- Shares of Hindalco Industries fell over 6% after Novelis released weak quarterly results

- Novelis reported a 10% rise in net sales to $4.7 billion but lower shipments and EBITDA

- EBITDA dropped to $422 million from $462 million, with per-tonne EBITDA down to $448

Shares of Aditya Birla Group's Hindalco Industries Ltd. declined by over 6% on Thursday after its subsidiary Novelis released its quarterly results during the market holiday. The report led to several downgrades for the parent company and reductions in price targets.

Novelis' results were weak, as anticipated, with net sales rising 10% year-on-year to $4.7 billion. Total shipments of Flat Rolled Products stood at 941 kt, slightly lower than 945 kt in the same period last year.

Earnings before interest, tax, depreciation, and amortisation for the Hindalco subsidiary dropped to $422 million from $462 million a year earlier. On a per-tonne basis, Ebitda declined to $448 from $489 last year.

The company reported a net negative impact of $54 million from U.S. tariffs imposed under the Trump administration during the quarter, nearly double the $28 million impact seen in the previous quarter.

Following a fire at its Oswego plant, Novelis expects a cash flow impact ranging between $550 million and $650 million, while Ebitda could take a hit of $100 million to $150 million. However, 70% to 80% of these losses are expected to be recoverable in the next financial year through insurance claims. Another concern is that Novelis' net debt has risen to nearly $5.8 billion, marking its highest level in 21 quarters.

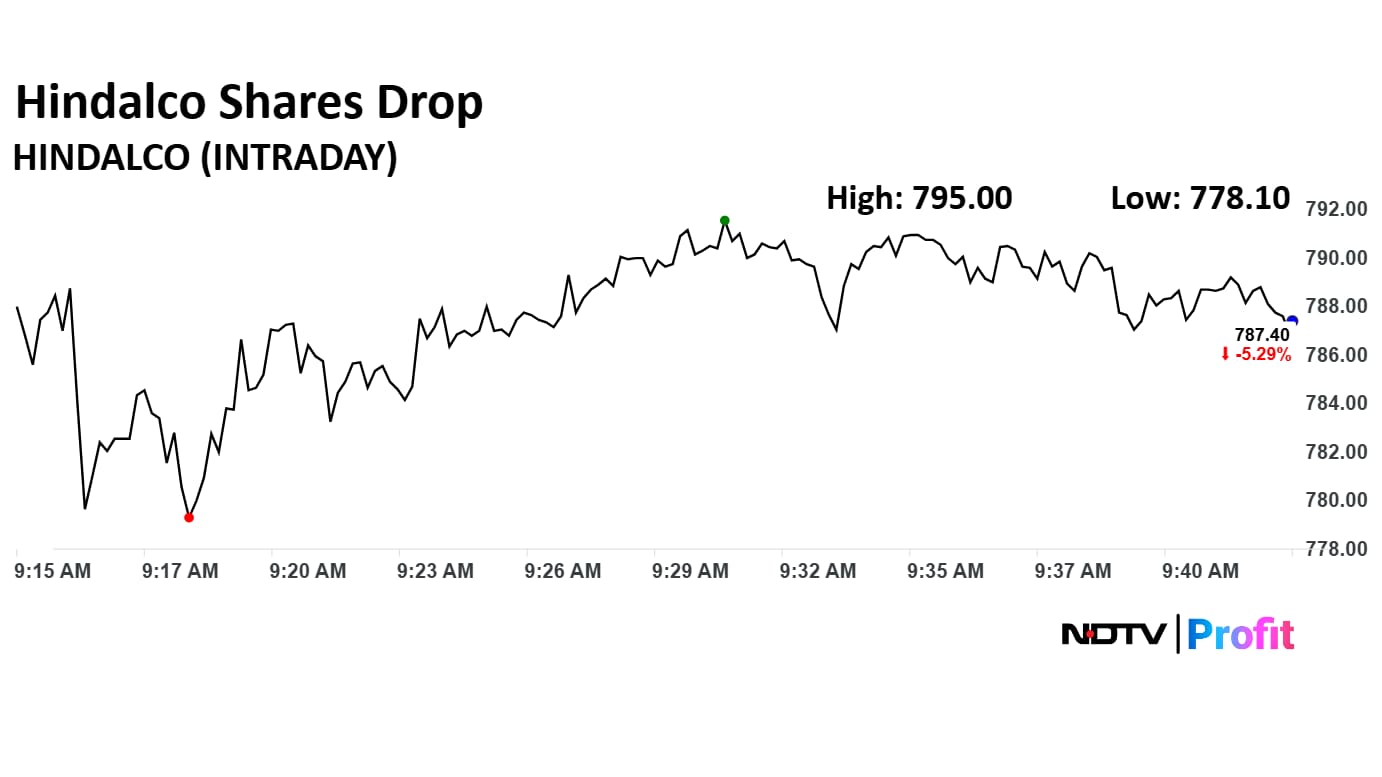

Hindalco Share Price Today

The scrip fell as much as 6.41% to Rs 778.10 apiece. It pared losses to trade 5.41% lower at Rs 786.45 apiece, as of 09:45 a.m. This compares to a 0.05% advance in the NSE Nifty 50 Index.

It has risen 30.33% on a year-to-date basis and 10.87% in the last 12 months. The relative strength index was at 61.25.

Out of 28 analysts tracking the company, 15 maintain a 'buy' rating, seven recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 0.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.