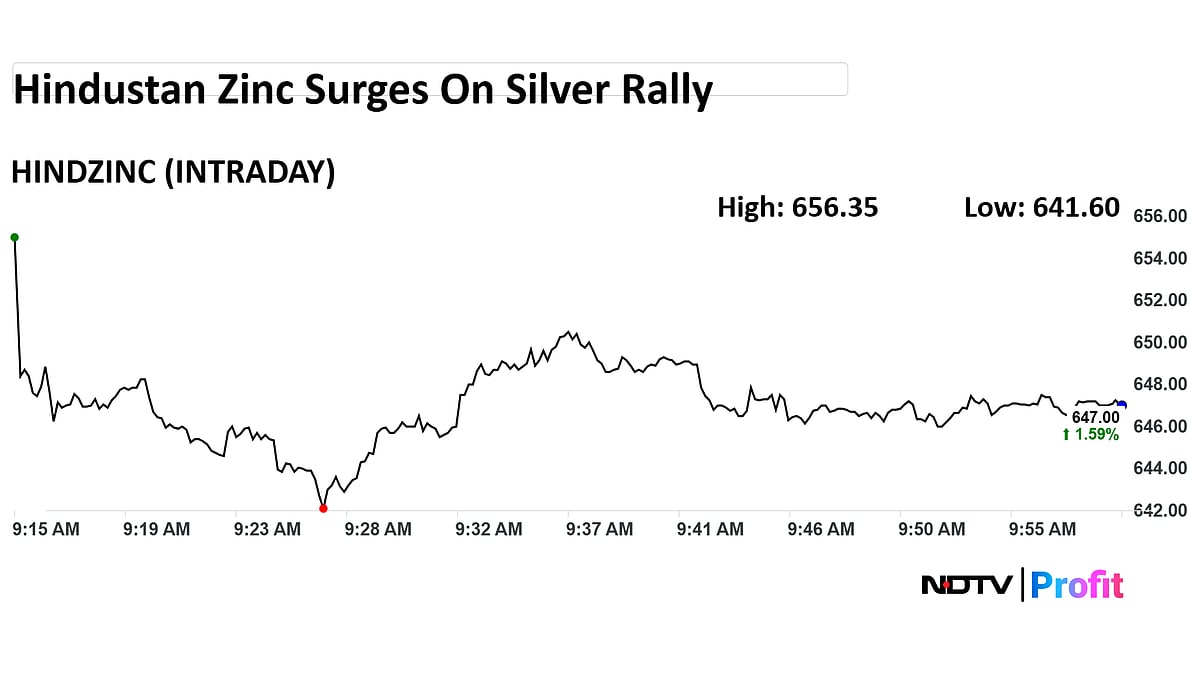

Here's Why Hindustan Zinc Shares Are Surging In Trade

They are in focus during Monday’s trade after silver extended its stellar rally in 2025, briefly touching a new record of $82 per troy ounce.

Shares of Hindustan Zinc are trading over 1.5% higher, at Rs 647. They are in focus during Monday’s trade after silver extended its stellar rally in 2025, briefly touching a new record of $82 per troy ounce.

The surge has been fueled by tight supply, robust demand, and expectations of a softer monetary policy stance from global central banks. However, after hitting the peak earlier today, silver prices eased, slipping back to around $80.

Of the analysts tracked by Bloomberg, that are covering this stock, nine have a 'buy' call, three have a 'hold' stance, and six analysts have a 'sell' rating on the stock.

Spot silver rose for the sixth consecutive trading session, crossing $82 per ounce for the first time.

The prices did retreat on Monday after briefly soaring on speculative buying and a persistent supply-demand imbalance. The white metal dropped as much as 5% during the session before currently recovering some losses.

Spot silver is currently trading at $79.79, while three-month future prices stood at $79.36.

Investor demand for safe-haven assets such as gold and silver remains robust, fueled by escalating geopolitical tensions and shifting economic dynamics. The U.S. blockade of Venezuelan crude shipments, ongoing Russia-Ukraine hostilities, and Washington’s recent military strike against ISIS in Nigeria have heightened global uncertainty, reinforcing the appeal of precious metals.

At the same time, markets are factoring in two quarter-point rate cuts by the Federal Reserve in 2026, as inflation continues to ease and labor market conditions soften. However, Fed officials remain divided on the future policy path, adding to volatility in financial markets.

Commodity experts believe the record-breaking rally in bullion could extend into early 2026, supported by a weaker dollar, cooling inflation, and persistent geopolitical risks. These factors are expected to keep safe-haven demand elevated, positioning precious metals as a key hedge against uncertainty in the year ahead.