- Indigo Paints says stock volume rise is market-driven with no undisclosed info

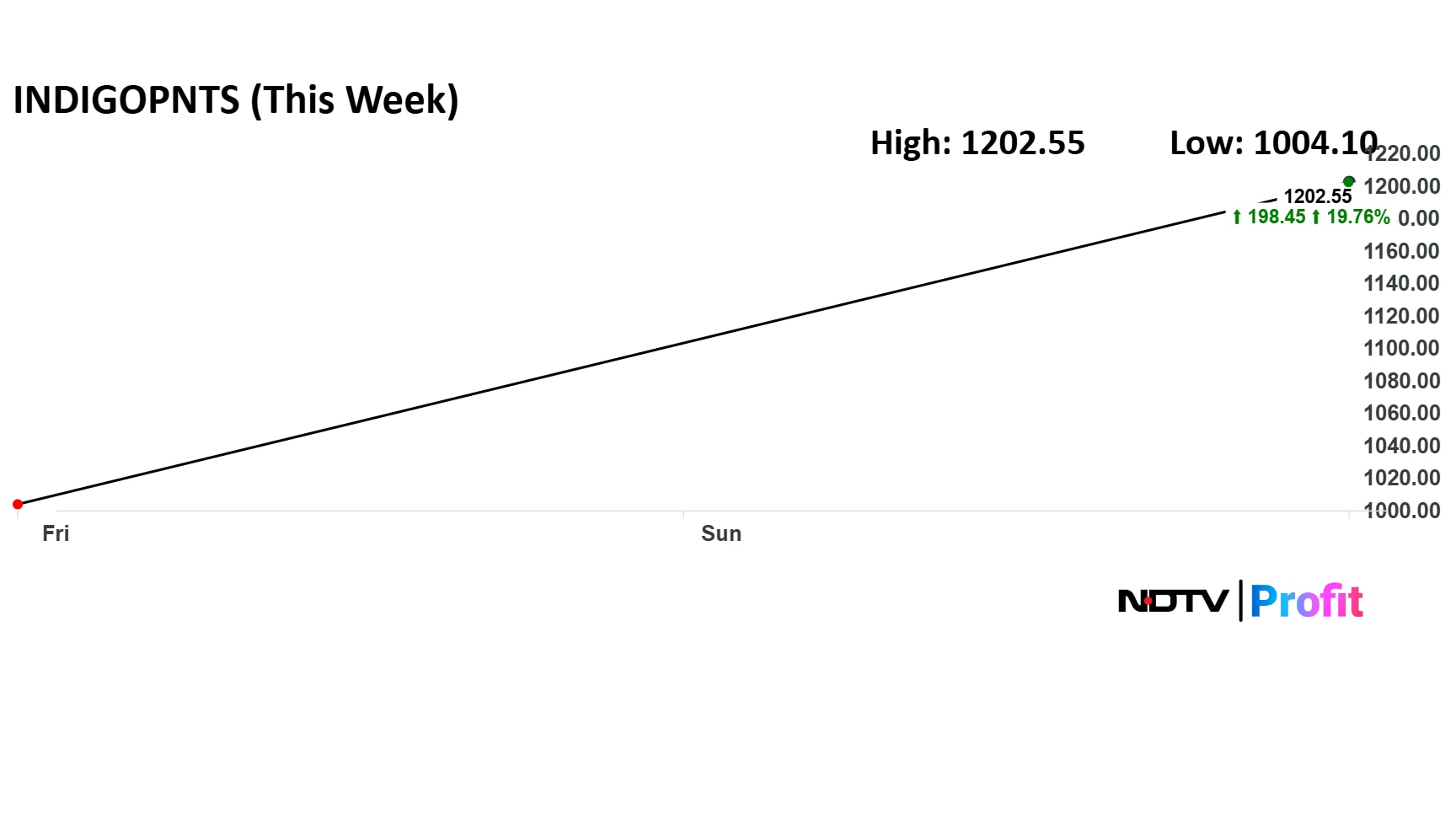

- Share price gained over 20% in two days, closing at Rs 1,202.55 on NSE Tuesday

- Company's market cap stood at Rs 5,745 crore after three days of price rally

Indigo Paints Ltd. on Tuesday said the increase in traded volume of the stock is market-driven and there is no undisclosed or price-sensitive information to be shared. The share price has gained more than 20% in two days.

"There is no undisclosed/price sensitive information or any impending announcement /corporate action which needs to be informed to the exchange at this point of time. The increase in Volume of the Company's securities in recent past is purely due to market conditions and is market driven," a stock exchange filing said.

The share price extended its rally to a third day on Tuesday, closing over 4% to settle at Rs 1,202.55 on the NSE. The total traded volume was Rs 161 crore.

On Monday, the scrip closed 15% higher.

The company's market capitalisation stood at Rs 5,745 crore.

The company's September-quarter results were announced on Nov. 6, with brokerages citing improving margins, steady demand recovery and operational gains.

Indigo Paints Q2 Results (Consolidated, YoY)

Revenue up 4.2% at Rs 312 crore vs Rs 300 crore

Net Profit up 11% at Rs 25 crore vs Rs 22.7 crore

EBITDA up 12% at Rs 46.5 crore vs Rs 41.5 crore

Margin at 14.9% vs 13.9%

Nuvama Institutional Equities said Indigo Paints reported its highest revenue growth in four quarters and best EBITDA growth in six quarters.

Indigo Paints stock has fallen 19% in the last 12 months and 14% on a year-to-date basis.

Five out of the 10 analysts tracking Indigo Paints have a 'buy' rating on the stock, three recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets is Rs 1,217, which implies a potential upside of 1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.