Indian lenders have requested the central bank to make various tweaks to the government's bond-borrowing program that would make it easier to absorb supply amid market volatility, according to people familiar with the discussions.

Banks in a meeting with the Reserve Bank of India discussed an extension to the government's second-half borrowing plan until mid-March, instead of traditionally ending in February, the people said, asking not be named discussing private matters.

An extended window would allow for smaller weekly issuances, helping the market better digest the supply, they added.

The central bank, which is the government's debt manager, did not immediately reply to an email seeking comment. The RBI typically releases the second half borrowing plan by end-September.

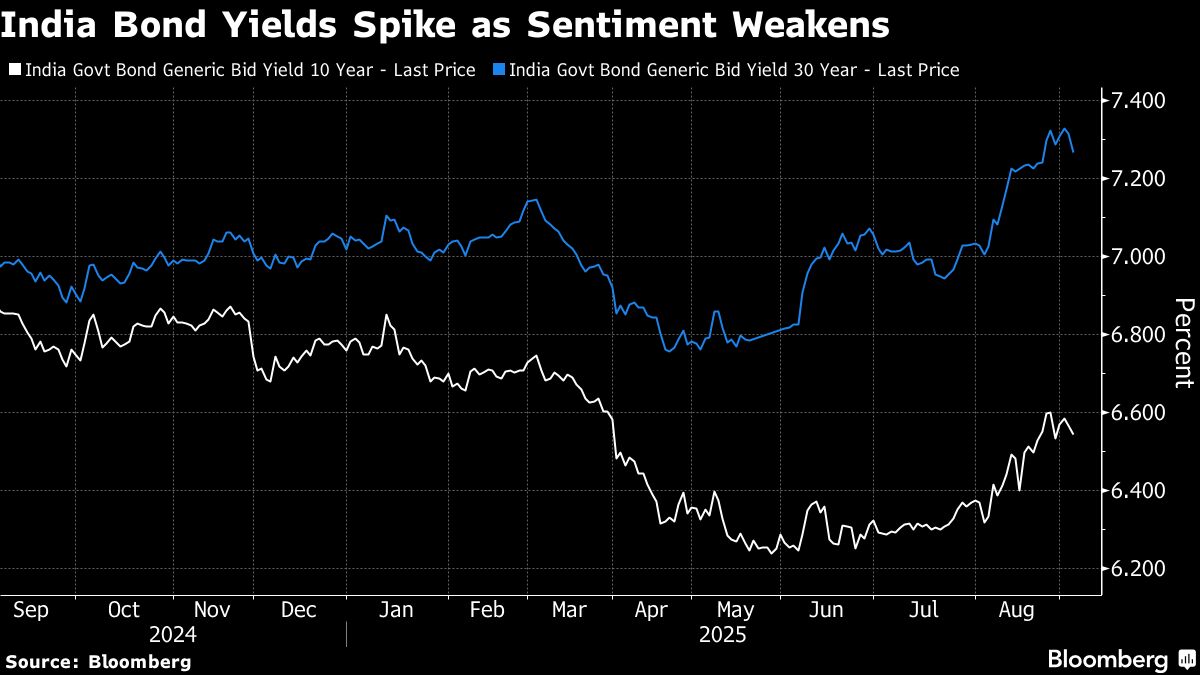

The discussions follow the biggest bond selloff in three years last month, driven by fading expectations of interest-rate cuts and renewed fiscal concerns initially sparked by proposed consumption tax reductions. The slump also coincides with a global bond rout, fueled by worries of rising debt issuance and deteriorating fiscal discipline.

Lenders have also urged the central bank to ask state governments to reduce the number of individual securities they issue and to shift state bond auctions to the so-called uniform-price system, the people said. Under this method, all successful bidders receive bonds at a single price set by the RBI.

In the uniform-price-auction method, banks would be spared the risk of buying state bonds at undesirable prices - an issue that has frequently occurred under the current so-called multiple-price method, they said.

A record long-tenor bond issuance by state governments has strained banks' investment capacity and pushed up sovereign yields. Some recent state auctions have also fallen short of targets due to weak market demand.

Some large Indian lenders have asked the central bank to reduce the supply of longer-duration bonds in the government's October–March borrowing plan, Bloomberg News reported earlier this week.

The government set first-half borrowing at 8 trillion rupees ($90.8 billion) out of a total 14.82 trillion rupees planned for the full fiscal year, leaving around 6.8 trillion rupees in bond sales scheduled for the second half, according to the federal budget.

Yields on India's 10-year bond jumped about 20 basis points in August, the sharpest monthly rise in nearly three years, pushing up borrowing costs for firms and undermining the transmission of past central bank rate cuts aimed at supporting the economy.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.