.png?downsize=773:435)

Moody's affirmed IndusInd Bank Ltd.'s ratings because the lender's core profitability, strong capital, and stable funding will likely mitigate near-term risks to standalone credit strength, according to the agency. It affirmed its Ba1 long-term rating, foreign currency, bank deposits and issuer ratings, not-prime short-term foreign currency and letter of credit counter party risk ratings.

However, Moody's placed IndusInd's Ba1 Baseline Credit Assessment and adjusted BCA under review for downgrade, it said in a report on Monday. The review is taking into account the potential negative impact of the inadequate internal controls highlighted by the bank's accounting for derivative transactions.

The impact of derivatives transactions along with the ongoing stress in retail unsecured loans will likely hurt the bank's profitability, capital, and funding, which will potentially lead to downgrade of the BCA. IndusInd Bank's potential leadership changes also remain a monitorable, the rating agency said.

Reserve Bank of India approved IndusInd Bank's managing director and chief executive officer's re-appointment for a year, in contrast to the lender's request and usual practice of three-year extension. Recently. IndusInd Bank's chief financial officer also resigned.

On March 10, IndusInd Bank reported accounting discrepancies in its derivative transactions conducted in the last five-seven years. These discrepancies caused an impact of 2.35% in its net worth as of Dec. 31, 2024. The discrepancy in the accounting shows that IndusInd Bank has weakness in the risk-management compliance. In case IndusInd Bank continues to report this weakness, it will tarnish the lender's image, ultimately impacting funding and liquidity.

IndusInd Bank has now appointed external advisors to review the processes, determine the root cause, and assess the impact of mark-to-market losses. The review is expected to be completed within the next three months. The near-term impact because of this will be manageable, according to Moody's. However, the discrepancies highlighted IndusInd Bank's inadequate internal controls, which are credit negative.

IndusInd Bank's non-performing loans are expected to increase in the near term which will cause some stress in the asset quality. Meanwhile, the private lender's proactive provisioning will limit the impact on profitability and capital, Moody's said.

Despite all issues, IndusInd Bank will be able to keep its funding and liquidity stable because of its domestic franchise and strong access to international funding sources, Moody's said.

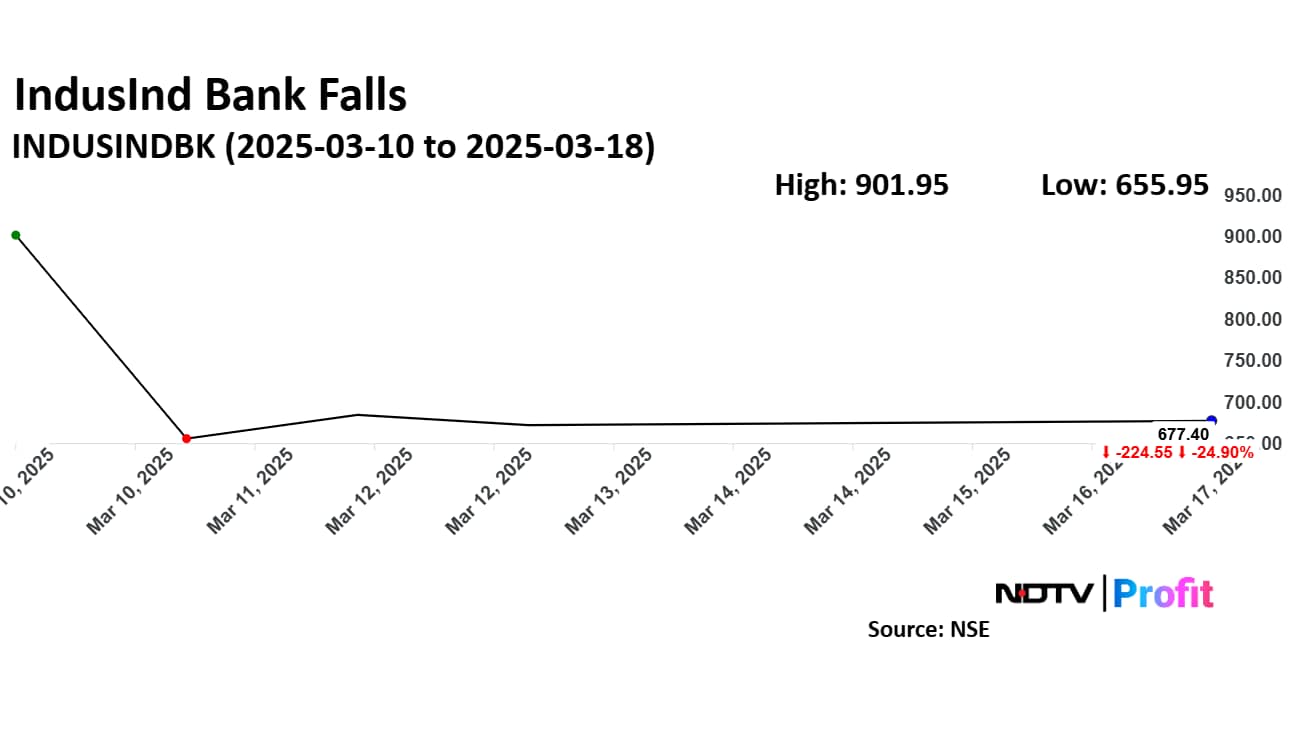

Following the discrepancy revelation, IndusInd Bank witnessed around 27% stock decline on the exchanges. CLSA and Bernstein cut target prices. However, after the Reserve Bank of India provided assurance, the stock started to recover on Monday. The decline since March 10 reduced to 25.14%.

IndusInd Bank Share Price

IndusInd Bank's share price fell 1.39% to Rs 686.80 apiece. It erased all gains to trade 0.77% down at Rs 672.20 apiece as of 10:40 a.m., as compared to 1.13% advance in the NSE Nifty 50.

The scrip gained from Monday's session. It declined 54.60% in 12 months. Relative strength index was at 18.08, which implied the stock is oversold.

Out of 48 analysts tracking the company, 21 maintain a 'buy' rating, 18 recommend a 'hold' and nine suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 50.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.