(Bloomberg) -- India's index-eligible bonds are headed for their first monthly outflow since April, as foreigners exit a swap trade used to gain exposure to the country's $1.3 trillion sovereign debt market.

Global funds have been net sellers of emerging market debt, driven in part by the rising US Treasury yields. Some of the outflows from Indian bonds are linked to unwinding of total return swap trades tied to government debt, according to Morgan Stanley and Gama Asset Management.

Total return swaps have been one of the key products for foreigners to get India exposure without the need to open a domestic account or deal with investing rules. These instruments, being offered by banks including Standard Chartered Plc and HSBC Holdings Plc, have become popular since the announcement of India's inclusion in global bond indexes.

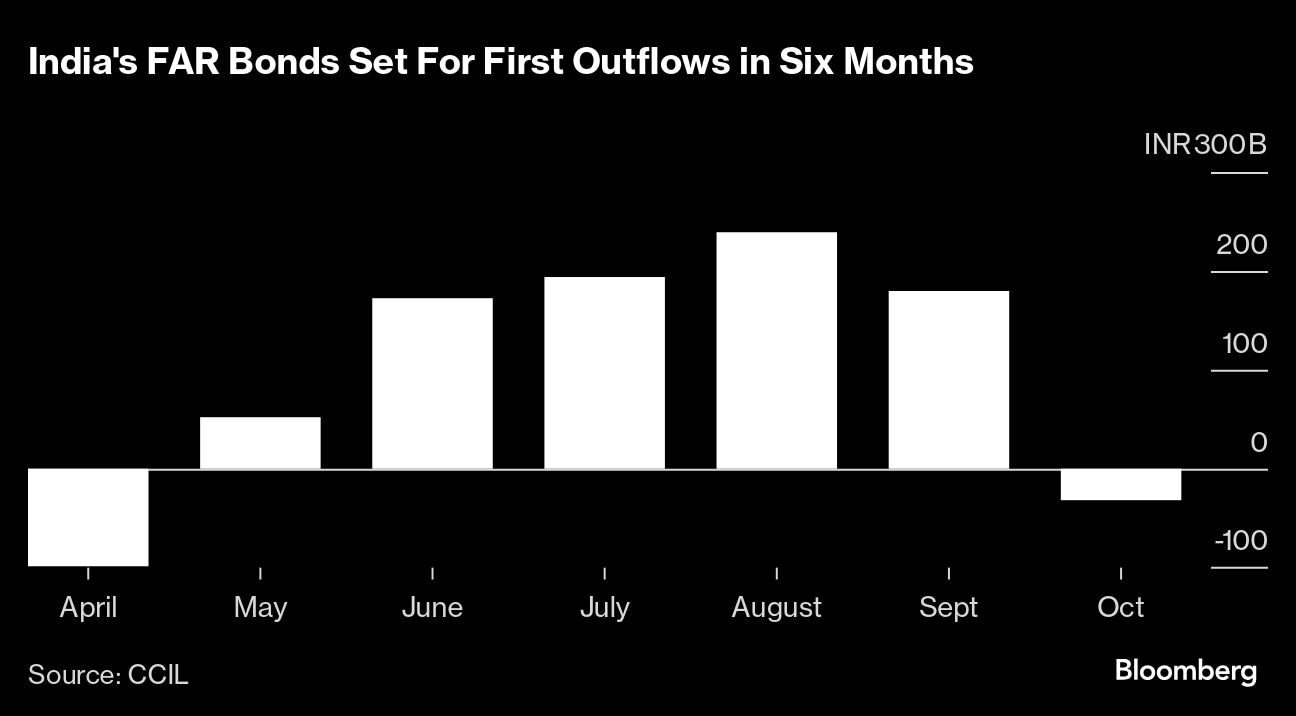

India's so-called Fully Accessible Route bonds — a special category of debt that's freely available to foreigners — have seen outflows of about 40 billion rupees ($476 million) so far in October.

“The inclusion of Indian government bonds into global EM indices has tightened the linkage between global and our markets, and will be a feature going forward,” said Rajeev De Mello, chief investment officer at Gama Asset Management.

A JPMorgan client survey note in June showed that 17% of investors were using these swaps to invest in India government bonds. These derivatives are traded over the counter, so exact estimates are difficult to obtain.

Emerging market bonds have seen outflows as uncertainty over the size of Fed rate cuts have pushed US yields higher, narrowing the spread appeal that local currency debt enjoys.

India's so-called Fully Accessible Route bonds — a special category of debt that's freely available to foreigners — have seen outflows of about 40 billion rupees ($476 million) so far in October. That's a stark contrast to monthly inflows of over $2 billion since the nation's debt was added to JPMorgan Chase & Co's emerging markets debt index in June.

Paring back of expectations for the Federal Reserve rate cuts, reallocations to Chinese markets and the unwinding of some total return swaps have contributed to the subdued flows, Morgan Stanley strategists Nimish Prabhune and Min Dai wrote in a note.

Indian central bank's reluctance to follow global monetary authorities in cutting rates has also dampened the appeal of the nation's debt.

“Fewer rate cuts by the US have implications for Asian central banks” as it would limit the number and timing of the reductions in the region, said Kaushik Rudra, global head of fixed income research at Standard Chartered Plc. “India FAR bonds have been more resilient than others but not immune to this move.”

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.