The shares of India's state-run lenders fell on Wednesday after the Finance Ministry clarified on increasing the Foreign Direct Investment (FDI) limit within the sector. The decline was led by Indian Bank Ltd. and Punjab National Bank Ltd.

The government has dismissed expectations of a hike in foreign direct investment (FDI) limits for public sector banks (PSBs), confirming that the cap will remain unchanged at 20%. This means no fresh foreign inflows will be enabled for state-owned lenders despite earlier market speculation of an increase to 49%.

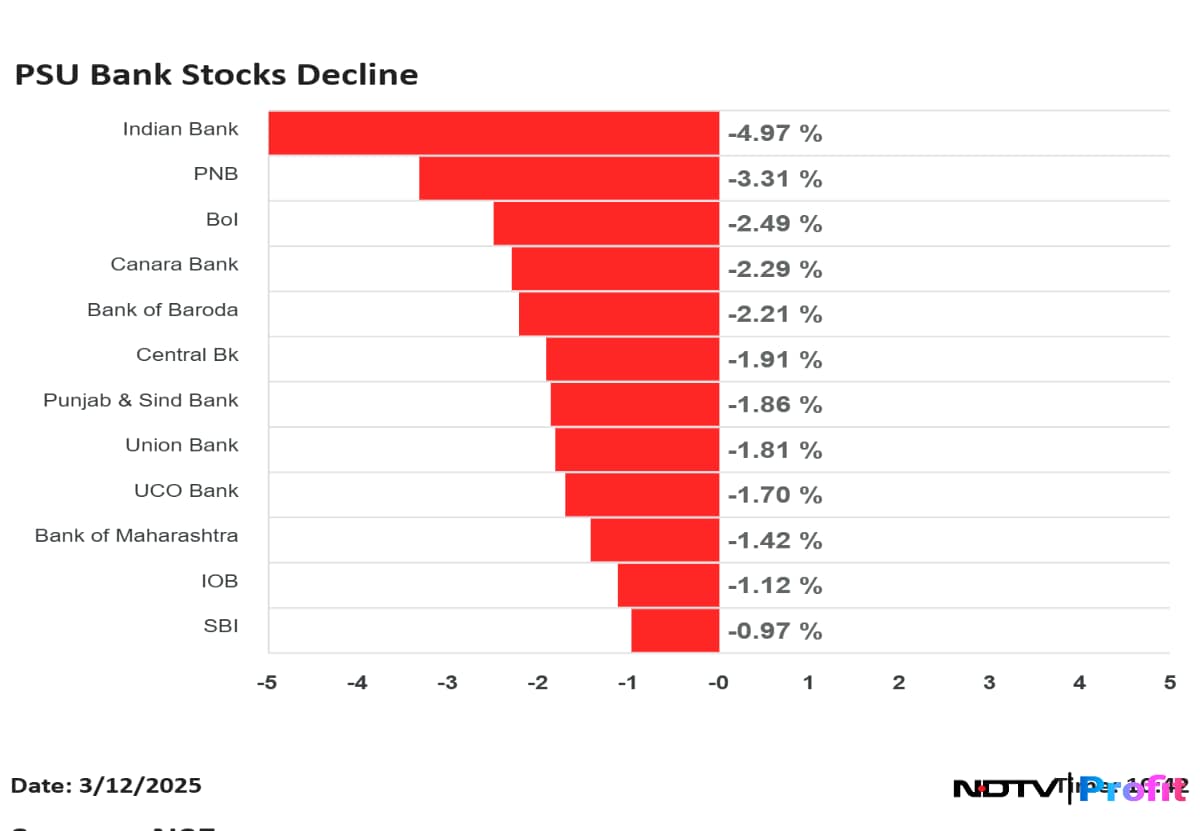

Indian Bank shares fell the most at 5% followed by Punjab National Bank which was down over 3%. Bank of Baroda, Bank of India, Canara Bank, Central Bank and Union Bank were down over 2%, while UCO Bank, SBI, Punjab And Sind Bank, Bank of Maharashtra, Indian Overseas Bank fell over 1%.

In a written reply to the Lok Sabha, the Ministry responded to questions from MPs Ranjeet Ranjan and Haris Beeran, who sought clarity on whether the government had proposed raising the FDI ceiling in PSBs, which banks would be affected, the potential inflows expected, and what safeguards were planned to prevent excessive foreign ownership.

The Ministry firmly denied any such proposal. “No, Sir,” it stated. It further clarified that within the private sector, 49% FDI is permitted under the automatic route, while investments between 49% and 74% require government approval.

The Ministry also pointed to regulatory safeguards set by the Reserve Bank of India. Under the RBI's master directions on acquisition and holding of shares in banking companies, any transaction resulting in an investor owning or controlling 5% or more of a bank's paid-up capital requires prior approval from the central bank.

The clarification signals continuity in India's banking policy framework, shutting down speculation that the government was preparing a major shift to attract foreign capital into state-owned lenders.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.