(Bloomberg) -- Indian bond traders are expected to overlook the modest increase announced in the budget, as hopes for an interest-rate cut this week help the nation's debt extend gains.

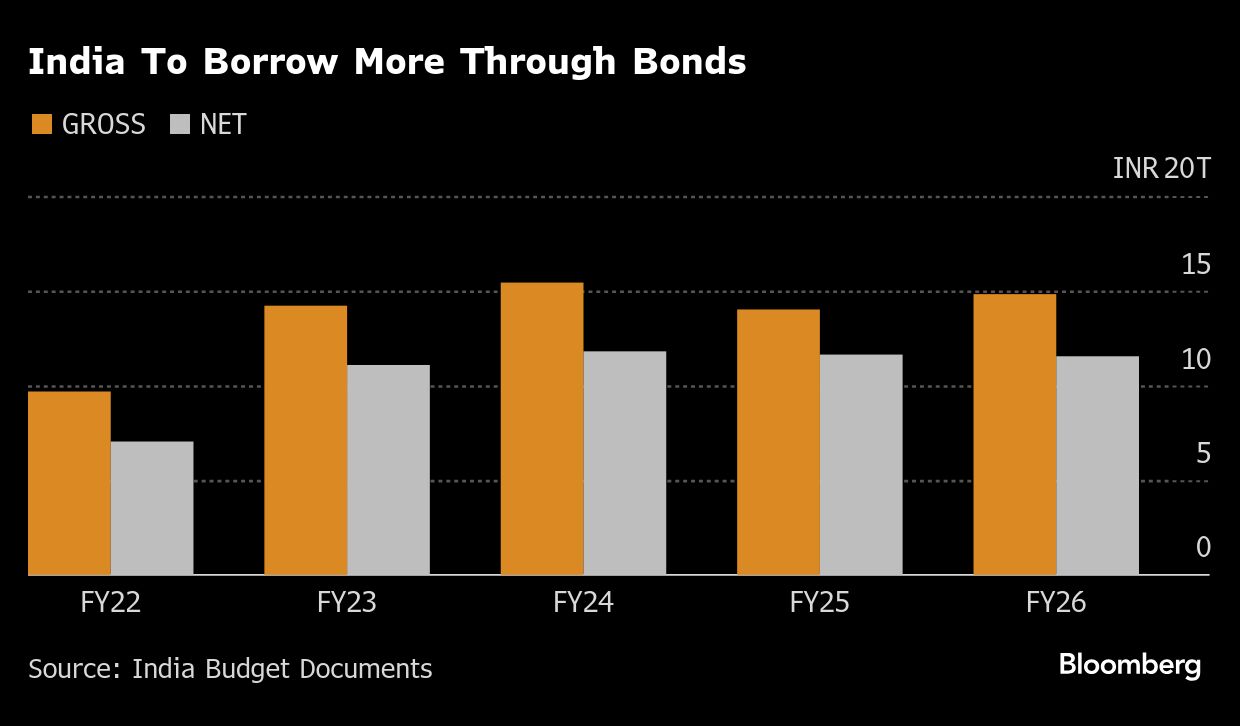

Yields may rise marginally on Monday after the government on Saturday projected a higher-than-expected 14.82 trillion rupees ($171 billion) of bond sales, according to Tata Asset Management and Quantum Asset Management. Yet, analysts expect bonds to remain well-supported in the coming weeks.

“Since the overall demand-supply dynamics are still favorable, we anticipate the negative effect on bonds will be transient,” said Pankaj Pathak, fixed income fund manager at Quantum Asset. “We expect positive momentum to continue, with long-term yields declining further.”

Indian bonds have gained in recent days, driven by the central bank liquidity measures aimed at easing a financial system cash deficit that had climbed to its highest level in more than a decade. Last week, the benchmark 10-year yield fell to its lowest in almost three years after the Reserve Bank of India announced steps to inject about $18 billion into the banking system, including bond purchases.

Further supporting the sentiment, analysts expect the RBI to cut interest rates in its Feb. 7 meeting. The authority last week bought 200 billion rupees of bonds and injected $5 billion via foreign-exchange swaps to improve liquidity.

The yield on the 10-year debt declined by six basis points in January, closing at 6.70% on Friday.

“Given the fact that the RBI may continue to buy bonds, from a demand perspective the supply numbers may be easily digested,” said Sakshi Gupta, principal economist at HDFC Bank Ltd. Yields may continue to inch lower, helped by the fact that there may be rate cuts, she added.

Borrowings are set to rise as the government expects lower collections from small savers, according to Tata Asset. Net borrowings, adjusted for repayments, are estimated at 11.54 trillion rupees for the year starting April 1, Finance Minister Nirmala Sitharaman announced on Saturday.

Despite the doubling in the government's debt sales since the pandemic, robust demand from long-term investors, like pension funds and insurance companies, has helped absorb supply.

Foreign interest has also played a role in supporting bonds in the current financial year, following JPMorgan Chase & Co.'s decision to include India in its emerging market debt index. Global funds poured $14.4 billion into index-eligible bonds in 2024.

Still, some foreign demand may slow this year as the impact of President Donald Trump's trade war on the greenback and the global economy is complicating the outlook for emerging markets.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.