Indian stocks are emerging market investors' biggest underweight market after they accelerated rotation to Asian peers last month, according to Nomura Holdings Inc.

Investors re-allocated from India to Taiwan, Hong Kong/China and South Korea in July, with 71% of EM funds becoming underweight on India at the end of the month, compared with 60% at end-June, an analysis of large funds by Nomura showed.

The analysis echoes the findings of a Bank of America Corp. survey which showed India has gone from fund managers' top Asian pick to their least preferred in just three months. The shift underscores how Indian stocks are fast becoming the top funding source for foreign investors, as the US boosts tariffs on the South Asian nation due to its purchases of Russian oil. This weakens the case for India's domestically driven economy to serve as a relative haven during global volatility.

Tariffs have only compounded the woes of Indian equities, which were already seeing a hit to investor sentiment from slowing earnings growth and rich valuations. Overseas investors have net sold $12.7 billion worth of Indian stocks this year.

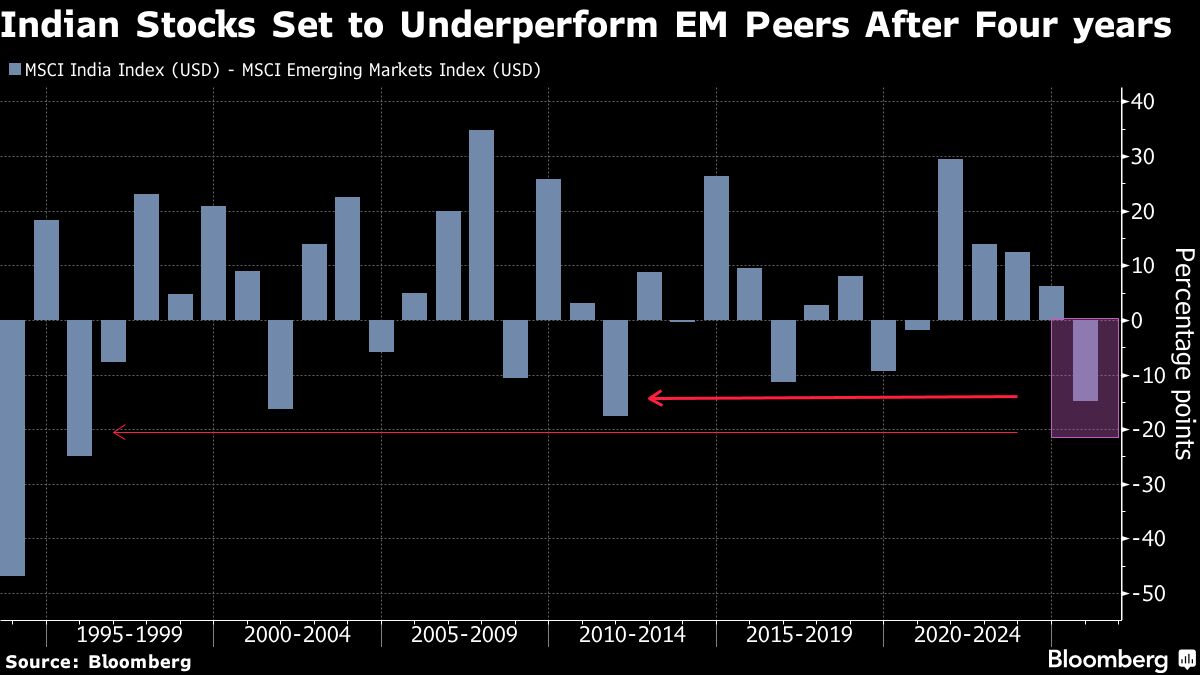

The MSCI India Index has lagged the EM equities benchmark by nearly 15 percentage points this year in dollar terms, putting it on track for its biggest annual underperformance since 2011. The local market is now trailing onshore China by $6.8 trillion, the widest gap since March.

EM funds' relative allocations to India “decreased significantly” by 1 percentage point in July over the previous month, while the same to Hong Kong/China, Taiwan and Korea increased, Nomura strategists including Chetan Seth wrote in a note dated Aug. 20. Out of 45 funds in their sample size, 41 reported lower allocations to India.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.