India's government is considering a significant policy shift to increase the foreign investment limit in Public Sector Undertaking banks, according to a report by the Economic Times. The Nifty PSU Bank is at its This move could trigger substantial passive inflows and is part of a broader economic reform agenda.

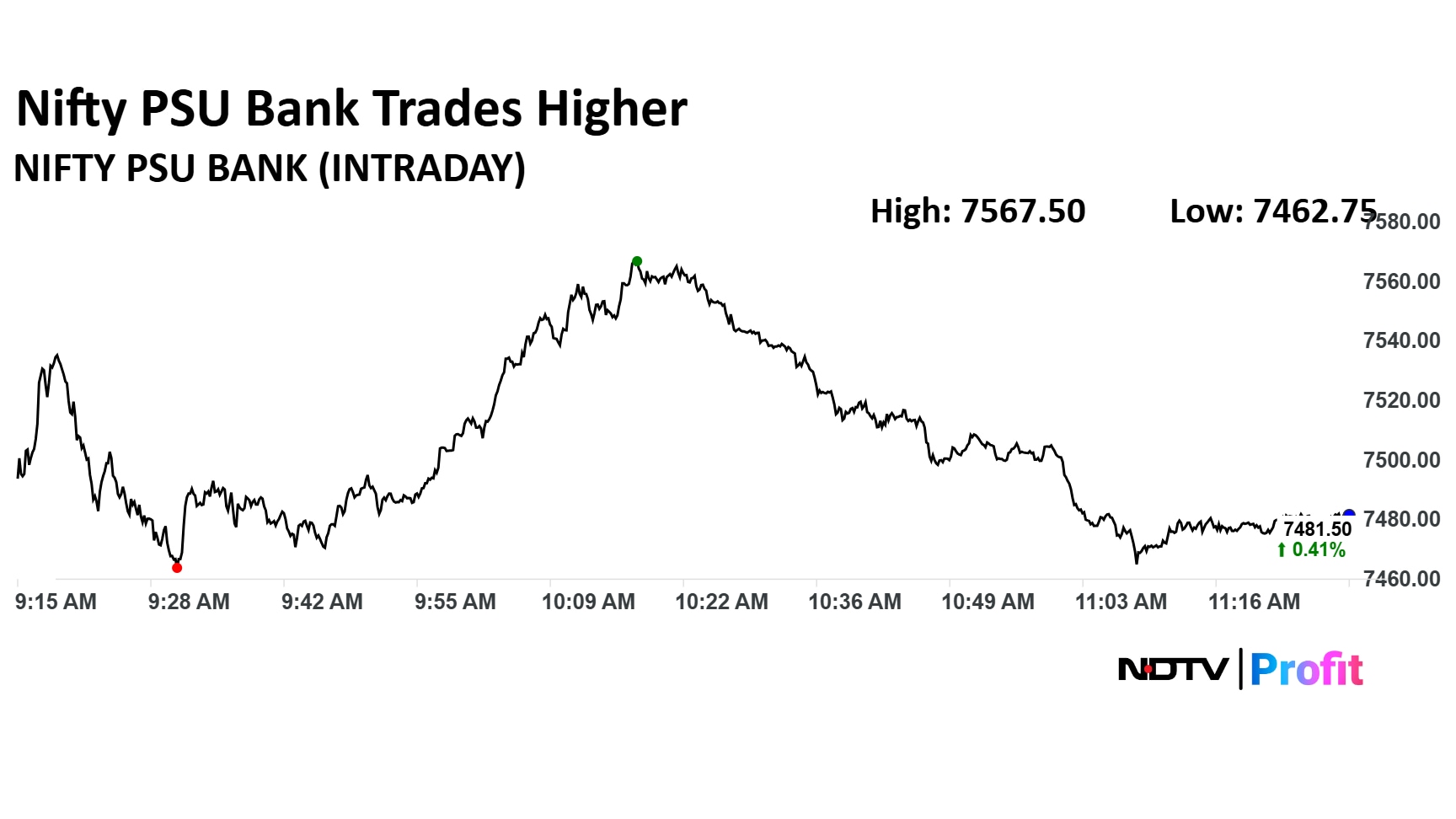

Following the media report, the Nifty PSU Bank has risen as much as 1.56% in trade so far, to its highest levels in over a year. The previous high was recorded on June 19, as the index was trading 0.34% higher at Rs 7,476 compared to a 0.43% decline in the Nifty 50 as of 11:29 a.m.

The proposal would raise the foreign portfolio investor limit from the current 20% to as high as 49%, while the government would retain a majority stake of over 51%. This move is expected to bring significant capital into the banking sector, particularly for banks included in key global indices.

Assuming the FPI limit is increased to 49% from 20%, the State Bank of India, which is part of both MSCI and FTSE indices, stands to be the biggest beneficiary. It could see a total inflow of over $554 million from rom FTSE-tracked funds.

Following SBI, Bank of Baroda is projected to attract inflows of $64 million, while Canara Bank could see $55 ,million. Punjab National Bank could also see an inflow of $7 million from the FTSE.

As of June 2025, the government's ownership in these banks is substantial, ranging from 57.42% in SBI to the highest holding in Indian Overseas Bank, with 94.61% holding.

Foreign Institutional Investor holdings, by contrast, are currently much lower, with Canara Bank having the highest FII share at 11.38% and is followed by State Bank of India at 9.33%. The IOB has the minimal FII holding among the lot with 0.08%.

The proposed policy would allow overseas investors to significantly increase their shareholding, potentially to more than 20%, bringing the Indian banking sector more in line with global financial markets.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.