Stocks turned lower in late hours while bonds rose after President Donald Trump outlined reciprocal tariffs that included a 20% levy on the European Union, 24% on Japan and 34% on China.

S&P 500 futures sank about 2% in late hours while contracts on the tech-heavy Nasdaq 100 slipped almost 3%. Trump said Wednesday he will apply a minimum 10% tariff on all exporters to the US. The president, displaying a chart, indicated that dozens of countries with the largest trade imbalances will face even higher rates.

“While today's tariff revelations might offer investors some additional clarity from which to reassess the economic implications from Trump's attempts to restructure the global trade landscape, the developments are unlikely to offer anything definitive,” said Vail Hartman and Ian Lyngen at BMO Capital Markets. “As a result, elevated uncertainty and volatility should emerge.”

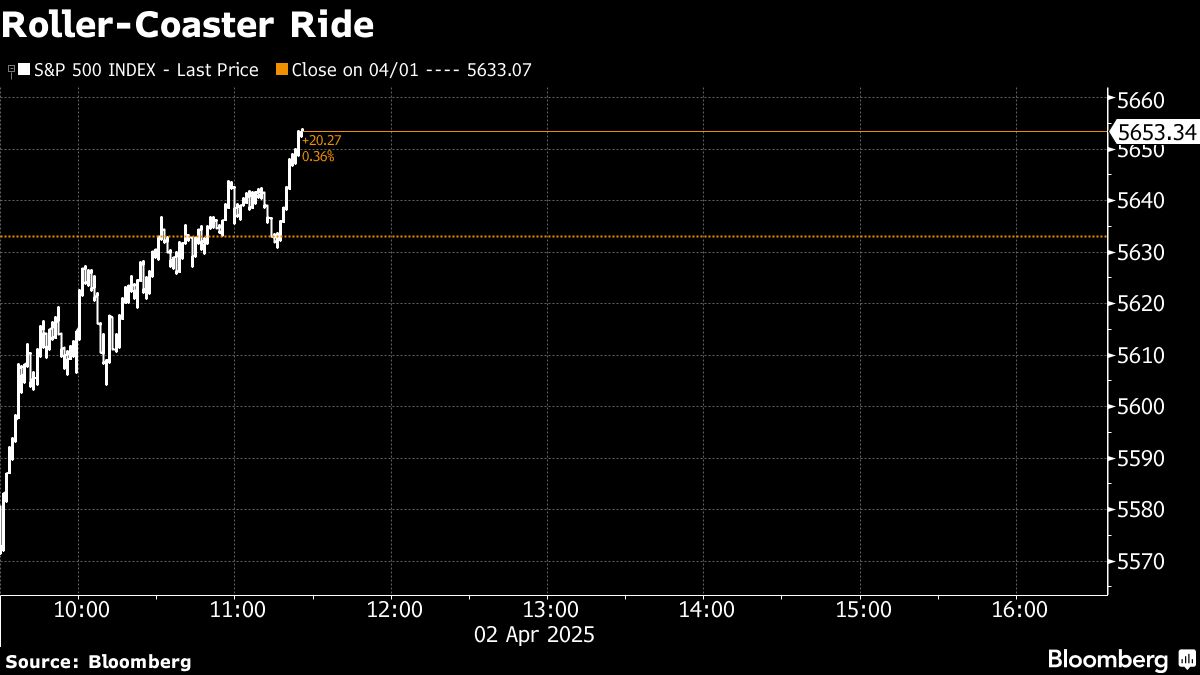

In regular hours, the S&P 500 rose 0.7%. The Nasdaq 100 added 0.7%. the Dow Jones Industrial Average gained 0.6%. Tesla Inc. jumped 5.3% on hopes Elon Musk will refocus on the carmaker as a news report suggested his time as a top adviser to Trump may end soon. On an X post, Musk referred to the article as “fake news.” Amazon.com Inc. was said to make a bid for TikTok in the US.

The US 10-year yield advanced four basis points to 4.21%. The dollar fell 0.2%.

Options traders are betting that the S&P 500 will move roughly 1.1% in either direction on Thursday based on the price of at-the-money straddles, according to Stuart Kaiser, Citigroup Inc.'s head of US equity trading strategy.

“We believe uncertainty will linger for at least a few months and the focus will shift to the US economic outlook while markets remain hyper-sensitive to any news flow,” said Chris Senyek at Wolfe Research.

Rather than trying to read the tea leaves and adjust investments based off of what's going on in Washington, David Bahnsen at The Bahnsen Group says he's focused on investing in companies that have superior cash flow generation during all seasons — and not just seasons when we're worried about tariffs.

“Companies that are committed to growing their dividend tend to do so for a very long time,” according to Bahnsen.

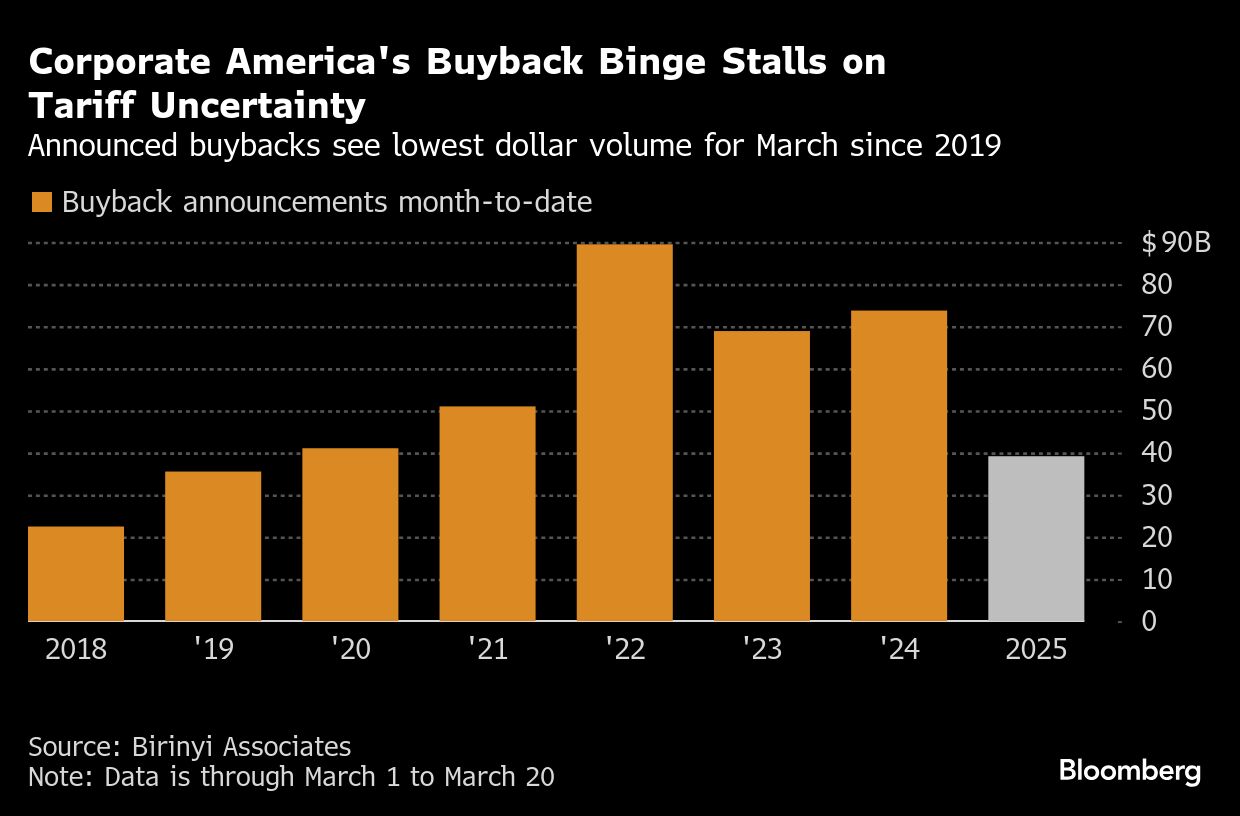

Meantime, Corporate America last month announced the fewest stock buybacks, in dollar terms, since the Covid pandemic, an early sign of cash hoarding from worries about economic growth and the impact of a global trade war.

The value of announced buybacks in the US reached $39.1 billion in March, the lowest dollar value since October 2020 and the lowest for March since 2019, according to data compiled by Birinyi Associates. That's a worrisome sign for investors since buybacks offer a crucial pillar of support for the US stock market, which is already down significantly from February's all-time highs.

The mood among market participants is among the grimmest since the pandemic, according to JPMorgan Chase & Co.'s Ilan Benhamou, but he still sees a case for US equities to rally.

Benhamou, in the bank's equity derivatives sales team, said it's hard to not be more bearish in the face of a slowing economy, rising recession odds, mounting earnings revisions and falling equities price targets. Still, he writes that “when everything looks grim that the fiercest bounces usually happen.”

Investors are eager for clarity on the scope of the levies to assess their impact on the already wobbly US economy. Fears that a trade war will dampen consumer sentiment and require more interest-rate cuts from the Federal Reserve to support activity have pushed yields lower in the past weeks.

Options traders are betting that Treasuries will extend their rally, as seen in big wagers on lower yields and expectations of deeper-than-expected Fed cuts reflected in interest rate-linked derivatives.

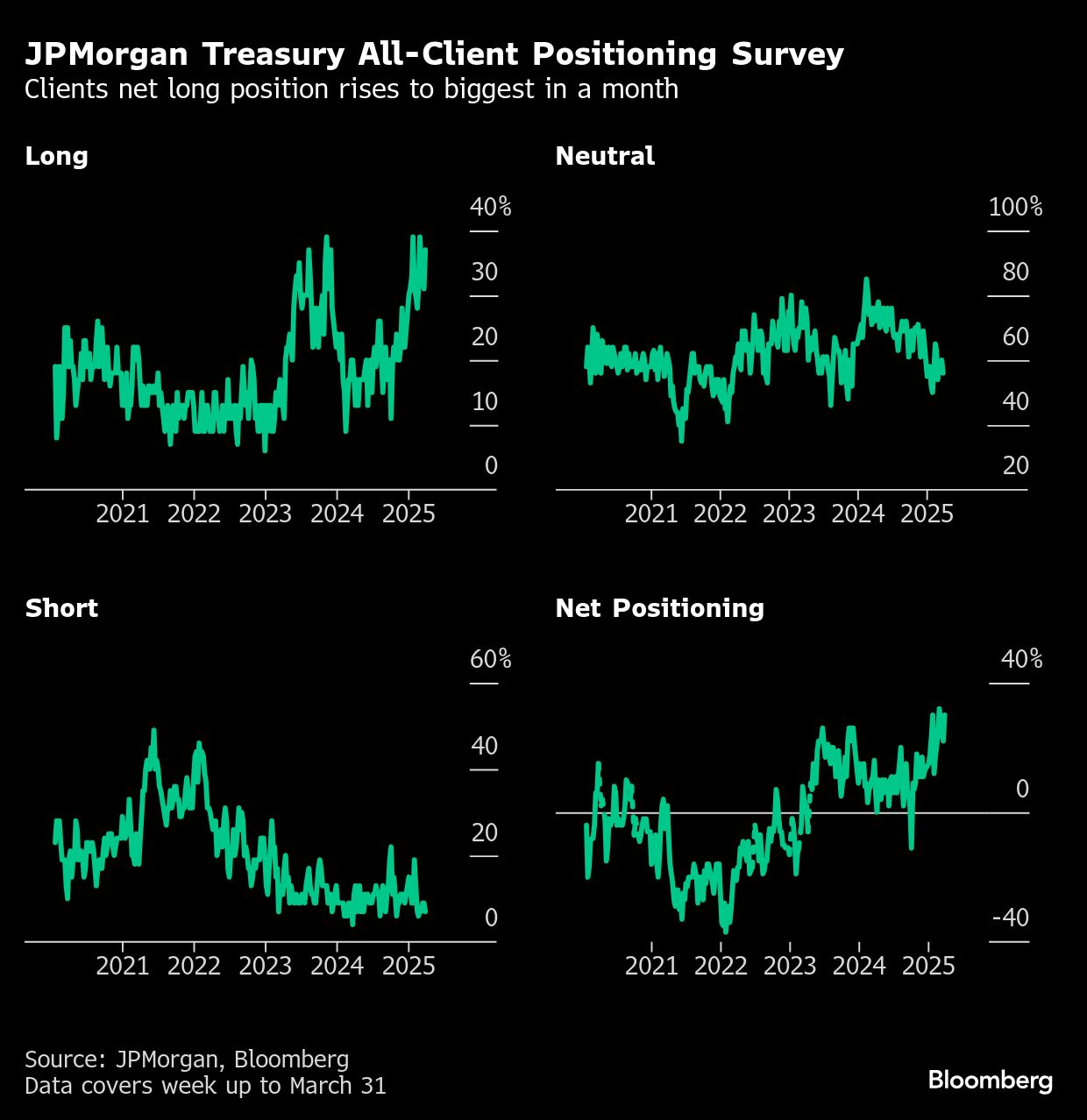

A similarly bullish narrative is playing out in the Treasury cash market, with this week's survey of JPMorgan Chase & Co. client positions showing that the level of net longs is at its highest in a month. And an increasingly dovish outlook on rates is evident in recent options activity linked to the Secured Overnight Financing Rate, which closely tracks the Fed's policy rate.

A top-performing Invesco Ltd. money manager has beefed up her bearish bets against the dollar to the highest level in months on expectations that Trump's tariffs will dent US growth.

“Our biggest concern is that this actually can be a really big, dollar negative story,” said Kristina Campmany, a senior portfolio manager at Invesco. “From the get-go, we have been more concerned about the growth-negative impact of tariffs.”

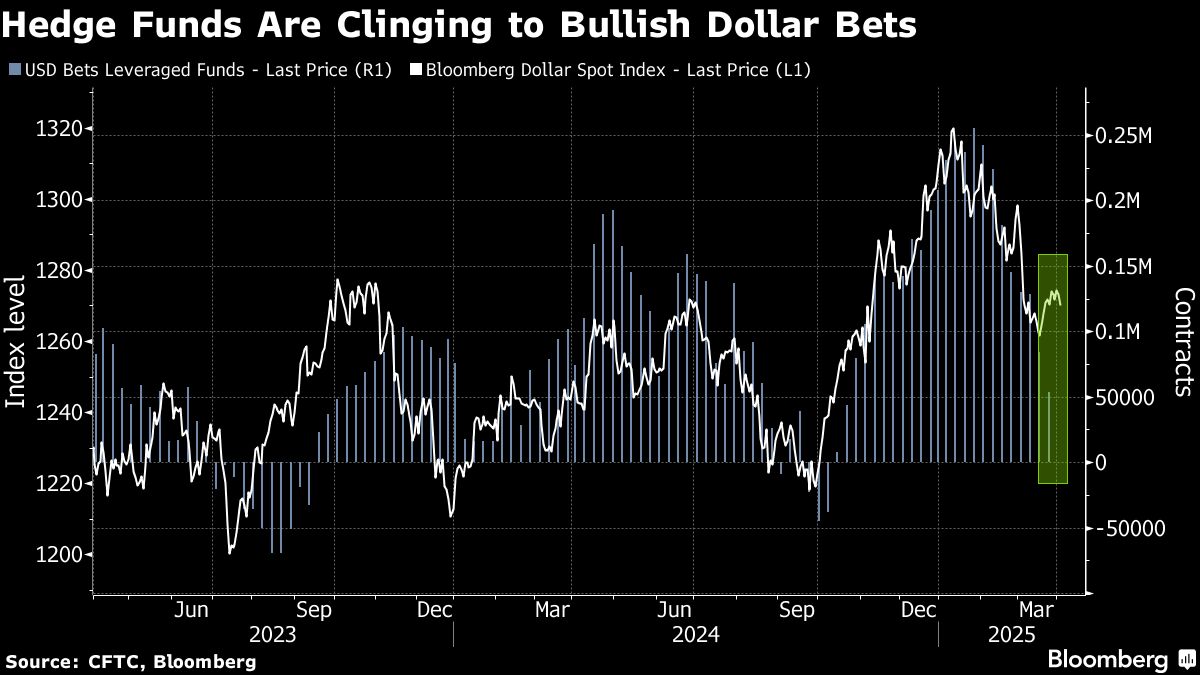

In the derivatives market, hedge funds have sharply cut long dollar wagers from a recent peak in January but remain bullish on the US currency, according to positioning data published by the Commodity Futures Trading Commission.

Some of the main moves in markets:

Stocks

The S&P 500 rose 0.7% as of 4 p.m. New York time

The Nasdaq 100 rose 0.7%

The Dow Jones Industrial Average rose 0.6%

The MSCI World Index rose 0.5%

Bloomberg Magnificent 7 Total Return Index rose 1%

The Russell 2000 Index rose 1.6%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.5% to $1.0850

The British pound rose 0.5% to $1.2982

The Japanese yen fell 0.3% to 150.02 per dollar

Cryptocurrencies

Bitcoin rose 1.8% to $86,806.6

Ether fell 0.1% to $1,910.46

Bonds

The yield on 10-year Treasuries advanced four basis points to 4.21%

Germany's 10-year yield advanced three basis points to 2.72%

Britain's 10-year yield was little changed at 4.64%

Commodities

West Texas Intermediate crude rose 0.9% to $71.83 a barrel

Spot gold rose 0.4% to $3,124.67 an ounce

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.