Honasa Consumer Shares Surge Nearly 10% Post Q3 Earnings

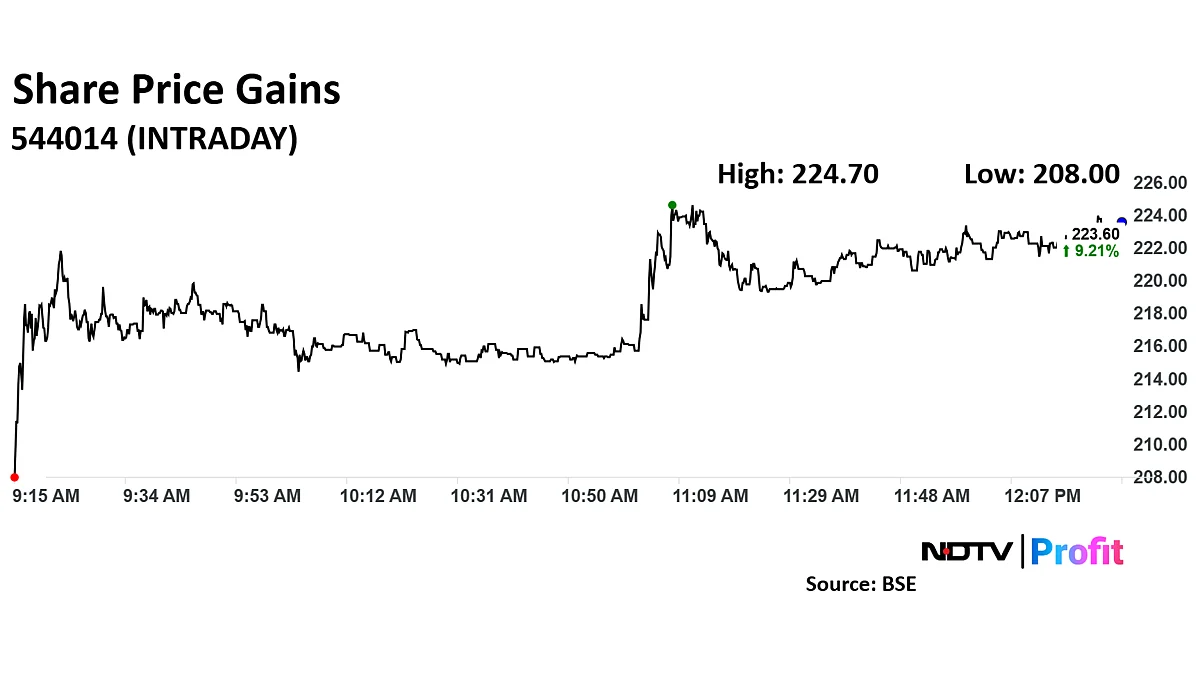

Honasa Consumer rose as much as 9.76% to Rs 224.68 apiece.

Honasa Consumer Ltd. saw its share price rise by nearly 10% on Thursday following the announcement of its third-quarter earnings. The company reported a 6% year-on-year increase in revenue.

Jefferies highlighted that Honasa’s revenue growth was in line with expectations, with a slight Ebitda beat. The company turned a loss to a profit, although margins compressed year-on-year.

Jefferies maintained a ‘High risk-high reward Buy’ rating, noting that the stock has sharply corrected and now trades at 2.5x FY26 sales. The brokerage emphasised the company’s focus on distribution revamp under Project Neev and expects steady growth in the coming quarters.

It said, "Following the shocker in earlier qtr, Honasa stock has sharply corrected and now trades at 2.5x FY26 Sales"

Citi maintained a cautious stance, highlighting the challenges Honasa faces in transforming its general trade distribution for the Mamaearth brand.

While other brands grew by 30%, Citi noted that Mamaearth’s revenue remained weak. The brokerage expressed concerns about the company’s growth trajectory and potential margin pressure, maintaining a ‘Sell’ rating despite the recent stock correction. It also reduced its target price for the stock to Rs 180

It said, "We lower our FY25-27E sales estimates by 3% as we expect prolonged impact of demand weakness for Mamaearth brand. The impact on Ebitda is much higher (23-32% cuts) given a low base, negative operating leverage and need for prolonged ad-spend to drive growth"

Honasa Consumer Ltd., known for its popular Mamaearth brand, has been expanding its product portfolio and distribution network. The company’s focus on innovation and strategic investments has positioned it as a significant player in the consumer products market.

The scrip rose as much as 9.76% to Rs 224.68 apiece. It pared gains to trade 8.71% higher at Rs 222.55 apiece, as of 12:20 p.m. This compares to a 0.63% advance in the NSE Nifty 50 Index.

It has fallen 47% in the last 12 months. Total traded volume so far in the day stood at 17 times its 30-day average. The relative strength index was at 45.

Out of 12 analysts tracking the company, seven maintain a 'buy' rating, two recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.4%