The upcoming week is expected to be sombre, with a shortened trading period as the exchanges will be closed on March 14 for Holi. India's latest industrial production and consumer price index is set to be released this week, along with key economic data like the US CPI and initial jobless claims figures.

On the IPO front, the Indian market is expected to see dull week. No mainboard companies will list this week, while NAPS Global India Ltd. will be debuting on March 11. Two SME IPOs will open this week.

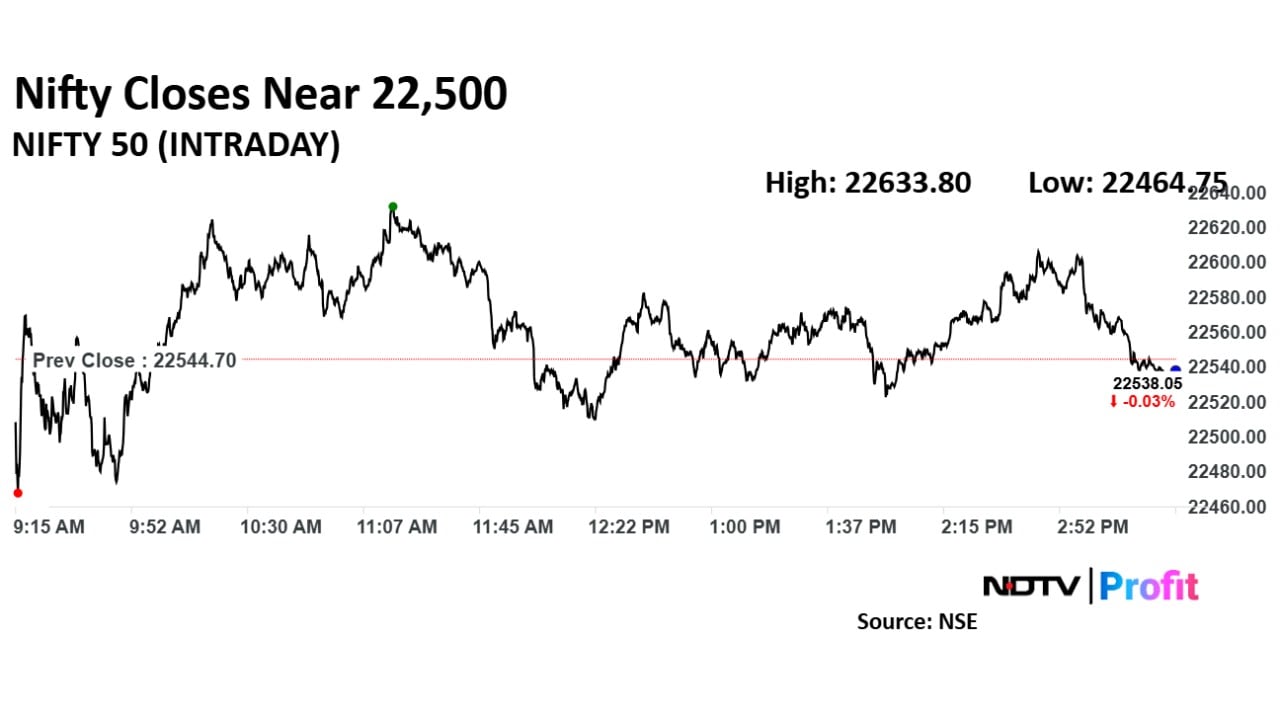

According to Hrishikesh Yedve, assistant vice president, technical and derivatives research at Asit C. Mehta Investment Interrmediates Ltd., the next significant resistance for the NSE Nifty 50 is in the range of 22,668-22,720, marking the location of the upcoming bearish gap. This is followed by the previous breakdown point at 22,800, he said,

“On the downside, 22,240 will act as immediate support. Though the overall market suggests strength, traders should wait for a move above 22,800. Until then, buy near support and take profits around resistance,” he said.

Markets This Week

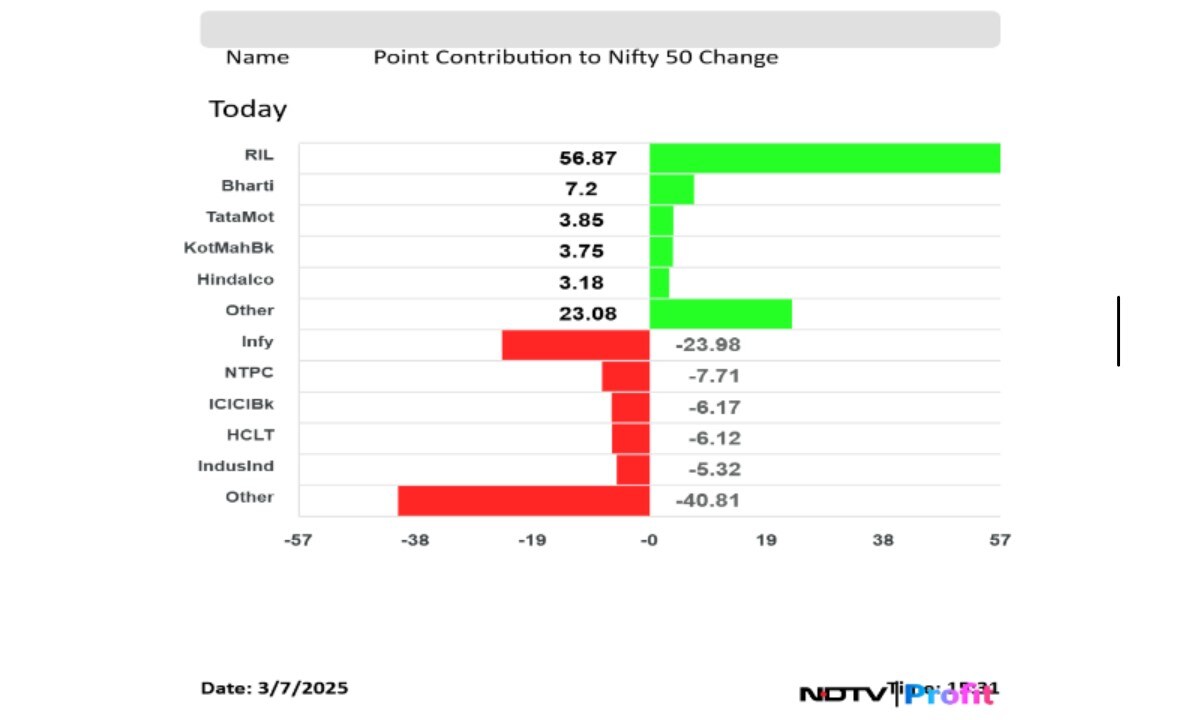

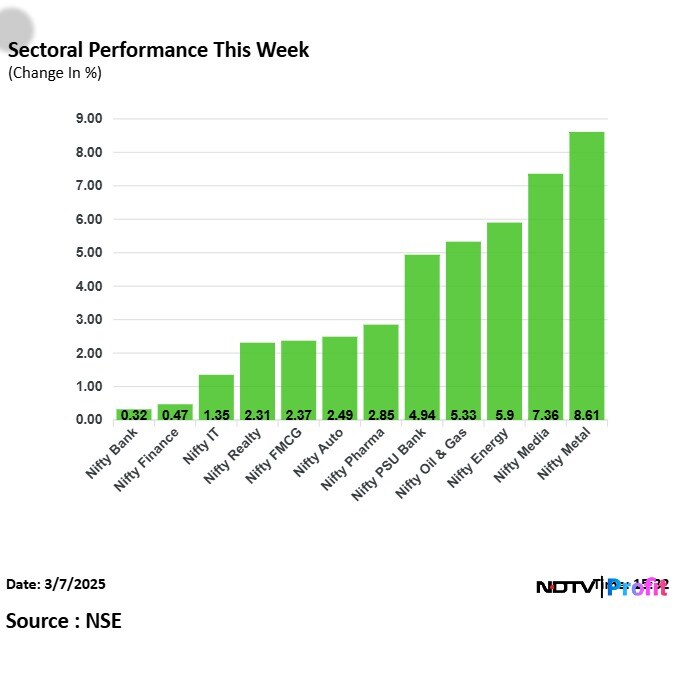

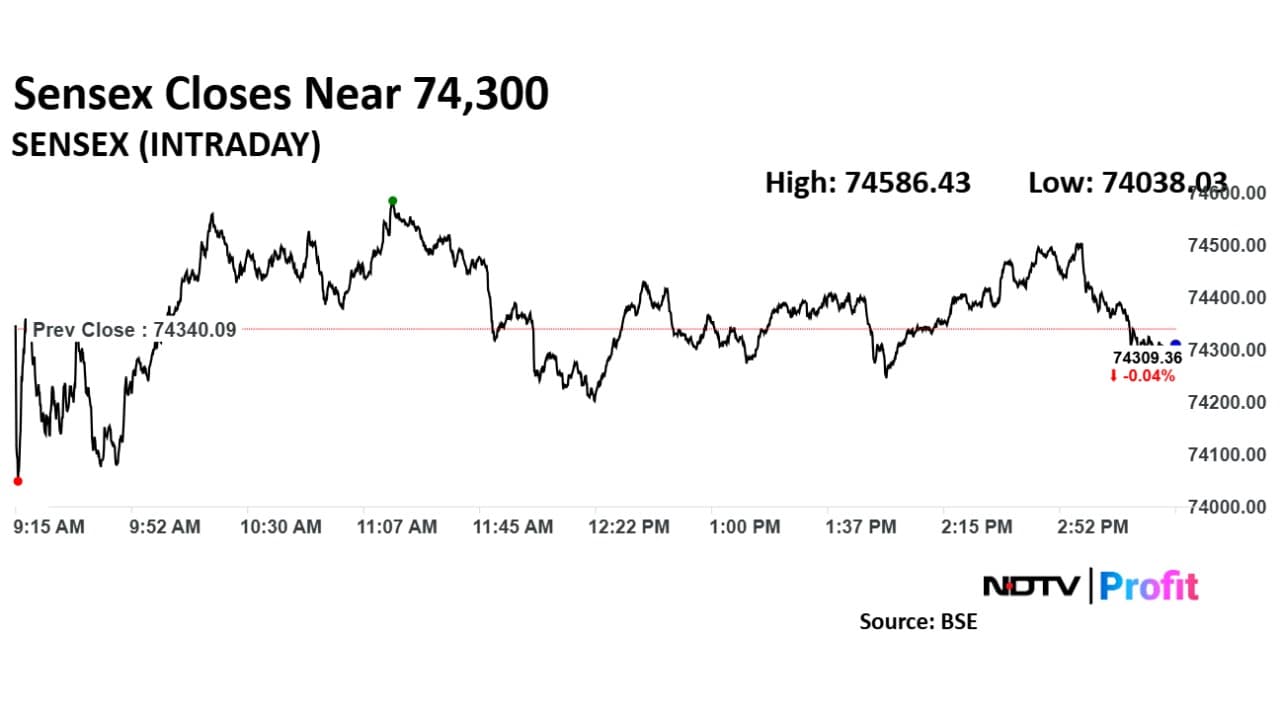

The benchmark equity indices closed flat on Friday, with the NSE Nifty 50 snapping its three-week rout and registering the best weekly gains in three months.

The Nifty ended 7.8 points or 0.03% higher at 22,552.5, while the BSE Sensex closed 7.51 points or 0.01% down at 74,332.58.

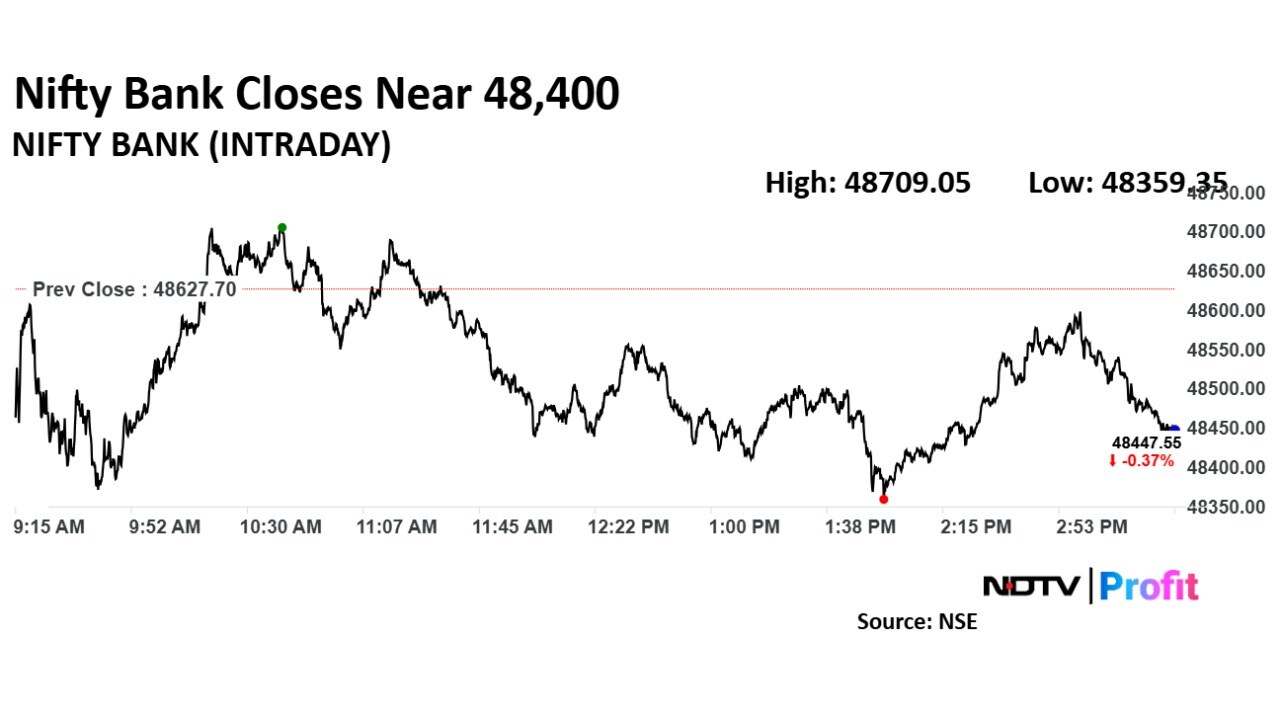

The Nifty Metal was the top gaining sectoral index for the week. The Nifty Pharma, Auto, IT, Finserv and Bank snapped their three-week losing streaks. The Nifty FMCG snapped its four-week losing streak.

Domestic Cues

India's CPI and IIP data will be released on March 12. India's retail inflation eased to a five-month low in January, driven by decreased vegetable prices. The Consumer Price Index-based inflation rate dropped to 4.31% in January from 5.22% in December.

On the other hand, India's Index of Industrial Production growth slowed to 3.2% in December, following a six-month high of 5% in November.

It is truncated week as the stock markets will be closed on March 14 due to Holi celebrations.

Global Cues

The week has begun with the Federal Reserve's communications blackout starting on March 8, in preparation for the March 18-19 policy meeting.

The US consumer price index for February is expected to be released on March 12, covering the first full month of President Donald Trump's second term while US producer price index and initial jobless claims data will be released on March 13.

On March 9, Canada's Liberal Party will elect a new leader to succeed Justin Trudeau, with the winner expected to be sworn in as prime minister shortly thereafter.

China's retaliatory tariffs of up to 15% on US agricultural goods are set to take effect on March 10 while European Union's finance ministers will gather in Brussels to discuss increasing defense spending in light of President Donald Trump's efforts to strengthen relations with Russia.

The week will conclude with a deadline for US lawmakers to reach a spending agreement that prevents a federal government shutdown.

Primary Market Action

The upcoming week will witness muted activity in the primary markets, in both the mainboard and SME segments. Investors will see no main board listing.

The upcoming SME IPO this week are Super Iron Foundry Ltd. and PDP Shipping & Projects Ltd. while NAPS Global India Ltd. will get listed on the bourses on March 11.

Corporate Action

Shares of Bharat Electronics Ltd., GR Infraprojects Ltd. and Housing & Urban Development Corp. will turn ex-date for the issue of interim dividends.

Meanwhile, shares of IoL Chemicals & Pharmaceuticals Ltd., Mehai Technology Ltd., Shalimar Agencies Ltd., and Shangar Decor Ltd. will turn ex-date for their stock split.

The table below shows the full list of corporate actions for the upcoming week.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.