(Bloomberg) --

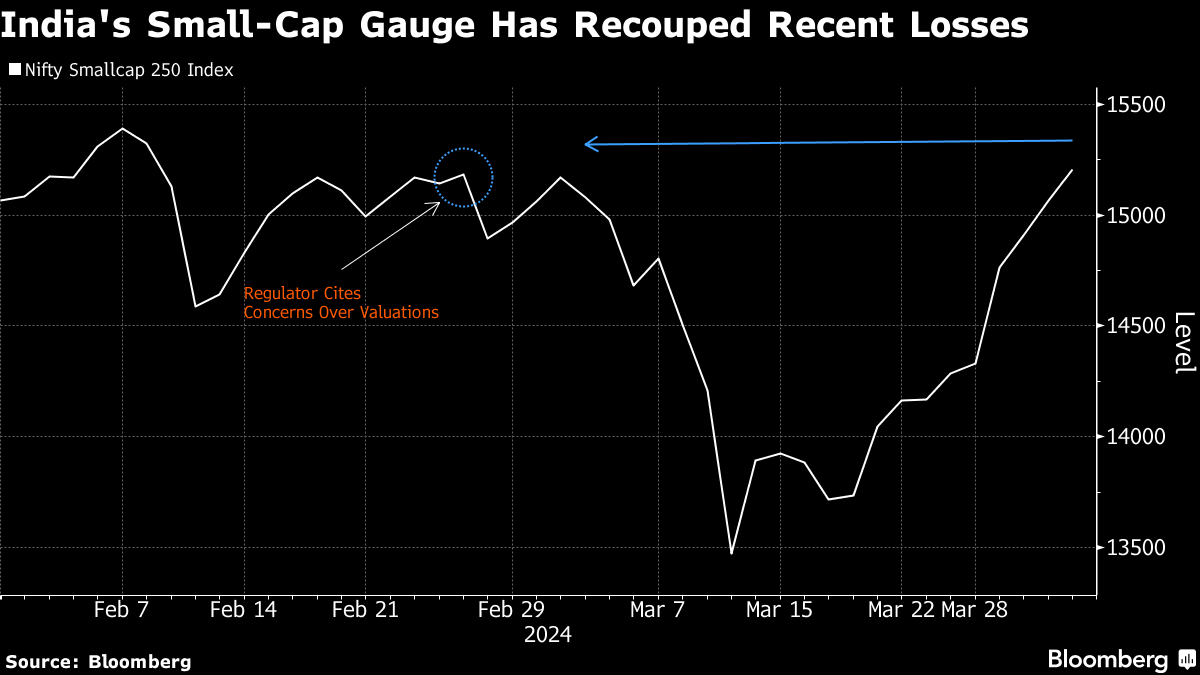

A key gauge of India's small-cap stocks recouped the month-long losses sparked by the regulator's concern over market froth, as the meltdown offered investors an opportunity to buy the dip.

The NSE Nifty Smallcap 250 Index rose as much as 1.1% on Thursday to briefly recover from the decline since Feb. 27 when the regulator flagged the risk of a bubble in the smaller firms. The gauge pared the day's gain but is still set for its longest winning streak since December, and is about 1% away from its February peak.

“We have advised our clients to not exit small caps,” said Ram Kalyan Kumar Medury, chief executive of advisory firm Jama Wealth. This segment has many companies valued at more than $500 million that can grow into large caps, and “investors should not respond to any knee jerk reaction,” he said.

The rout erased more than $80 billion in value from the S&P BSE Small Cap Index over two weeks in March after the regulator directed mutual funds to take steps to shield investors from the speculative bubble in this segment. The measures include periodic stress tests to see how many days it would take for such funds to sell 25% to 50% of their portfolios in a downturn.

Still, there's a technical hurdle to further gains over the short term. The NSE small-cap gauge's 14-day relative strength index — a gauge of price momentum — is nearing 70, a level that signals the index is overbought to some traders.

“The recovery in small-caps is beyond our expectations,” said Shrikant Chouhan, an analyst at Kotak Securities Ltd. “The technicals are projecting that the indexes may hold the levels for some time before consolidating.”

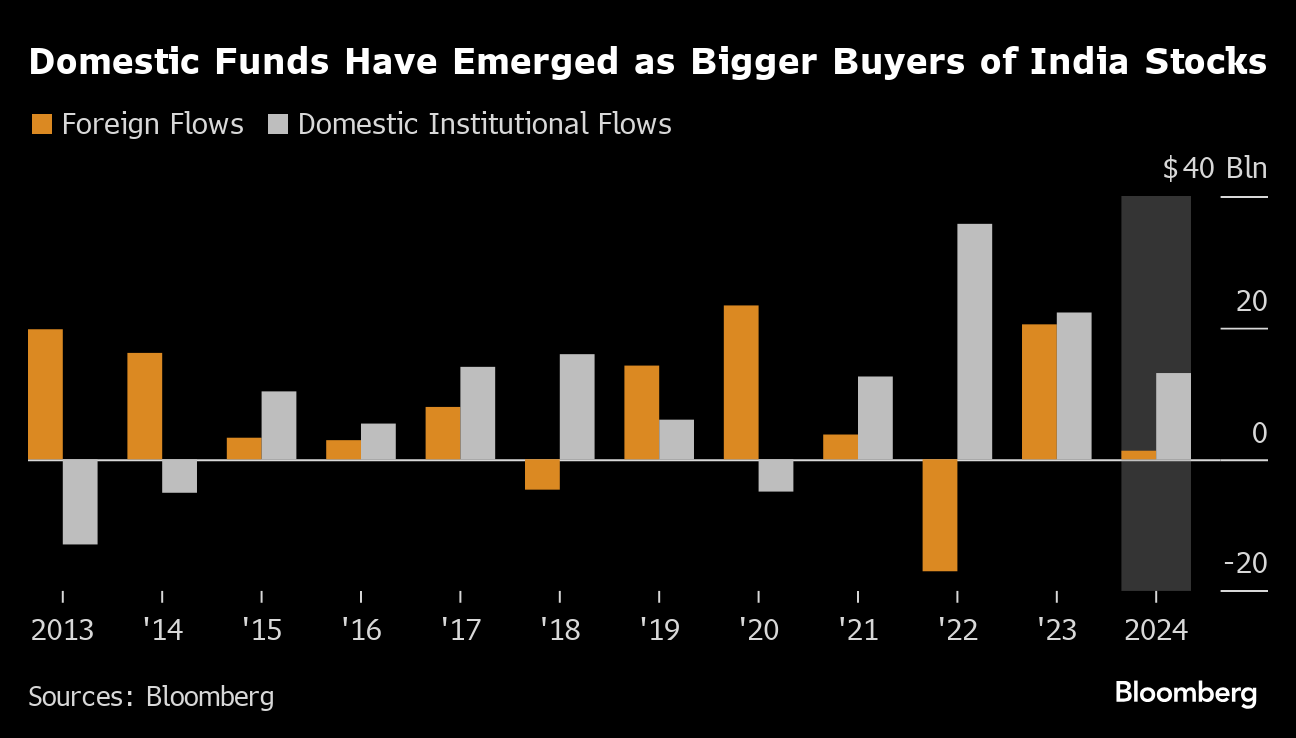

Last month's selloff came after the furious rally in the broader equity markets in India added more than $3 trillion in market value from the Covid-era lows. Local funds focused on smaller companies took in nearly 40% of the net inflows of $19.5 billion in 2023.

As the NSE's small-cap gauge slid more than 4% in March, the biggest monthly drop since June 2022, domestic institutions put the cash to work, buying a net $6.8 billion of shares — the highest since March 2020.

The optimism has been fueled by the shift in India's economic growth trajectory from consumption and services toward manufacturing and investment, according to Emkay Institutional Equities.

“This shift has led to a redistribution of the incremental profit pool away from sectors such as banks, fast-moving consumer goods, and information technology, which are dominant in the large-cap universe,” Emkay strategists wrote in a note last month.

(Updates with analyst comments in third, sixth paragraphs)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.