Ipca Laboratories Ltd.'s share price rose to a record high on Tuesday, after Nomura hiked its target price on the stock, on margin expansion and consistent outperformance in the domestic formulation market.

The brokerage has maintained a 'buy' rating on the stock, but upgraded the target price to Rs 1,750 per share from Rs 1,502 apiece earlier. This implies a 20% upside from the previous close.

Consistent outperformance in the domestic formulation market is one of the main positives for the pharmaceutical company, Nomura said. "The business attracts higher valuation multiple, and we believe it will contribute ~50% of fiscal 2026-2027 Ebitda."

There is scope for improvement in other business segments in the near to medium term, particularly in generics and API, the brokerage said. Further, there will likely be cost and revenue synergies at its subsidiary Unichem Ltd. in the near to medium term, the note said.

The brokerage estimates a 30% earnings CAGR over fiscal 2025-27F. The growth momentum may remain strong post-FY27F as well, it said.

The pharma major looks to revive contract drug development and manufacturing aspirations, which were impacted due to USFDA regulatory issues in the past, it said.

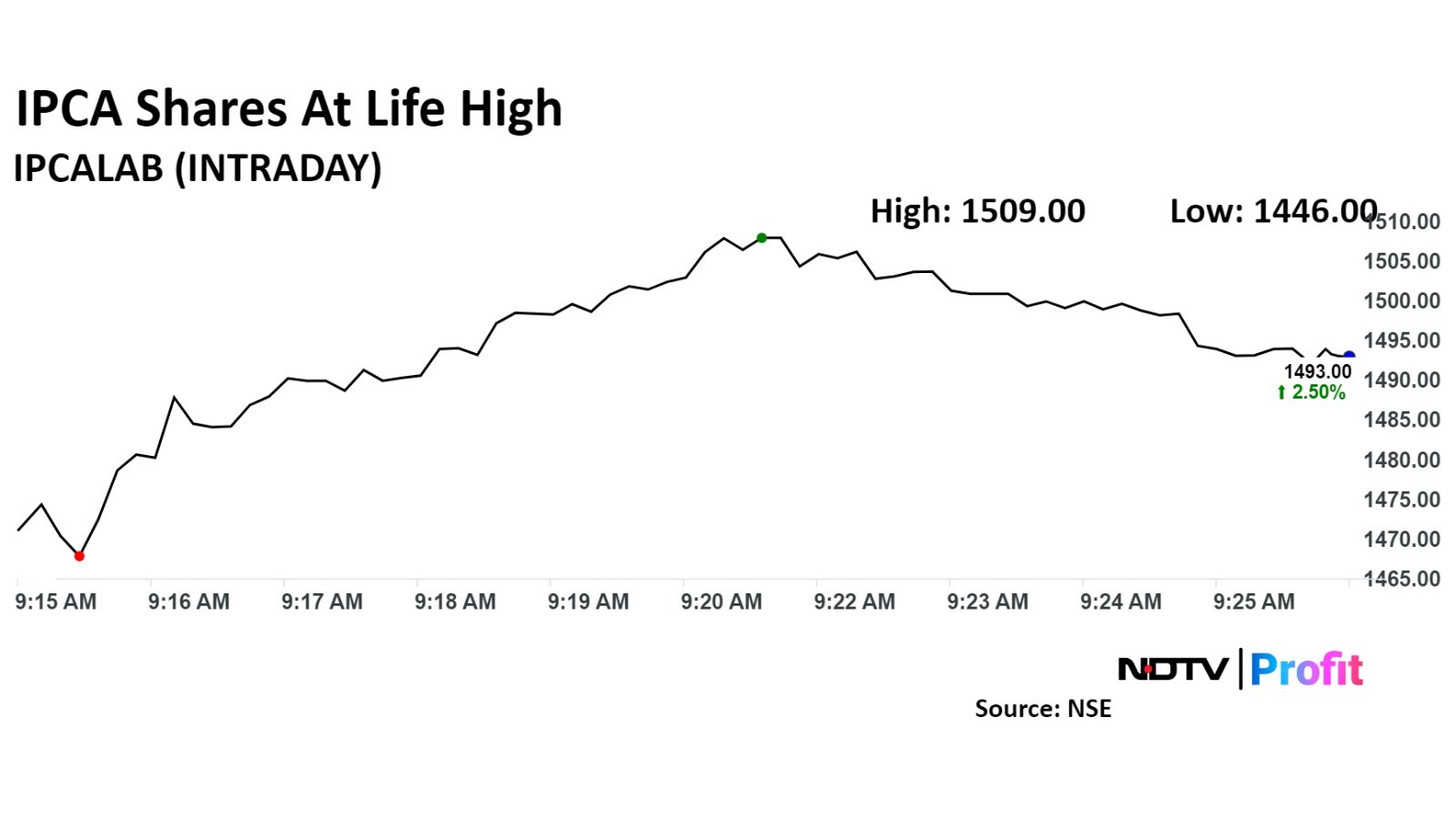

IPCA Labs Share Price

IPCA Labs' stock rose as much as 3.6% during the day to a life high of Rs 1,509 apiece on the NSE. It pared some gains to trade 3.45% higher at Rs 1,506.7 apiece, compared to a 0.04% decline in the benchmark Nifty 50 as of 09:23 a.m.

It has risen 363% during the last 12 months and has declined by 34% on a year-to-date basis. The relative strength index was at 67.

Seven of the 18 analysts tracking the company have a 'buy' rating on the stock, two suggest a 'hold' and nine have a 'sell', according to Bloomberg data. The average 12-month analysts' price targets implies a potential downside of 8.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.