IndusInd Bank Ltd.'s share price snapped a four-day rally as Goldman Sachs downgraded the stock rating, as the investment banker believes the private bank is likely to have weak growth ahead. Goldman Sachs downgraded the stock to Sell from Neutral while it hiked the target price to Rs 722 from Rs 634 apiece.

Goldman Sachs cut earnings-per-share estimates by 25% and 17% for financial years 2026 and 2027, respectively. The EPS will reflect persistent margin pressure amid a weaker yield trajectory and elevated funding cost.

Even post normalisation in the second half of the current financial year, IndusInd Bank will likely see weakness in growth because of market share loss in key loan portfolios as well as in deposits. Moreover, a decline in revenue engines and challenges in operational controls are also going to pressure IndusInd Bank's growth, Goldman Sachs said.

IndusInd Bank's franchise has weakened in our view with its key revenue drivers deteriorating, such as yields due to portfolio mix, fee income and productivity of its branches, Goldman Sachs said. The lender has continued to lose its market share at a time when the banking sector is up for growth.

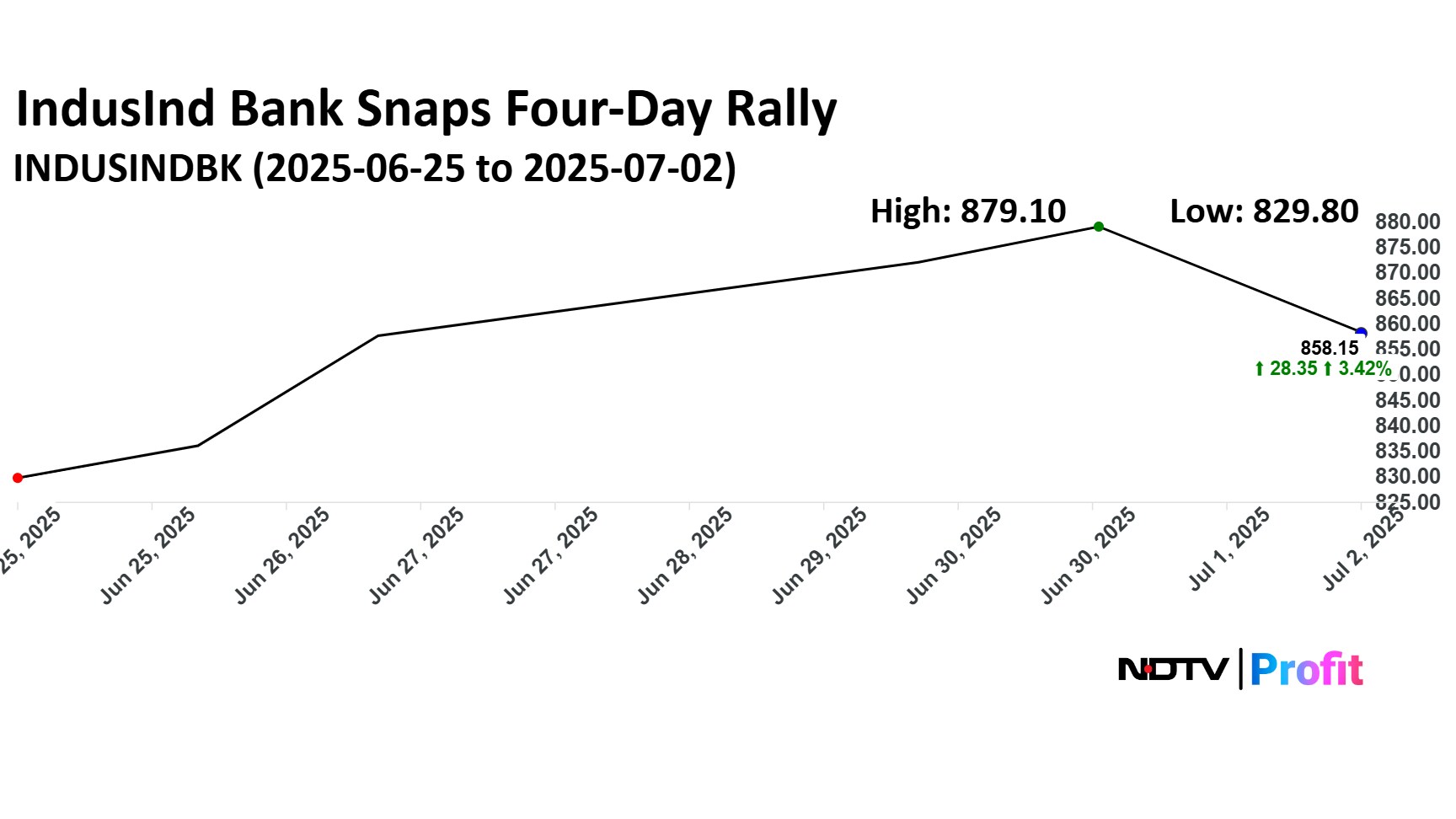

IndusInd Bank share price declined 3.57% to Rs 847.7 apiece. It was trading 0.41% down at Rs 875.50 as of 10:58 a.m., as compared to the 0.18% decline in the NSE Nifty 50 index.

The stock declined 40.05% in 12 months and 10.68% on a year-to-date basis. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 57.57.

Out of 46 analysts tracking the company, 10 maintain a 'buy' rating, 13 recommend a 'hold' and 23 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 10.7%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.