- Hindustan Unilever Ltd's demerger of Kwality Walls will take effect on Dec 1

- Record date for shareholders to receive KWIL shares is fixed for Dec 5

- Share entitlement ratio is 1:1, one KWIL share for each HUL share held

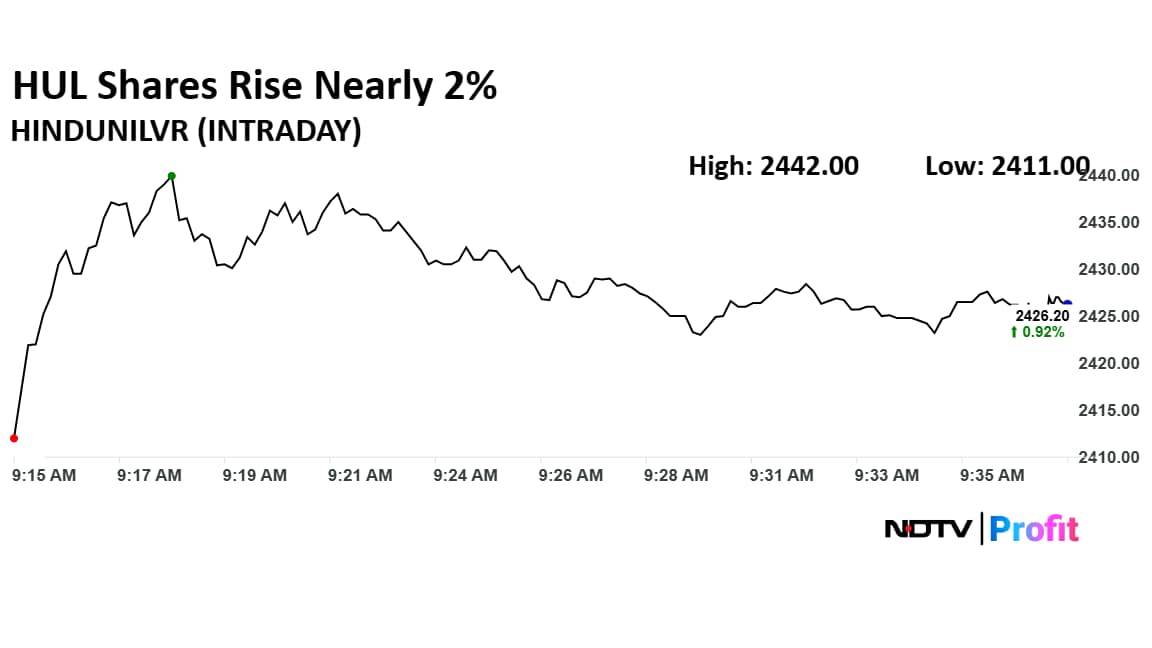

The shares of Hindustan Unilever Ltd. rose nearly 2% on Wednesday as the demerger of Kwality Wall's (India) Ltd. from HUL will take effect on Dec. 1. The board on Tuesday also fixed Dec. 5, as the record date to determine the eligible shareholders entitled to receive equity shares of KWIL.

The demerger of Kwality Wall's (India) Ltd. from Hindustan Unilever Ltd. will take effect on Dec. 1, the company announced on Tuesday. The board fixed Friday, Dec. 5, as the record date to determine the eligible shareholders entitled to receive equity shares of KWIL.

The share entitlement ratio is 1:1 which means one fully paid-up equity share of face value of Rs 1 in KWIL will be given for everyone held in HUL.

The Kwality Wall's listing is anticipated in the fourth quarter of the current financial year, subject to necessary regulatory approvals, HUL executives told analysts during a recent earnings call.

Earlier this year, the fast-moving consumer goods giant announced the demerger and listed its ice cream company. After the HUL demerger is completed, Kwality Wall's will become an independent company, and its equity shares will be listed on the bourses.

HUL board approved the demerger of Kwality Wall's in January 2025 and the FMCG major had received regulatory approvals from BSE and NSE in May. Shareholders gave their nod to the plan in August.

Kwality Wall's owns famous ice cream brands like Cornetto, Magnum, Feast, Creamy Delight and more.

KWIL will be a leading listed ice cream company in India, with an experienced management equipped with greater focus and flexibility to deploy strategies suited to its distinctive business model and market dynamics, thus realising its full potential, HUL has said.

Revenue from the ice cream business declined year-on-year in the September quarter, impacted by extended monsoon in addition to GST transition. Kwality Wall's demerger is expected to result in an improvement of 50-60 bps to the reported margin as ice bream business operates at a margin lower than HUL average, as per the company.

HUL Share Price Today

The scrip rose as much as 1.58% to Rs 2,442 apiece on Wednesday. It pared gains to trade 0.98% higher at Rs 2,426.20 apiece, as of 10:03 a.m. This compares to a 0.06% decline in the NSE Nifty 50 Index.

It has risen 0.67% in the last 12 months and 4.24% year-to-date. Total traded volume so far in the day stood at 1.39 times its 30-day average. The relative strength index was at 63.83.

Out of 44 analysts tracking the company, 33 maintain a 'buy' rating, nine recommend a 'hold' and two suggests 'sell', according to Bloomberg data. The average 12-month consensus price target of Rs 2,795.24 implies an upside of 16.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.