Indian Oil Corp.'s share price gained over 2% after Jefferies upgraded the stock to a 'buy' rating. IOCL has the most leverage among its peers to benefit from an improvement in refining margins, owing to its high refining-to-marketing ratio, the brokerage said.

The oil marketing company's integrated margins are notably superior to those of Hindustan Petroleum Corp. and comparable to Bharat Petroleum Corp., the note said.

IOCL's prospects are buoyed by several positive factors. Historical trends suggest that China's fiscal stimulus announcements have spurred strong growth in petrochemical product demand, as seen in 2009 and 2015. Jefferies expects a similar trend in 2025, with China's ongoing stimulus measures likely driving higher oil demand.

Another favour point is that refinery closures are accelerating and three major refineries have announced plans to stop operations in 2025. Jefferies expects this will lead to production going down by 1 Million Barrels Per Day— the highest in three years.

Additionally, net refinery capacity additions in 2025 are expected to be around 0.6 mbpd, significantly lagging the forecasted demand growth of 1.1 mbpd. Therefore, demand will exceed the capacity additions.

Jefferies noted that IOCL's risk-reward has turned favourable after a nearly 20% correction over the past three months, with the stock now trading at a steeper discount to the Nifty, compared to its long-term average.

The brokerage raised its price target to Rs 185, valuing the stock at 1.3 times forward price-to-book for a 15% full-cycle return on equity.

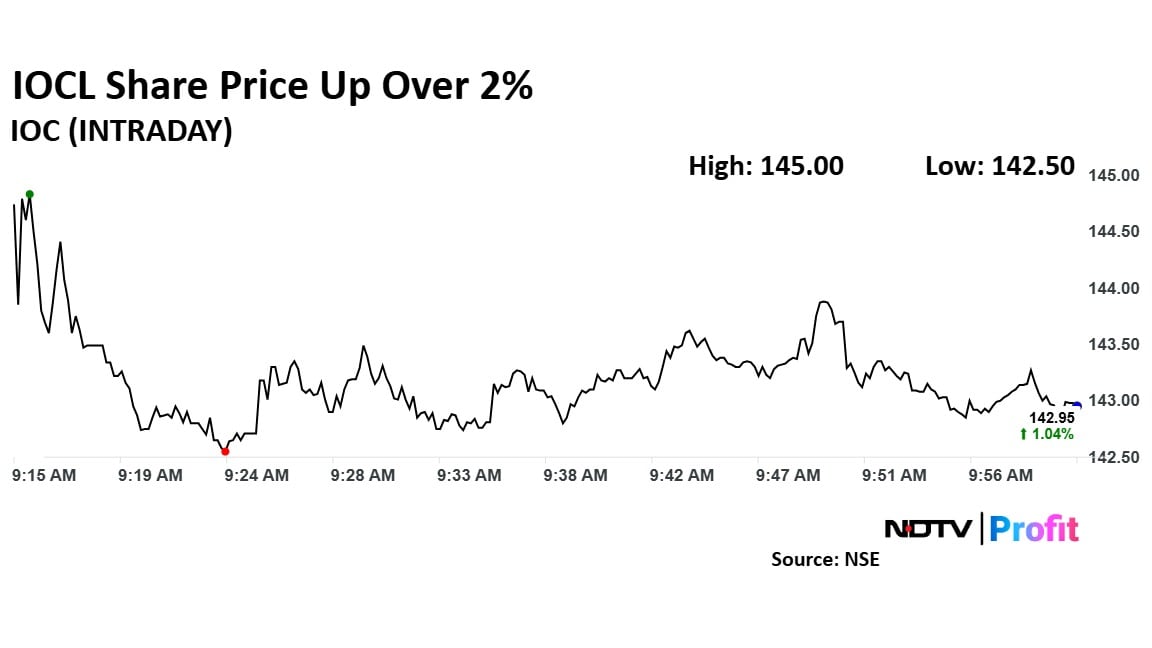

IOCL Share Price Today

IOCL stock rose as much as 2.49% during the day to Rs 145 apiece on the NSE. It was trading 1.04% higher at Rs 142.95 apiece, compared to a 0.70% decline in the benchmark Nifty 50 as of 9:57 a.m.

It has risen 19.67% in the last 12 months and 10.2% on a year-to-date basis. Total traded volume so far in the day stood at 3.2 times its 30-day average. The relative strength index was at 52.30.

Sixteen of the 34 analysts tracking the OMC have a 'buy' rating on the stock, seven recommend a 'hold' and 11 suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 163.13, implying a upside of 13.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.