Hindustan Copper Ltd. share price reversed three-day gaining streak in Wednesday's session. The stock rose for three sessions to Tuesday as it reported that its consolidated net profit surged 84% on the year to Rs 186 crore during July–September.

Hindustan Copper's consolidated net profit was at Rs 102 crore in the corresponding period of the previous financial year.

The consolidated topline of the copper producer increased 38.6% on the year to Rs 718 crore from Rs 518 crore during the second quarter of current financial year, Hindustan Copper said in an exchange filing on Tuesday.

The merged operating profit of Hindustan Copper advanced 85.8% on the year to Rs 282 crore from Rs 152 crore. Hindustan Copper reported margin at 39.3% during July–September compared to 29.3% in the corresponding period of the previous financial year.

Track live updates on Indian stock markets, stock market news, and analsysts' call here.

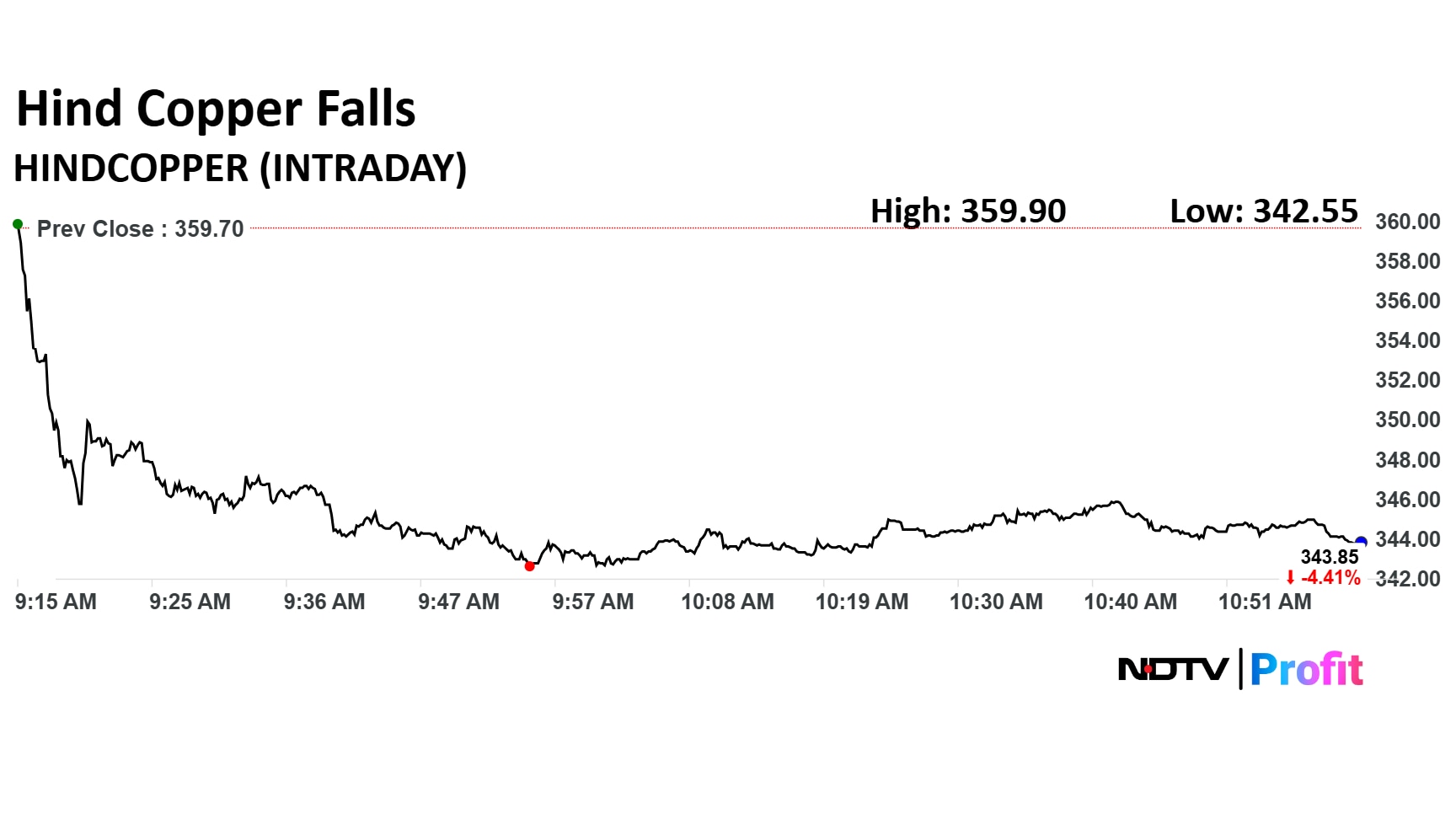

Hindustan Copper Ltd. share price declined 4.77% to Rs 342.55 apiece. It was trading 4.32% down at Rs 344.15 apiece as of 11:00 a.m., compared to 0.66% advance in the NSE Nifty 50 index.

The stock advanced 27.70% in 12 months, and 38.8% on an year to date basis. Total traded volume so far in the day stood at 1.3 times its 30-day average. The relative strength index was at 54.29.

On Oct 9, Hindustan Copper share price touched the highest level since June 4, 2024. The share price rose 6.81% on that day.

Copper price surging in the international markets is the main reason behind the increase in share price during October. Copper futures on the London Metal Exchange hit a fresh high of $11,200 per ton.

Hindustan Copper is the only vertically integrated producer of refined copper in India. The company owns all the operating mining leases of copper ore in India.

Hindustan Copper will likely benefit from the supply-demand imbalance in the market by fetching better prices of copper.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.