Hindustan Unilever's Capital Markets Day on Nov. 29 highlighted the company's renewed focus on innovation, premiumisation, and catering to affluent consumers. Management reiterated their strategy to deliver double-digit earnings growth over the medium term by strengthening key brands, introducing premium products, and leveraging digital channels.

Goldman Sachs maintained a ‘neutral' rating with a target price of Rs 2,775, noting HUL's increased investments in product portfolio enhancements, particularly targeting affluent Indian consumers. The brokerage appreciated HUL's ambitious long-term initiatives, such as transitioning from powders to liquids in home care and scaling premium beauty and nutrition segments. However, Goldman Sachs expects these efforts to take time to show material impact on earnings, given near-term challenges in urban demand and rising input costs.

UBS, also 'neutral' with a target price of Rs 2,800, highlighted HUL's segmented growth strategies under its ‘Core,' ‘Future Core,' and ‘Market Makers' framework. While the brokerage lauded management's optimism regarding India's FMCG growth prospects, it revised earnings estimates downward due to anticipated lower volume growth amid urban demand challenges and margin pressures from higher commodity prices.

Morgan Stanley has an ‘underweight' rating with a target price of Rs 2,110, reflecting cautious optimism. The brokerage acknowledged HUL's aggressive shift in strategy, particularly in beauty and wellbeing and home care, but emphasised the multi-year nature of execution risks. It also highlighted the competitive pressures HUL faces from direct-to-consumer brands and smaller FMCG players in key categories like beauty and health foods.

"We expect HUL's earnings growth to lag the growth of smaller peers like Marico, Dabur, Tata Consumer and GCPL," the note said.

Citi Research, with a ‘buy' rating and a target price of Rs 3,400, expressed confidence in HUL's ability to adapt to the evolving consumer landscape. The brokerage praised the company's focus on future growth segments, including premiumisation, digital marketing, and differentiated strategies for top-tier cities. Citi expects HUL's initiatives to position it for robust growth over the next decade. It noted that while some categories already have a high annual penetration, there are multiple other categories such as face cleanser, moisturisers, body lotion, sun care, serums and treatments that still have room for penetration led growth.

Management Commentary

HUL's management noted that the current environment remains challenging, with moderating urban demand, gradual rural recovery, and inflationary pressures on key commodities like palm oil and tea. However, the company plans to mitigate these challenges through a focus on premiumisation, digital trade channels, and technological innovation.

While near-term growth may remain subdued, analysts broadly agree that successful execution of HUL's strategic initiatives could unlock medium- to long-term opportunities for the company.

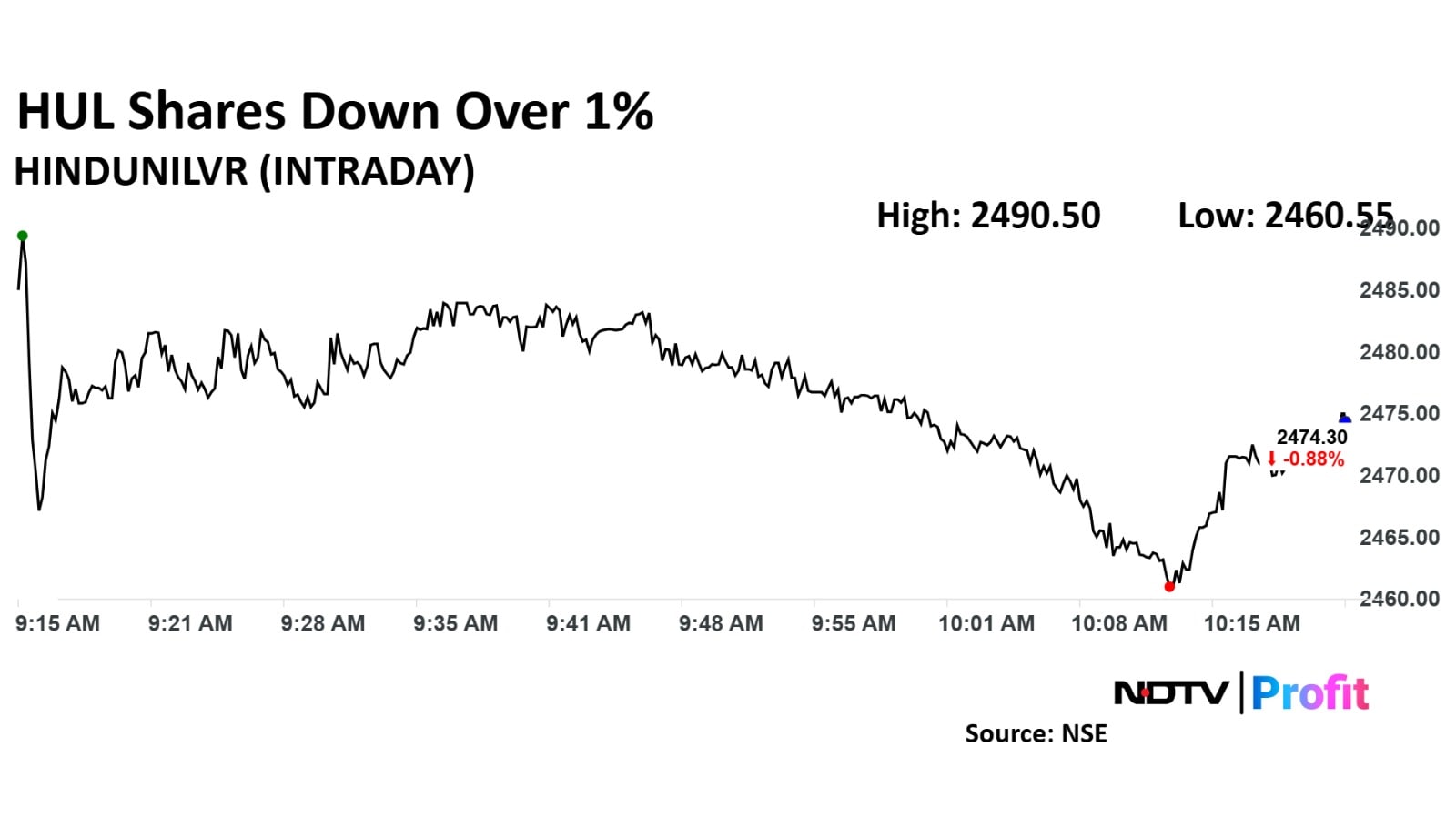

HUL Share Price Today

The Nifty 50 FMCG stock fell as much as 1.43% during the day to Rs 2,460.55 apiece on the NSE. It was trading 0.97% lower at Rs 2,471.90 apiece, compared to a 0.17% advance in the benchmark Nifty 50 as of 10:21 a.m.

It has fallen 5.03% in the last 12 months and 6.9% on a year-to-date basis. The relative strength index was at 43.05.

Twenty six out of the 43 analysts tracking HUL have a 'buy' rating on the stock, 14 recommend a 'hold' and three suggest a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 15.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.