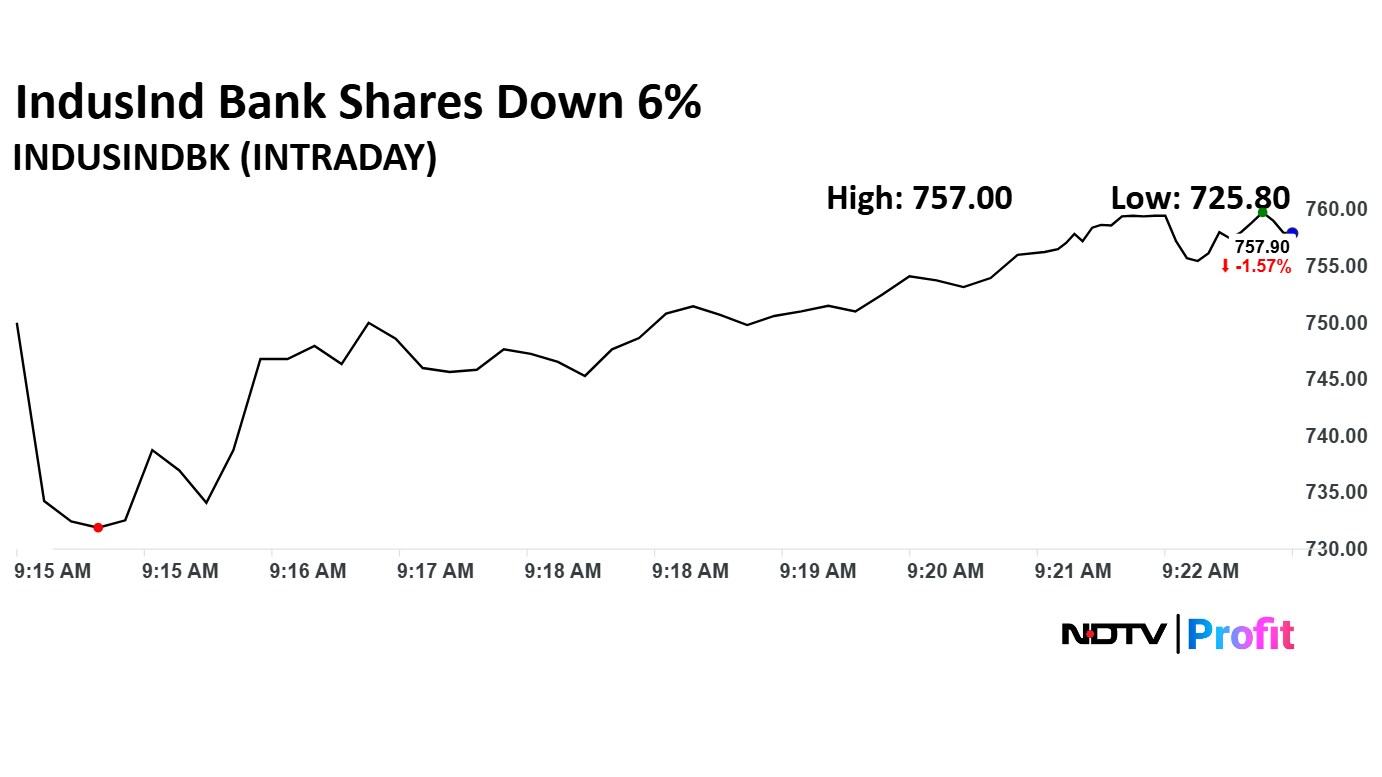

Share price of IndusInd Bank Ltd. recovered after slipping nearly 6% in early trade on Thursday, after the lender posted a consolidated net loss of Rs 2,329 crore for the final quarter of 2025, amid rising discrepancy controversies.

Share price of the bank was trading 2.25% higher at Rs 787.30 as of 09:30 a.m.

Brokerages Morgan Stanley, Jefferies, CLSA, HSBC Global Research all cut target prices on the stock, saying that growth and profitability will likely slow down in the current fiscal.

The accounting issues in the bank's derivatives portfolio, which were disclosed in March, were expected to have an impact of Rs 1,960 crore on its balance sheet for fiscal 2025. Also, the two more accounting discrepancies in interest income—discovered in the internal audits last week—worth Rs 674 crore and Rs 595 crore also reflected in the March quarter results.

IndusInd Bank Q4 Highlights (Consolidated, YoY)

Loss of Rs 2,329 crore versus net profit of Rs 2,349 crore (Bloomberg estimate: Loss of Rs 318 crore).

NII down 43% at Rs 3,048 crore versus Rs 5,376 crore.

Provisions up 165% at Rs 2,522 crore versus Rs 950 crore (Estimate: Rs 3,371 crore).

NIM at 2.25% versus 3.96% (QoQ).

Operating loss at Rs 4,909 crore vs operating profit of Rs 4,082 crore.

GNPA at 3.13% versus 2.25% (QoQ).

NNPA at 0.95% versus 0.68% (QoQ).

IndusInd Bank Share Price Today

The scrip fell as much as 5.73% to Rs 725.80 apiece. It pared losses to trade 3.95% lower at Rs 739.50 apiece, as of 09:23 a.m. This compares to a 0.85% decline in the NSE Nifty 50 Index.

It has fallen 22.33% on a year-to-date basis, and 45.20% in the last 12 months. The relative strength index was at 44.18.

Out of 45 analysts tracking the company, 13 maintain a 'buy' rating, 17 recommend a 'hold' and 15 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.