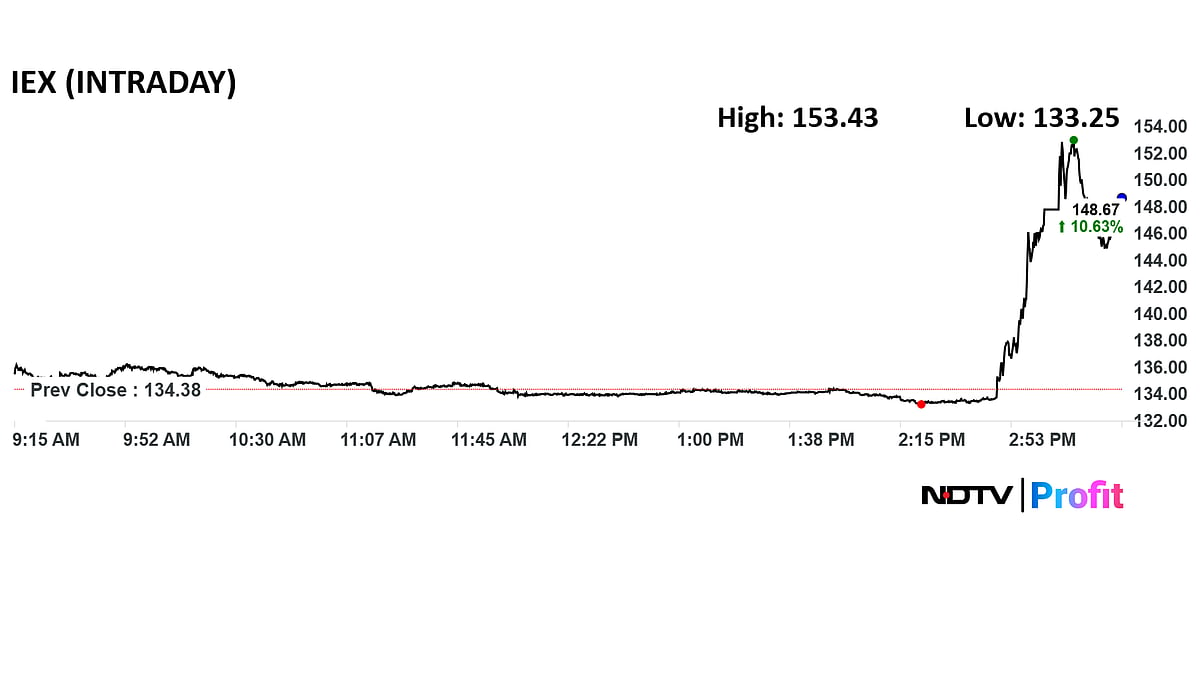

IEX Calls 14% Share Price Surge 'Market Driven' After Court Hearing

The movement in the share price, if any, appears to be market-driven based on publicly available information regarding the said APTEL hearing, IEX said.

Indian Energy Exchange Ltd. on Tuesday clarified that the sharp movement in its share price was "market driven" and it has no unpublished price sensitive information.

The stock jumped as much as 14% intraday as the Appellate Tribunal for Electricity (APTEL) resumed its hearing on the controversial market coupling mandate by the Central Electricity Regulatory Commission.

"This is to confirm that the company is not aware of any information or event that has not been disclosed to the Stock Exchanges, and which could explain the movement in the trading," the company said in a statement.

"The company further confirms that, as on date, it does not have any unpublished price sensitive information (UPSI) or any other information which is required to be disclosed... The movement in the share price, if any, appears to be market-driven based on publicly available information regarding the said APTEL hearing," it added.

The firm arguments from IEX's legal counsel raised serious procedural objections regarding a key report submitted by Power Grid Corp.

During the proceedings, the counsel of IEX argued that a pivotal report, reportedly submitted by Power Grid in the first few weeks of January 2025, has still not been made available to the exchange.

"The report has not been given to us yet," the lawyer contended, highlighting that the Power Grid report was allegedly based on 'historical data' and questioned the rational behind the CERC decision to push ahead with market coupling without clear, current justifications

"There should have been some data on why the commission decided to go ahead with market coupling," the lawyer argued.

Market coupling would necessitate a single clearing price across all power exchanges, a structural shift that investors would erode IEX’s dominance in the market. The exchange currently commands nearly 85% of the market share.

Adding to the positive sentiment, IEX released a robust business update for the third quarter of FY26 earlier in the day.

The exchange reported a total electricity traded volume of 34.08 billion units, marking a nearly 12% year-on-year increase.