.png?downsize=773:435)

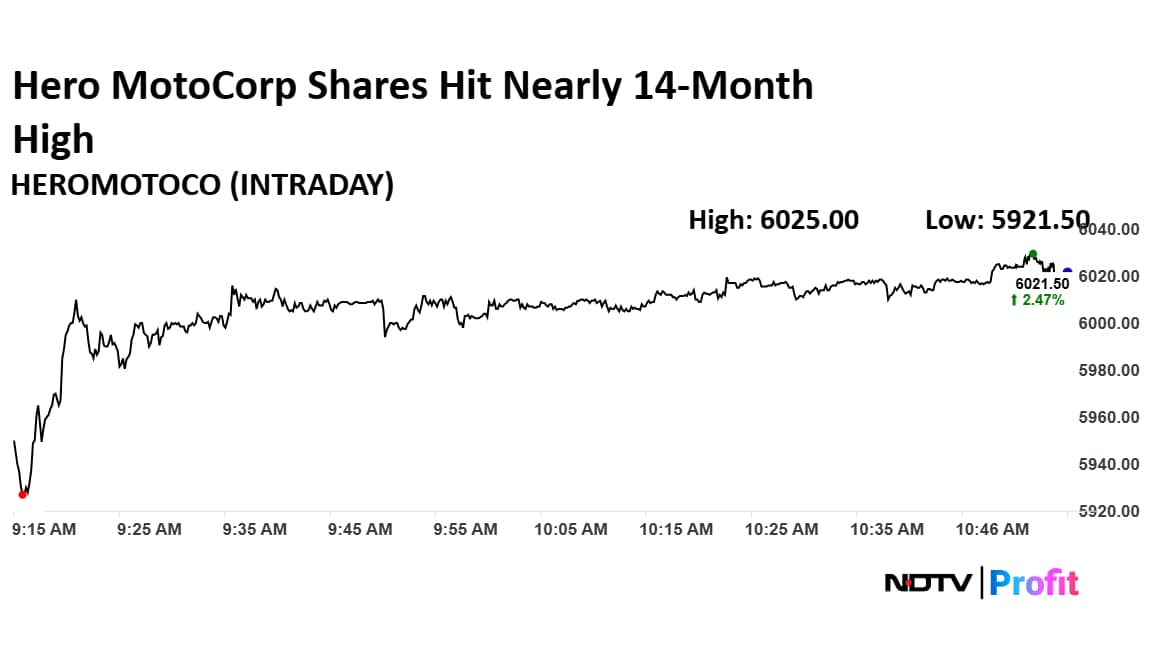

- Hero MotoCorp shares hit a nearly 14-month high, rising over 2.4% on Thursday

- Q2 profits and revenue rose 16%, with market share and margins showing improvement

- EV sales surged 163% YTD, with market share rising from 7% to 11% in 2025

Hero MotoCorp Ltd. shares hit a nearly 14-month high on Thursday amid a noticeable shift in sentiment on the Street, with three major brokerages upgrading the stock since its September quarter results.

The shares extended its gains for the third day with it trading over 2.4% higher on Thursday and rising over 9% since the auto giant announced its second quarter results.

Apart from the 16% rise in profit and revenue in quarter ended September, analysts have highlight market share stabilisation, improving traction across scooters and EVs, and better margin visibility as key reasons behind this renewed optimism.

The company, which had been losing market share for several years, is now showing early signs of recovery across its core motorcycle segment. At the same time, margins in the EV business have stabilised even as volumes scale up. Hero's disciplined inventory management, product refresh cycle and improving competitive position are seen as supporting this turnaround, the brokerages added.

Hero MotoCorp's EV Turnaround

On the EV front, Hero MotoCorp has delivered a sharp turnaround. EV sales have surged 163% year-to-date, rising to 73,742 units in financial year 2026 from 27,999 units a year earlier.

Its competitive position in the EV market has also strengthened meaningfully, with market share rising from 7% in April 2025 to 11% in October 2025—while some rivals like Ola Electric saw a steep drop over the same period.

What Brokerages Have To Say?

Macquarie upgraded Hero MotoCorp to Outperform with a target price of Rs 6,793, implying a 16% upside. The brokerage believes the company is “turning the corner” as demand improves in both motorcycles and scooters, aided by GST cuts and upcoming product launches. It also notes that internal combustion engine (ICE) margins continue to surprise positively, offering resilience even as the company ramps up its EV portfolio.

JPMorgan also upgraded the stock, shifting its stance to Overweight from Neutral while raising its target price to Rs 6,850 from Rs 5,640. Calling it the “Return of the King”, JPMorgan sees a stronger outlook driven by new launches, healthier channel inventory and demand revival in the bottom half of the two-wheeler market—an area where Hero traditionally dominates. The brokerage also sees scope for Hero's valuation discount to narrow as performance stabilises.

Morgan Stanley has taken a similarly constructive view, upgrading Hero MotoCorp to Overweight and increasing its target price to Rs 6,471 from Rs 5,968. The brokerage highlights improving gains in scooters, EVs and the premium segment. Better product mix and shrinking EV losses are expected to act as margin tailwinds. It also notes the stock trades at a reasonable 16.8x FY27 P/E (ex-subisidiaries) and offers a dividend yield above 3%, supporting its counter-consensus call.

Where Does Hero MotoCorp Stand In Peer Comparison?

From a valuation standpoint, Hero MotoCorp remains relatively attractive compared to peers. At 16.8x fiscal 2028 estimates, it trades at a discount to Bajaj Auto (20.1x), Eicher Motors (26.8x) and TVS Motor (32.2x).

Hero MotoCorp Share Price Today

The scrip rose as much as 2.53% to Rs 6,025 apiece on Thursday, highest since Sept. 27, 2024. It pared gains to trade 2.51% higher at Rs 6,023.50 apiece, as of 10:50 a.m. This compares to a 0.21% advance in the NSE Nifty 50 Index.

It has risen 26.14% in the last 12 months and 44.80% year-to-date. Total traded volume so far in the day stood at 0.64 times its 30-day average. The relative strength index was at 52.56.

Out of 11 analysts tracking the company, 26 maintain a 'buy' rating, 10 recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target is at Rs 6015.61.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.