In a market where over 6,500 companies are listed, only two names have stood the test of consistency. According to calculations made by NDTV Profit, HDFC Bank Ltd. and Pidilite Industries Ltd. have emerged as India's most reliable stocks, delivering positive returns every calendar year since 2015—a feat unmatched by any other listed company.

The journey has been marked by steady performance despite market cycles, global shocks, and sectoral downturns.

Stocks' Performance Over The Decade

Looking back to 2015, HDFC Bank rose 14%, while Pidilite gained 2%. The following year, the two stocks returned 11% and 7%, respectively. Their strongest year came in 2017, when both delivered more than 50% gains.

Even during challenging years such as 2018 and 2020, they managed to stay positive, with returns in the range of 13–27%. In 2021, HDFC Bank gave a modest 3% returns, while Pidilite delivered 39%.

However, in the last three years the companies have given returns in single digit, though still maintaining their positive streak. So far in 2025, HDFC Bank is up 9%, while Pidilite has risen 5%.

The numbers highlight that while both stocks have had phases of modest performance, they have never slipped into the red, an extraordinary achievement in volatile equity markets.

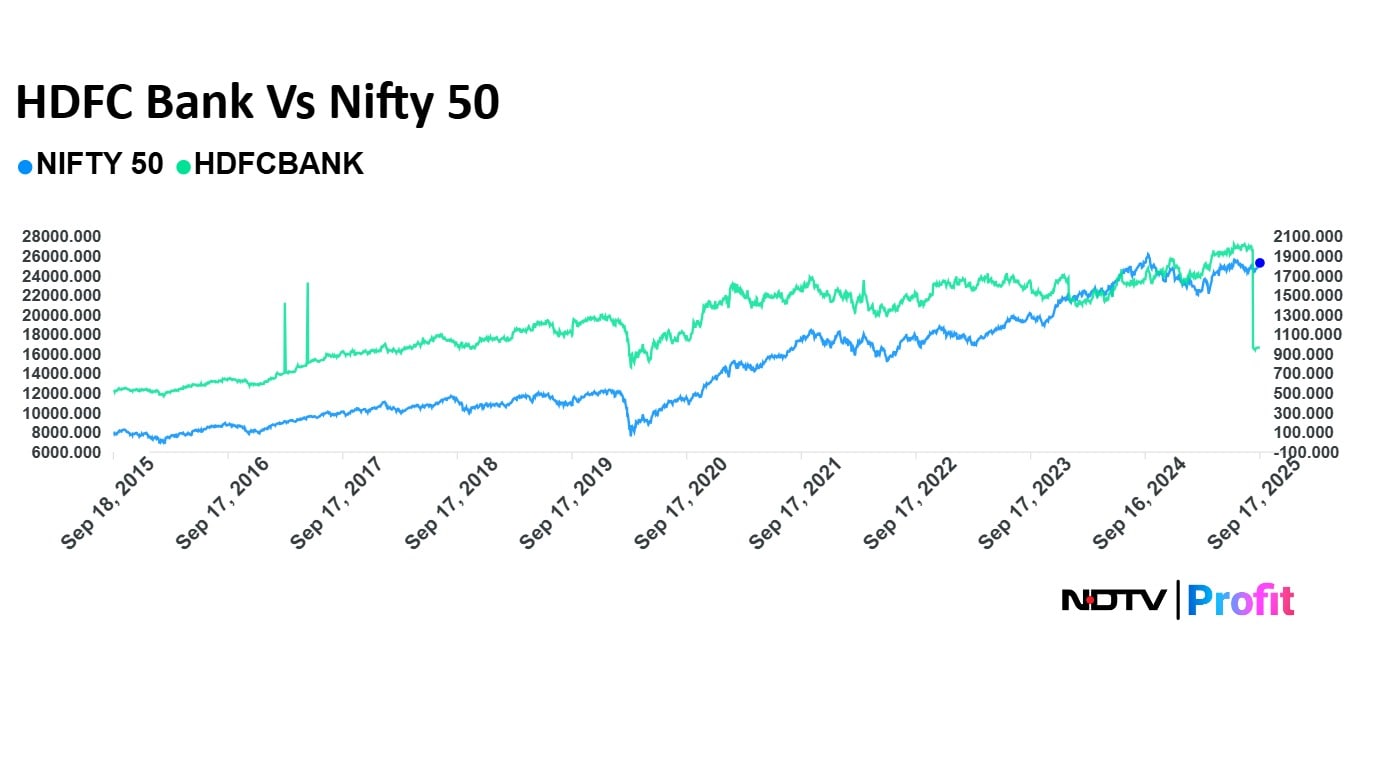

When you compare it with Nifty 50, both the companies outperformed the index between 2015 and 2019. However, in 2020, HDFC Bank, which was up 13%, slightly underperformed the index that rose 14.77%. Since then, the bank's performance while positive has still not matched the index.

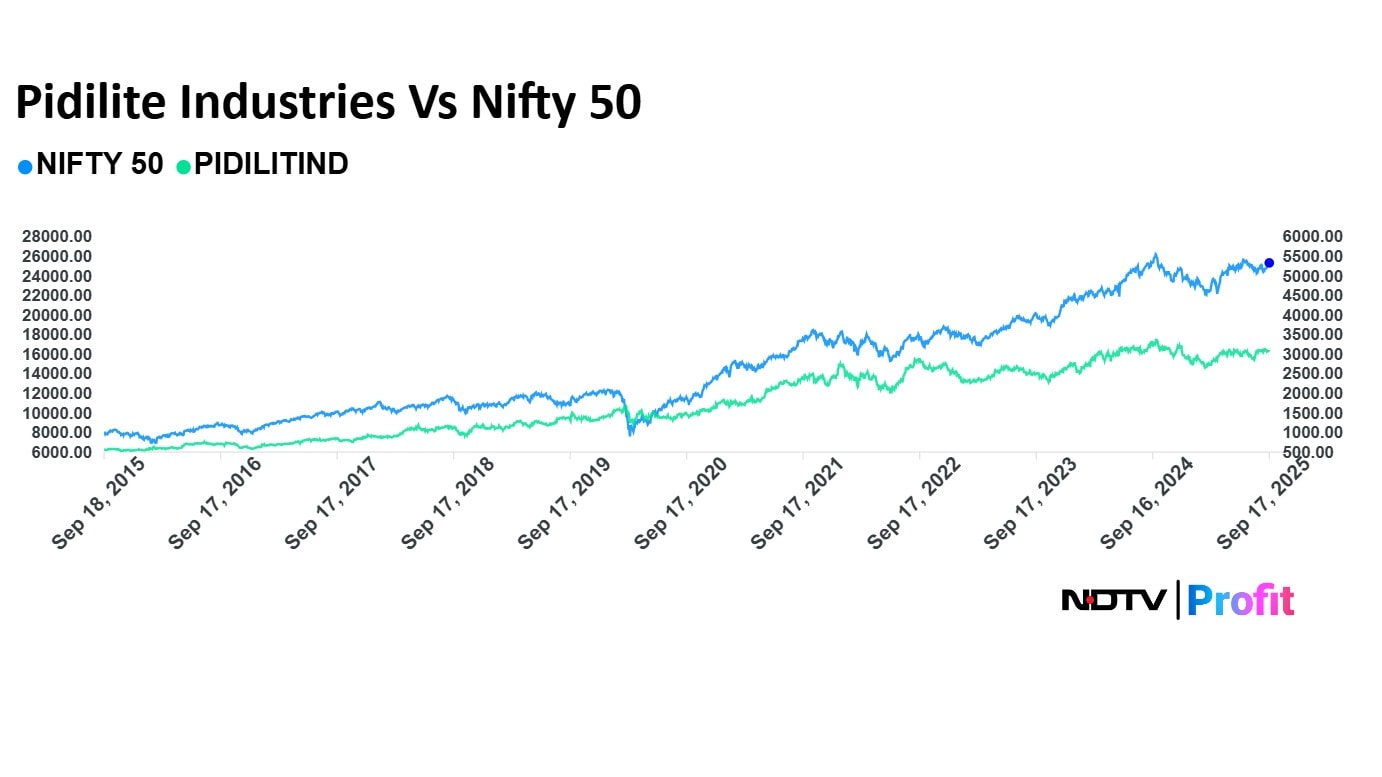

On the other hand, Pidilite in 2020 and 2021 outperformed the index, but since then the stock has also underperformed in comparison to the benchmark.

What Next?

Looking ahead, analysts maintain a supportive outlook on both companies, with sentiment particularly strong for HDFC Bank. Out of 49 analysts tracking the bank, 47 maintain a 'buy' rating and two recommend a 'hold', according to Bloomberg data.

This indicates that the stock enjoys a 96% 'Buy' rating. The average 12-month consensus price target of Rs 1,115.28 implies an upside of 14.2%. Out of 18 analysts tracking Pidilite, 11 maintain a 'buy' rating, two recommend 'hold', and five suggest 'sell', according to Bloomberg data.

This indicates the stock enjoys a 61% 'Buy' rating. The average 12-month consensus price target of Rs 3,293.11 implies an upside of 7.8%. On the valuation front, Pidilite trades at a premium, with a 12-month forward price-to-earnings ratio of 60 times compared with its five-year average of 68 times.

HDFC Bank appears more reasonably valued, with a 12-month forward price-to-book multiple of 2.6 times against its five-year average of 2.8 times.

HDFC Bank's outlook is underpinned by robust asset quality, expectations of loan growth recovering to above 10% over the next two financial years, and an improvement in net interest margins as interest rates ease. Operating leverage is also expected to strengthen as growth normalises, with return on assets projected to recover to 2% by FY28.

For Pidilite, management guidance remains strong, with promising new segment opportunities and benign input costs expected to support margins.

That said, risks remain. For HDFC Bank, much depends on the pace of loan growth recovery and the trajectory of interest rates. For Pidilite, valuations leave little room for error, and rising competition in its core categories could put pressure on growth.

Consistency is rare in equity markets, and HDFC Bank and Pidilite have demonstrated it in abundance. For investors seeking reliability, these two names have delivered every single year for the past decade. While valuations and competition pose challenges, their resilience makes them standout performers in India's stock market universe.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.