The shares of IndiaMart InterMesh Ltd. fell 10% to hit over two-year low on Wednesday, after brokerages remained bearish post its third quarter result. This comes following a weaker-than-expected quarterly performance and concerning trends in its subscriber base.

Nuvama and Nomura reduced the target price, citing factors such as decline in paid subscribers, weak customer additions, and elevated churn rates. While Nomura cut the target price to Rs 1,900, Nuvama has cut it to Rs 1,970 apiece.

Nuvama has retained its rating to 'reduce' rating and lowered the target price for the online business-to-business e-commerce platforms to Rs 1,970 from Rs 2,500 per share, reflecting concerns about slower growth and sustained subscriber churn. The firm also noted that margins were temporarily elevated due to reduced spending on sales and marketing.

Similarly, Nomura has cut its target price for IndiaMART to Rs 1,900 from Rs 3,150, and downgraded its rating to 'reduce' from 'neutral'. Nomura has also revised its PAT estimates downward by 4-13% for FY25-27, citing the slow pace of subscriber growth and limited potential for improving collections from existing customers.

The company on Tuesday reported a 47% rise in net profit to Rs 121 crore, while its revenue rose 16% to Rs 354 crore. Operating income, or earnings before interest, taxes, depreciation, and amortisation, rose 61.4% year-on-year to Rs 138 crore. The Ebitda margin expanded to 39% from 28.1% in the same period the previous year.

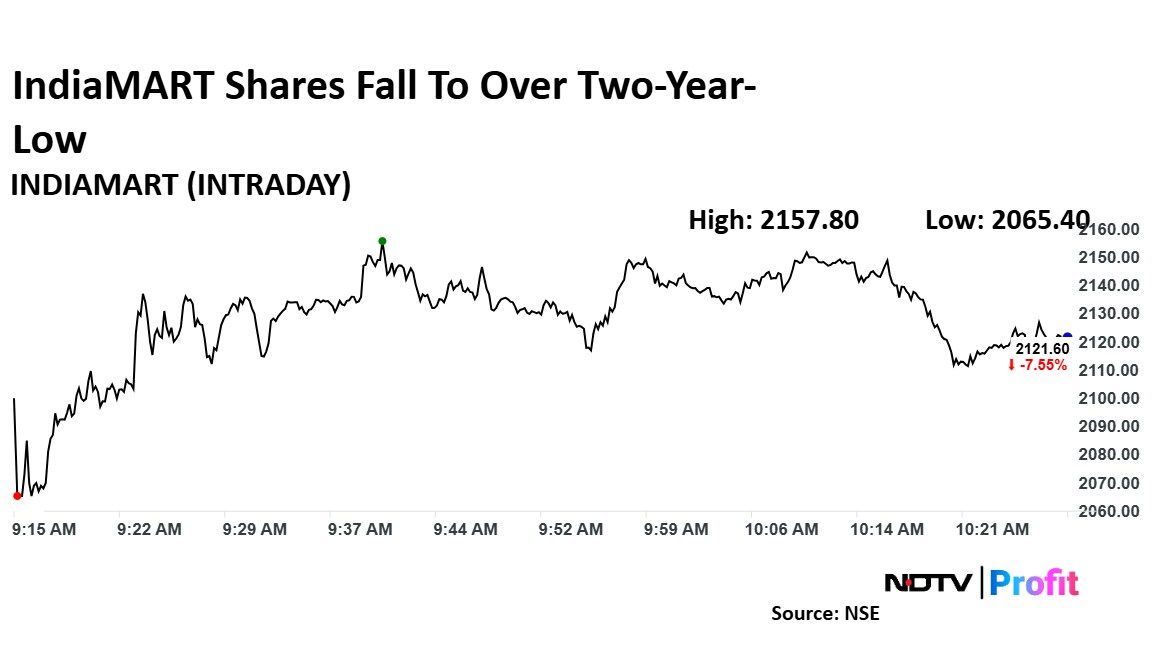

IndiaMART InterMesh Share Price

Shares of IndiaMart fell as much as 10% to Rs 2,065.40 apiece, the lowest level since December 2022. It pared losses to trade 7.67% lower at Rs 2,118.85 apiece, as of 10:26 a.m. This compares to a 0.34% advance in the NSE Nifty 50.

The stock has risen 13.13% in the last 12 months. Total traded volume so far in the day stood at 3.3 times its 30-day average. The relative strength index was at 35.

Out of 21 analysts tracking the company, eight maintain a 'buy' rating, three recommend a 'hold' and 10 suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 13.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.