The year 2022 was fraught with uncertainty amid a waning pandemic, Russia's war in Ukraine, soaring inflation and aggressive rate hikes. The Indian markets, however, showed resilience.

The benchmark Sensex scaled a new life-time high in December, driven by banking and consumer goods—the top performers of the year. Pharma and IT—which surged during the pandemic—struggled.

The Sensex is up only about 5%, as on Dec. 27 year-to-date, making it the best performer among key global indices.

Record Highs Amid Global Turmoil

The markets tumbled as Russia's invasion of Ukraine threatened pandemic-ravaged global supply chains. The subsequent energy crunch fuelled commodity inflation, prompting central banks to step in with coordinated rate hikes.

The Indian stock benchmarks remained volatile through the year before rallying to a record high in early December. It has since fallen off the peak amid persisting global recession concerns.

Banks Outperform Amid Volatility

The NSE Nifty Bank index outperformed, rising nearly 21% year to date, as on Dec. 27. That's aided by improving credit growth, improving asset quality and better margins, as deposit rates have not kept pace with the increase in lending rates.

The Bank Nifty hit a new life-time high of 44,151 points on Dec. 14, as the Reserve Bank of India scaled back the pace of rate hikes.

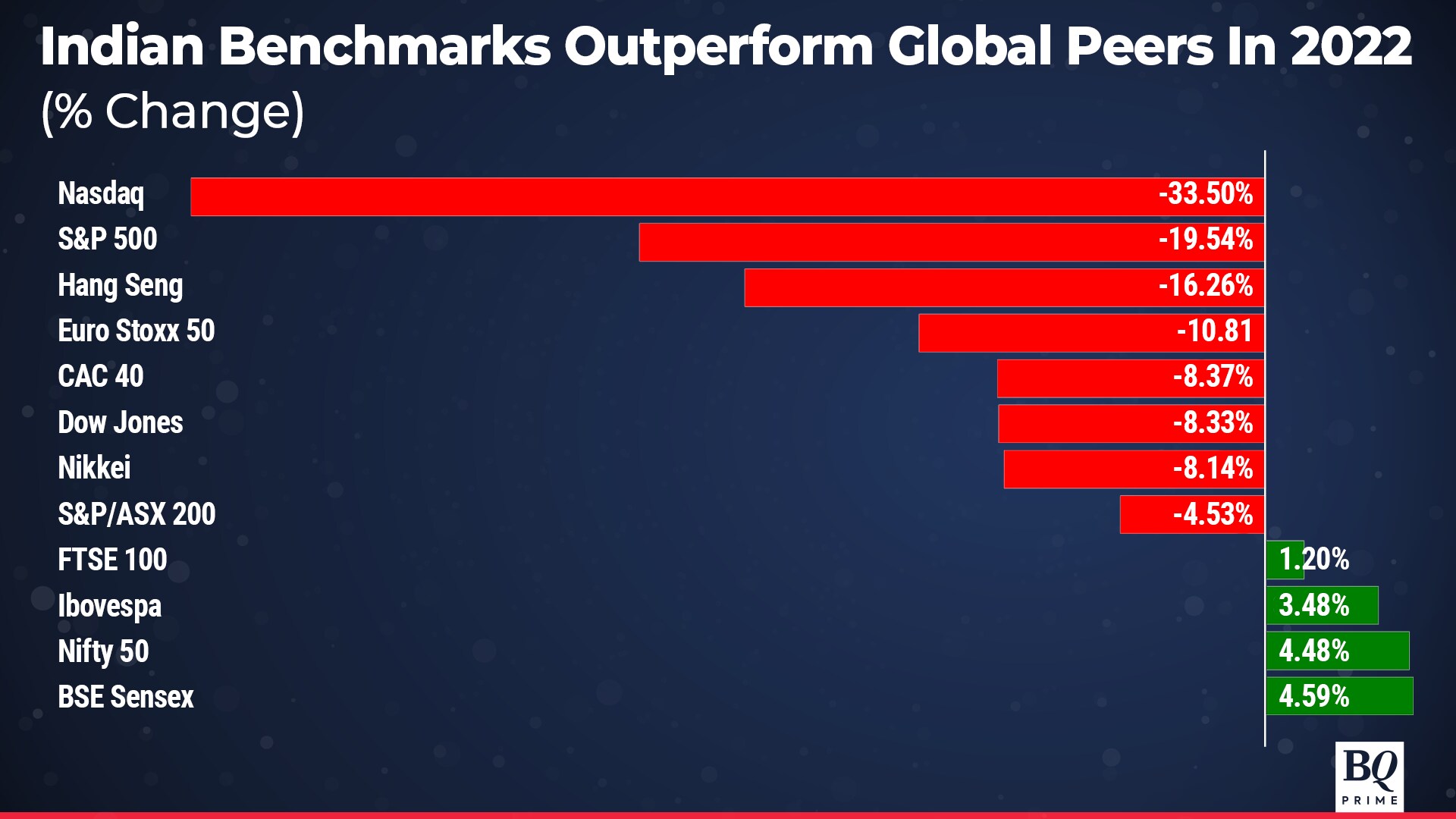

Sensex, Nifty Top Global Charts

The S&P BSE Sensex and NSE Nifty 50 emerged as the top performers among global peers in 2022.

The Sensex climbed 4.59% this year, while the Nifty rose 4.48%—the highest among world indices, as on Dec. 27.

The tech-heavy Nasdaq, on the other hand, plunged 33.50%—the most in 2022—followed by the S&P 500, Hang Seng and Euro Stoxx 50.

IT Tumbles The Most Since 2008, PSU Banks Outperform

The Nifty IT Index was the worst performer, falling the most among peers, as demand for digital services eased from pandemic highs and concerns persisted over client spending as a recession looms.

The gauge has declined 26.01% so far this year till Dec. 26. That's the worst performance since 2008, when the index tumbled nearly 55%.

The pharma, realty and media indices were the other laggards.

The Nifty PSU Bank index was the top gainer, aided by improving asset quality from Covid-19 lows, healthier balance sheets and low valuations.

Metals and FMCG were the other top sectoral gainers of 2022.

Best And Worst Performing Stocks Of 2022

Mazagon Dock Shipbuilders Ltd. and Karur Vysya Bank Ltd. were the top performing stocks from among Nifty 500 companies in 2022.

Bharat Dynamics Ltd., Raymond Ltd. and Great Eastern Shipping Co. also ranked among the top five gainers in the gauge.

Dhani Services Ltd., Brightcom Group Ltd., Tanla Platforms Ltd., One 97 Communications Ltd. and Metropolis Healthcare Ltd. were the laggards.

Worst Foreign Outflows On Record

It was the worst year on record with foreign outflows from the Indian equity markets amid global uncertainty.

The exodus picked up after the U.S. Federal Reserve increased the pace of rate hikes in June to quell record inflation, worsened by Russia's war in Ukraine.

Despite buying stocks worth nearly Rs 47,000 crore in the last two months, foreign portfolio investors net sold Indian equities worth Rs 1.21 lakh crore year to date as on Dec. 27.

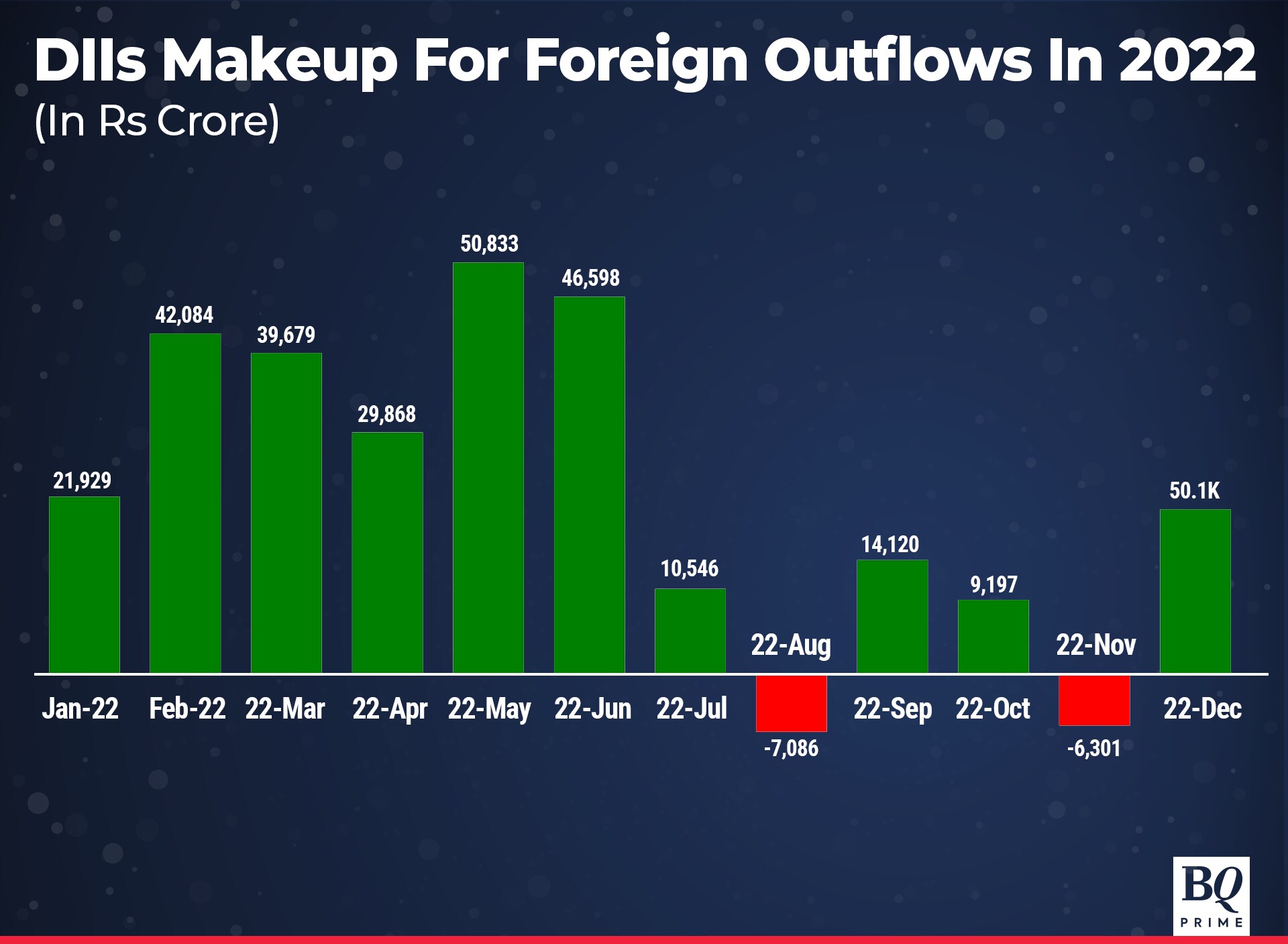

Domestic Institutions Buy Big

As FPIs offloaded equities, buying by domestic institutional investors cushioned the markets.

On March 8, when overseas investors sold the most in a day in the aftermath of Russia's invasion of Ukraine, DIIs bought the highest amount of stocks.

Domestic institutions have net bought equities worth Rs 2.72 lakh crore year to date, as on Dec. 26.

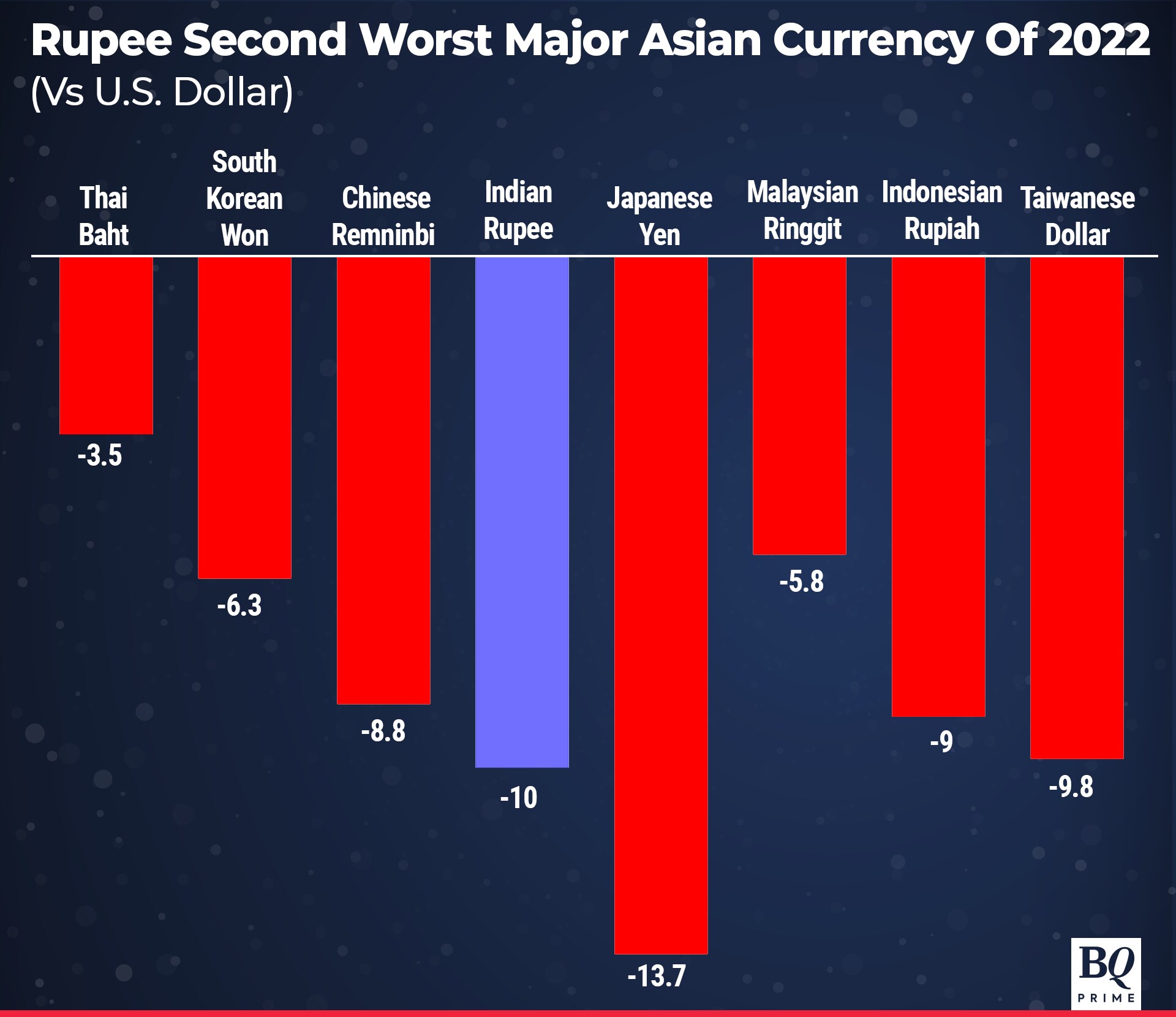

Rupee Hits Record Lows

The Indian rupee fell to record lows in 2022 against the U.S. dollar amid FPI exodus and surge in global commodity prices.

The Indian currency depreciated 11.46% against the U.S. dollar in 2022, making it the second worst performer in Asia after the Japanese yen. It touched an all-time low of 83.03 to the greenback on Oct. 20.

The U.S. dollar scaled its highest level in nearly two decades in September, as investors saw it as a safe haven asset amid uncertainty triggered by Ukraine conflict and global inflation.

Year Of Crude Supply Shocks

Crude rose to its highest level since its 2008 peak, as Russia's invasion of Ukraine hurt supply in Europe, driving up prices.

Brent crude rose to as high as $127.98 on March 8, but has since cooled to trade around the $80 per barrel mark. The decline was partly a result of demand cooling from China.

Overall, oil advanced 8.68% year to date as on Dec 27.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.