Shares of Indraprastha Medical Corporation Ltd. are once again buzzing in trade on Wednesday, marking the sixth straight day of gains for the company, which is essentially a joint venture between Apollo Hospitals and the Delhi government.

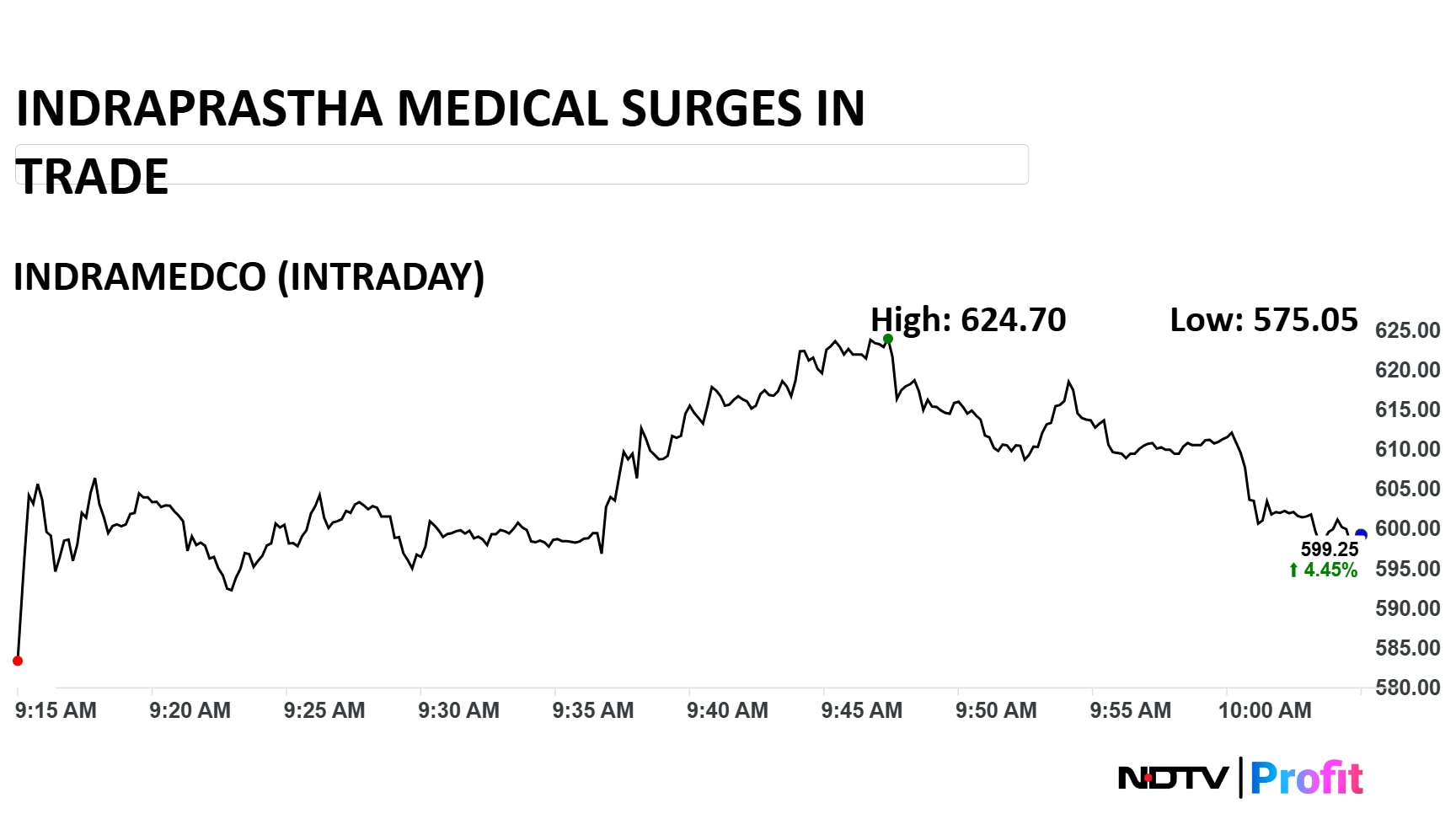

The stock is currently trading at Rs 609, which accounts for gains of more than 6% intraday. The stock price reached an intraday high of Rs 624, which is an all-time high.

This comes on the back of Tuesday's gains, where Indraprastha Medical Corp shares hit the upper circuit. Since the beginning of trade on Tuesday, the stock has gained over 30% and over a five-day period, the shares are trading with gains of almost 40%.

Photo: NDTV Profit

What's Driving Indraprasthra Medical's Rally?

The sharp upsurge in Indraprastha shares can be linked to the revisions announced by the Central Government Health Services (CGHS) - its biggest in 15 years.

In the revision, the CGHS has increased package rates for nearly 2,000 medical procedures, which is something that should benefit hospitals as well as government employees.

The new rates will raise hospital fees by 5-30%, especially for important specialities like orthopaedics, cardiology, and oncology.

This is a major boost for Indraprastha Medical as well, given the fact that higher CGHS tariffs translate into a direct increase in CGHS-linked revenues and a lift in average revenue per occupied bed (ARPOB).

In short, the CGHS tariff hike means higher realisations and improved profitability from government-linked care.

This is especially important for Indraprastha Medical, which has a substantial volume in Delhi NCR.

As mentioned earlier, shares of Indraprastha Medical has witnessed a strong upsurge in the last five trading sessions.

Over a year-to-date period, the stock has gained 15%, which jumps to 44% when it comes to a 12-month period.

Indraprastha Medical, however, is trading with a relative strength index of 82, which suggests that the stock could be in an overbought territory.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.