.webp?downsize=773:435)

Premier Energies Ltd.'s net profit in the third quarter of the current financial year rose 5.9 times to Rs 255 crore on an annual basis. The solar module and cell maker's margin expanded 1,260 basis points to 29.9%.

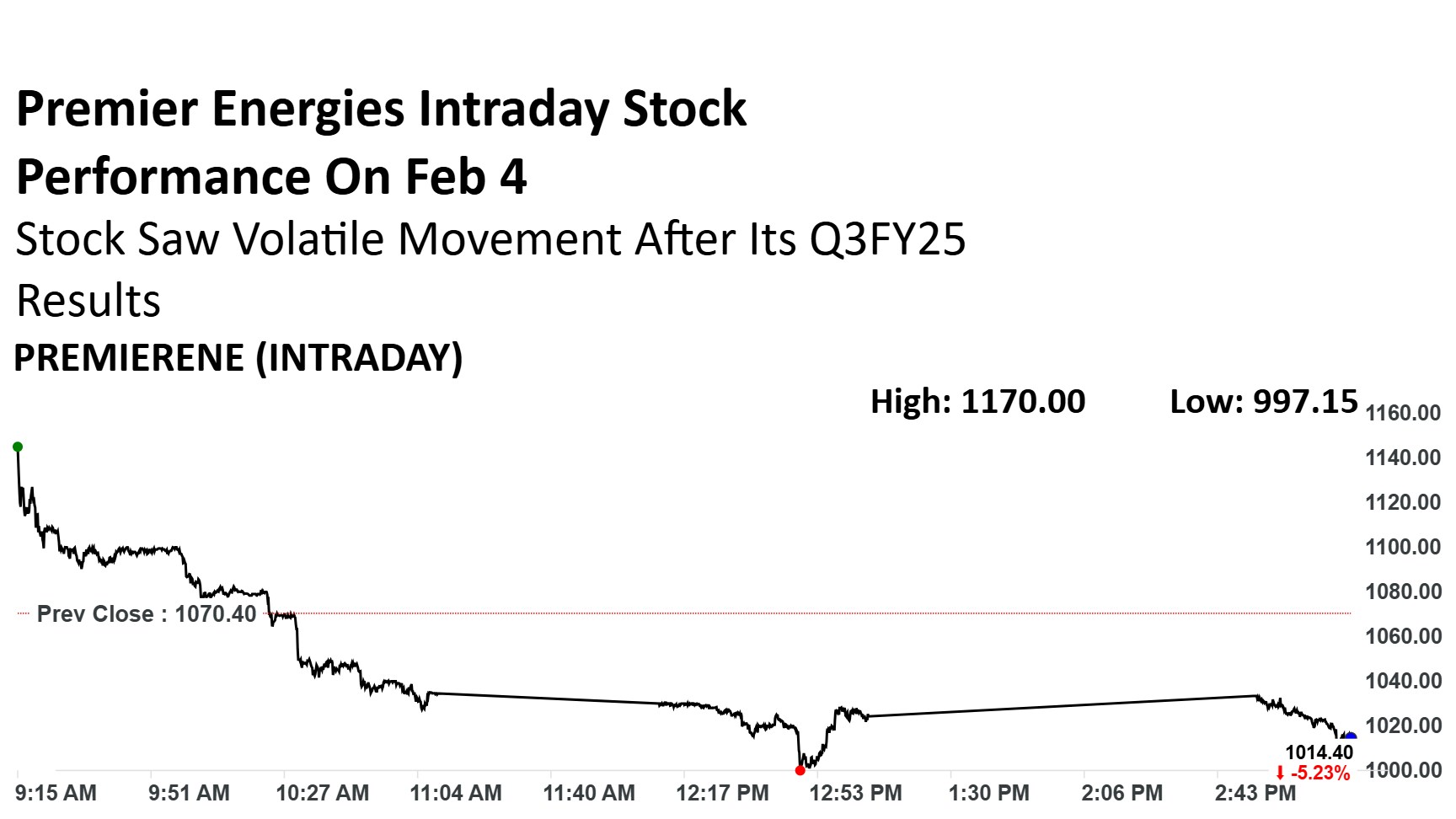

But despite this strong growth, shares of the company fell almost 7% on an intraday basis after initially gaining and stayed under pressure in trade on Tuesday. This was due to factors that were revealed in the earnings conference call.

Gross Margins Declines

While Premier Energies' Ebitda margin did see a significant improvement due to higher capacity utilisations and favourable revenue mix, the company's gross margin declined 160 basis points on a sequential basis, which was a surprise for Kotak Securities.

Delay In Capacity Additions

The company indicated a slight delay in the commissioning for an additional 1 GW TOPCon cell and module line by a quarter to Q1 FY26. This delay hinders revenue growth for the company's cell segment with current capacity at peak utilisation. Therefore, the company's next leg growth would likely be from Q2FY26 when the new capacity line stabilises.

On the other hand, the company's 4 GW TOPCon cell and module line is on track to be commissioned by Q1FY27. However Kotak notes that the progress on this line remains a key monitorable and any delay may potentially impact profitability and cash flow generation in the medium term.

ALMM For Solar Cells

While management is confident that the approved list of models and manufacturers for solar cells may get implemented from June 2026, the company also stated that there is a possibility of further delay. This puts an opportunity in the domestic content requirement market as a key monitorable.

Rise In Debt

Premier Energies also reported a 61% year-on-year and 89% quarter-on-quarter rise in net debt to Rs 1,917.7 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.