Hindustan Zinc Ltd. share price fell after hitting a one-month high on Friday as Ventura initiated coverage on the stock with a 'buy' rating and a two-year target price of Rs 585, implying a 27% upside.

In a bull-case scenario, the brokerage sees the stock hitting Rs 803, implying a potential upside of 71%. "We have assumed a 15% upside in average realisation and a USD INR average rate of Rs 90/$ to lead revenue of Rs 43,981 crore in FY27 (FY24- 27E and Ebitda margin of 55.3%," it said.

The brokerage's bear-case scenario comes with the assumption that a 15% downside in average realisation and a USD-INR average rate of Rs 82/$ to lead revenue of Rs 33,873 crore in FY27 and Ebitda margin of 46.5%. This will result in a price target of Rs 377 per share, downside of 20%.

Compared to peers, the expected FY27 return on invested capital of the company is the highest at more than 100%, while in terms of revenue CAGR over FY24-27, the company is among the top three along with Coal India and NMDC.

The brokerage noted that HZL has planned capex of around Rs 16,000 crore, including sustaining capex, for the period FY24-27 for funding the roaster plant at Debari, fumer and fertiliser plant at Chanderiya (sulphuric acid forward integration) and 450 MW renewable energy addition. "Despite the heavy capex, HZL is expected to turn net debt free by FY26," it said.

Due to power cost-saving measures and operating leverage, Ebitda and net profit are expected to reach Rs 19,142 crore and Rs 11,402 crore by FY27 respectively, said Ventura.

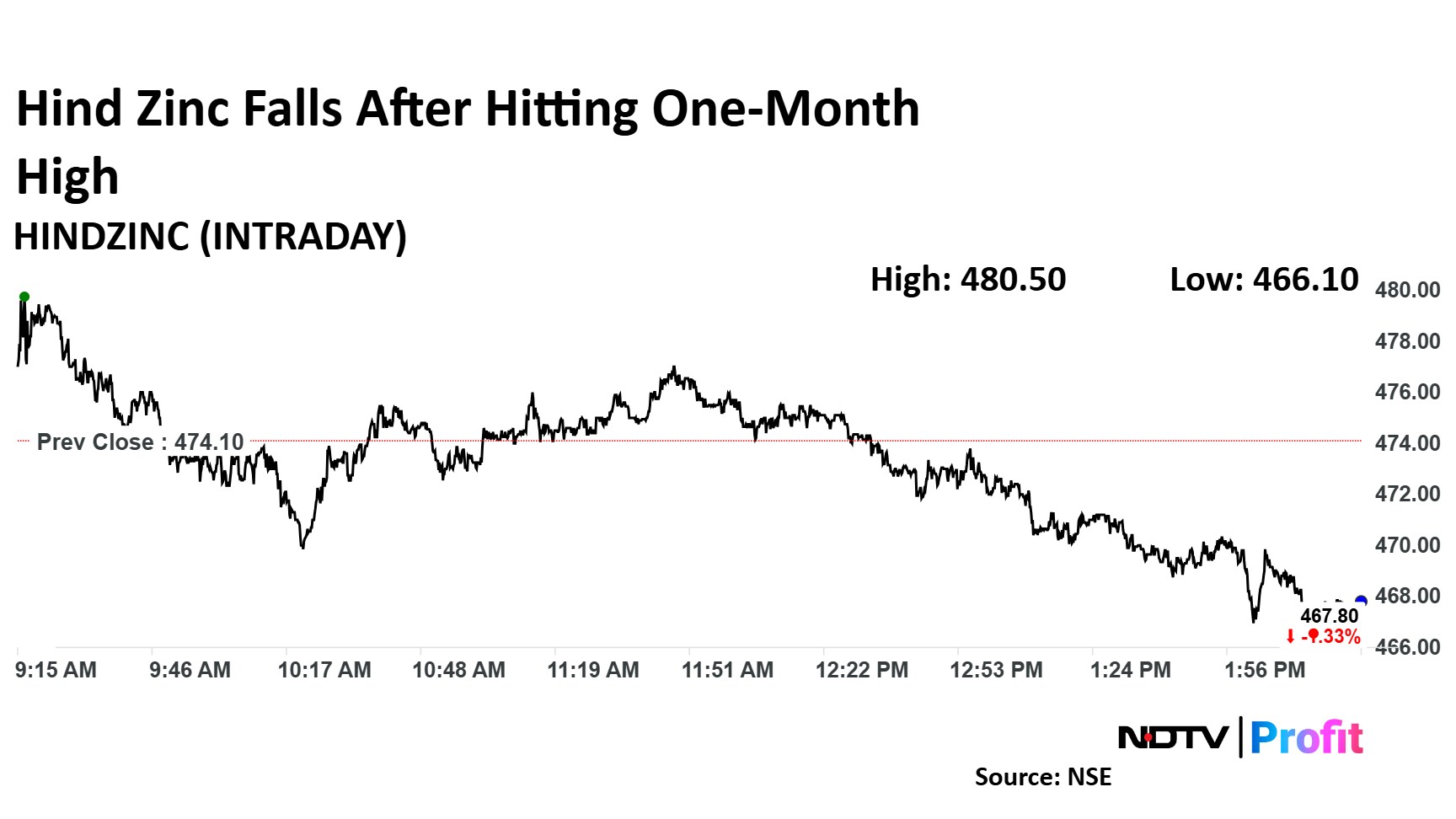

The scrip rose as much as 1.35% during the day to Rs 480.50 apiece, the highest level since Dec. 20. It erased gains to trade 1.5% lower at Rs 467 apiece, compared to a 0.3% decline in the benchmark Nifty 50 as of 2:30 p.m.

It has risen over 46% in the last 12 months. The total traded volume so far in the day stood at 3.78 times its 30-day average. The relative strength index was at 51.

Out of 13 analysts tracking the company, two maintain a 'buy' rating on the stock, four recommend 'hold' and seven suggest 'sell,' according to Bloomberg data. The average of 12-month analysts' price target implies a potential downside of 6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.