent ITC Ltd. came into effect on Jan. 1, 2025, opening the way for its listing on exchanges. This move, akin to Reliance's demerger of Jio Financial Services and NMDC Steel's demerger from NMDC, positions ITC Hotels as a standalone entity in India's evolving hospitality landscape.

Nuvama Alternative and Quantitative Research projects ITC's share price to adjust by Rs 18–25 per share on the ex-date, reflecting ITC's 40% stake in ITC Hotels with a 20% holding discount. Initial market expectations place ITC Hotels' shares in the Rs 150–175 range upon listing.

The initial valuation of ITC Hotels will hinge on the differential between ITC's closing price on Jan. 3, 2025, and its opening price during the special pre-open session on Jan. 6, 2025, said the report by Nuvama.

Global indices like MSCI are also expected to reflect these changes, with ITC Hotels moving to the MSCI Global Small Cap Index while ITC retains its position in the Standard Index. FTSE, on the other hand, might exclude ITC Hotels if it doesn't list within 20 working days, the report added.

While ITC Hotels may take up to a month post-record date to list, mirroring timelines of past demergers like Jio Financial and Piramal Pharma, its inclusion in derivatives markets remains off the table for now as per the report.

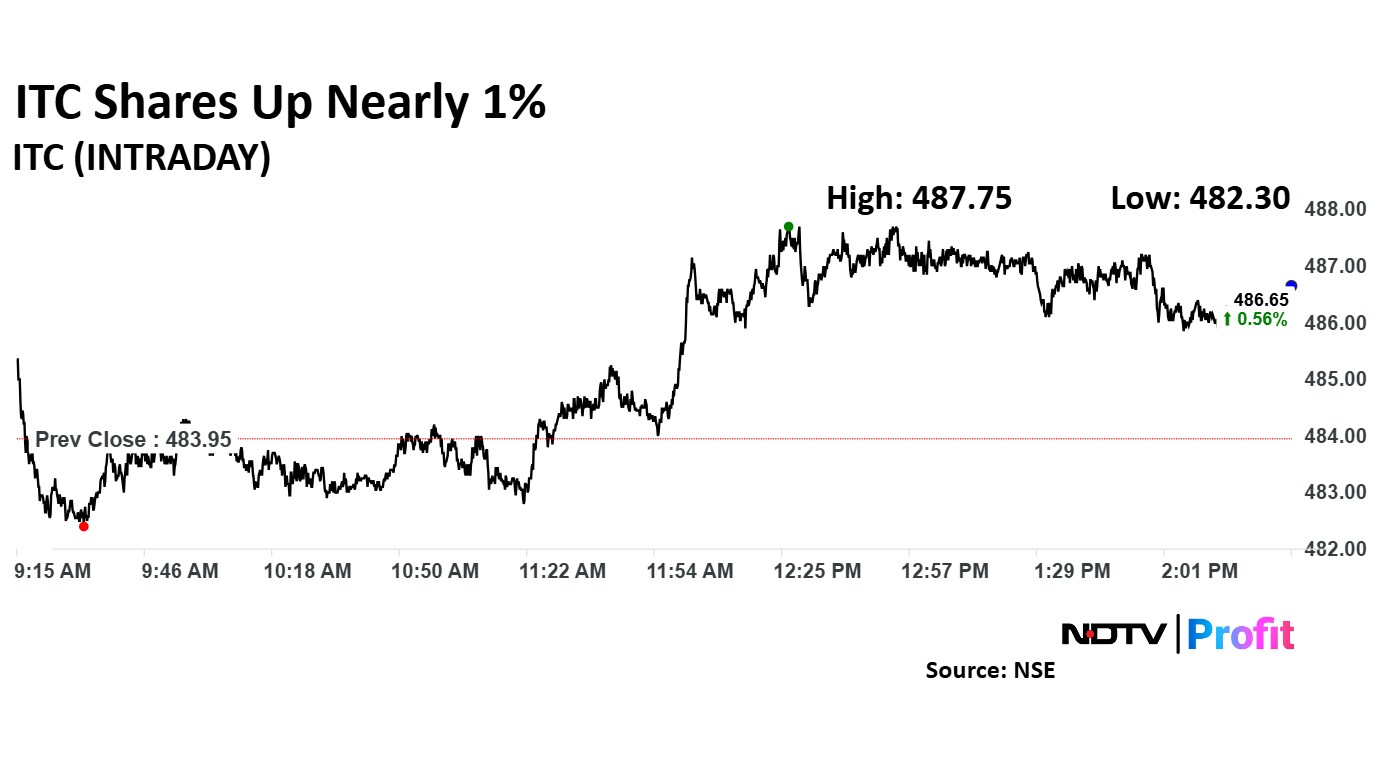

ITC Share Price Today

The scrip rose as much as 0.79% to Rs 487.75 apiece, the highest level since Nov. 4, 2024. It pared gains to trade 0.49% higher at Rs 486.30 apiece, as of 02:29 p.m. This compares to a 1.72% advance in the NSE Nifty 50 Index.

It has risen 3.40% in the last twelve months. Total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 63.22.

Out of 38 analysts tracking the company, 33 maintain a 'buy' rating, three recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.