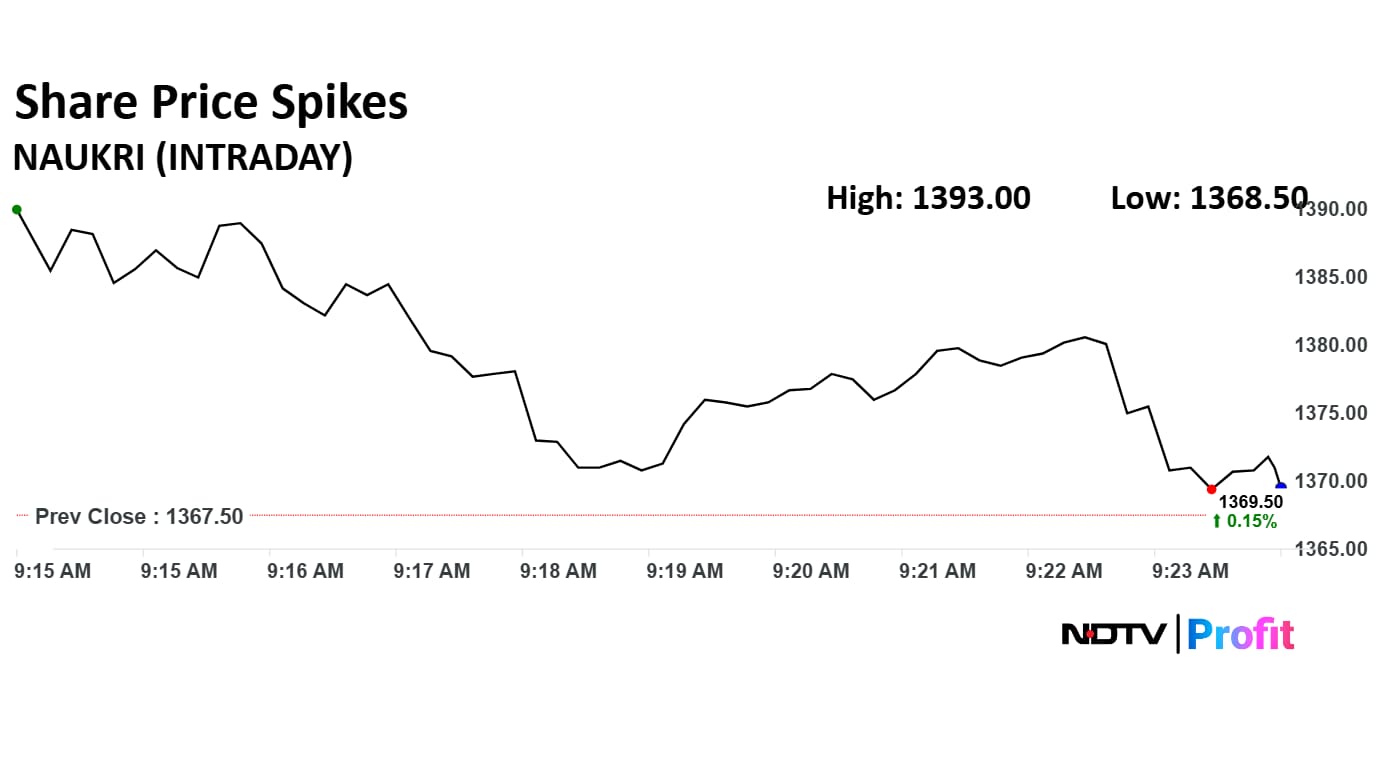

Info Edge share price spiked nearly 2% on Thursday after the company posted its second quarter business update. The scrip hit an intraday high of Rs 1,393. However, it later declined over 0.30%

The company reported standalone billings of Rs 729 crore for the quarter ended September 30, 2025, up from Rs 650.3 crore in the same period last year.

For the half-year ended September 30, 2025, billings stood at Rs 1,373.2 crore, marking an increase from Rs 1,229.7 crore in the corresponding period of the previous year.

Segment-wise, the recruitment solutions business continued to be the primary growth driver, contributing Rs 545 crore in Q2 FY26, compared to Rs 492 crore in Q2 FY25. The real estate vertical, 99acres, posted billings of Rs 122.4 crore, up from Rs 107.4 crore year-on-year. Other segments, including Jeevansathi and Shiksha, collectively brought in Rs 61.6 crore, up from Rs 50.9 crore.

Info Edge was incorporated on May 1, 1995 became a public limited company on April 27, 2006. Starting with a classified recruitment online business, naukri dot com, company expanded into sectors like, matrimony, real estate, education and related services.

The scrip rose as much as 1.86% to Rs 1,393 apiece. It later gave up gains to trade 0.34% lower at Rs 1,362.90 apiece, as of 09:31 a.m. This compares to a 0.21% advance in the NSE Nifty 50 Index.

It has risen 4% in the last 12 months. Total traded volume so far in the day stood at 49 times its 30-day average. The relative strength index was at XX.

Out of 20 analysts tracking the company, 14 maintain a 'buy' rating, three recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.8%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.