A surge in global iron ore prices will increase costs for domestic steelmakers. But not all domestic producers of the alloy will suffer.

Global iron ore prices rose over $130 a tonne for the first time since March on Tuesday, marking an eight-month high.

The rising prices come on the back of improving China sentiment, reducing Chinese iron ore inventory, and lower-than-expected supplies from Australia and Brazil, according to analysts.

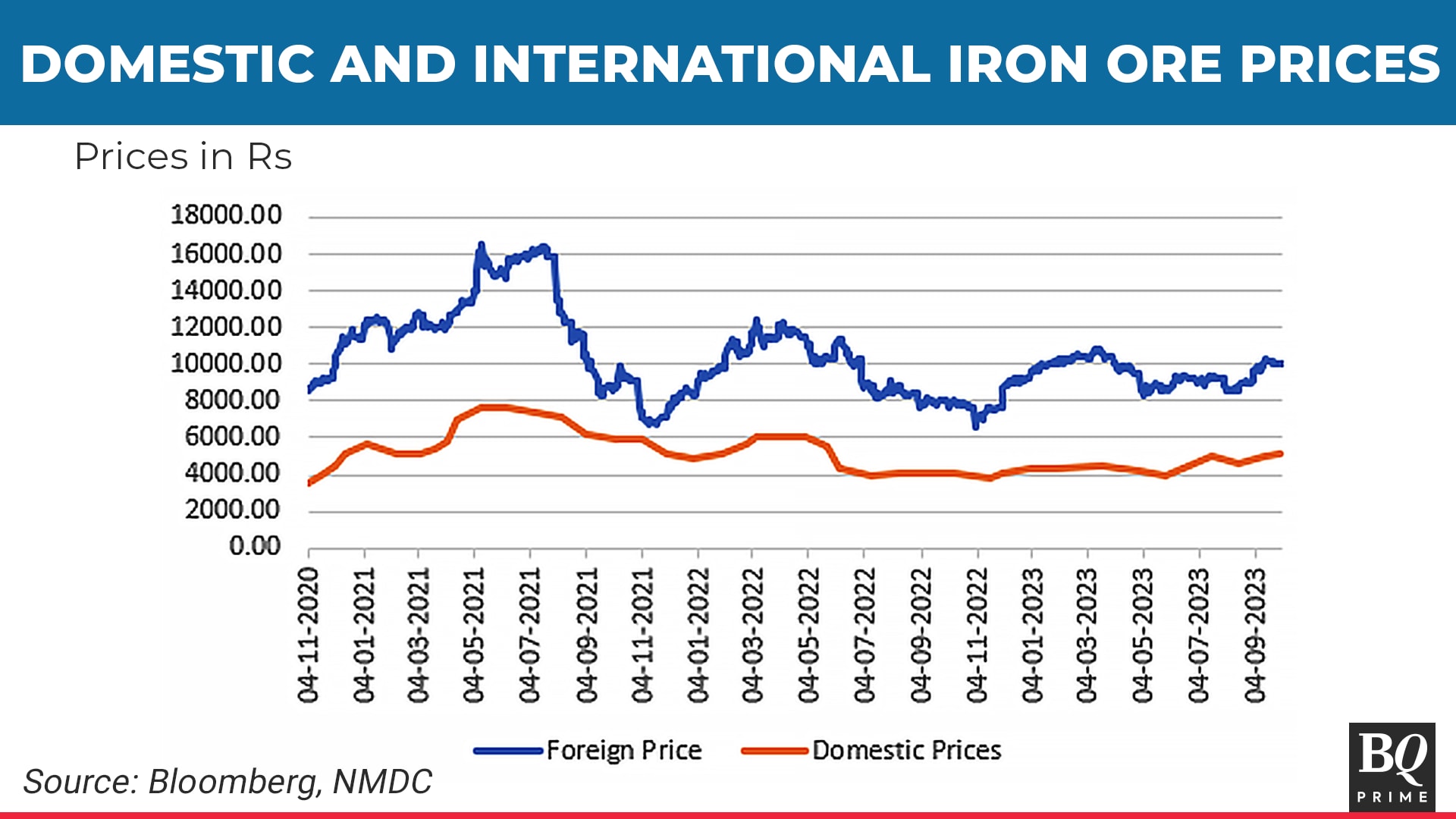

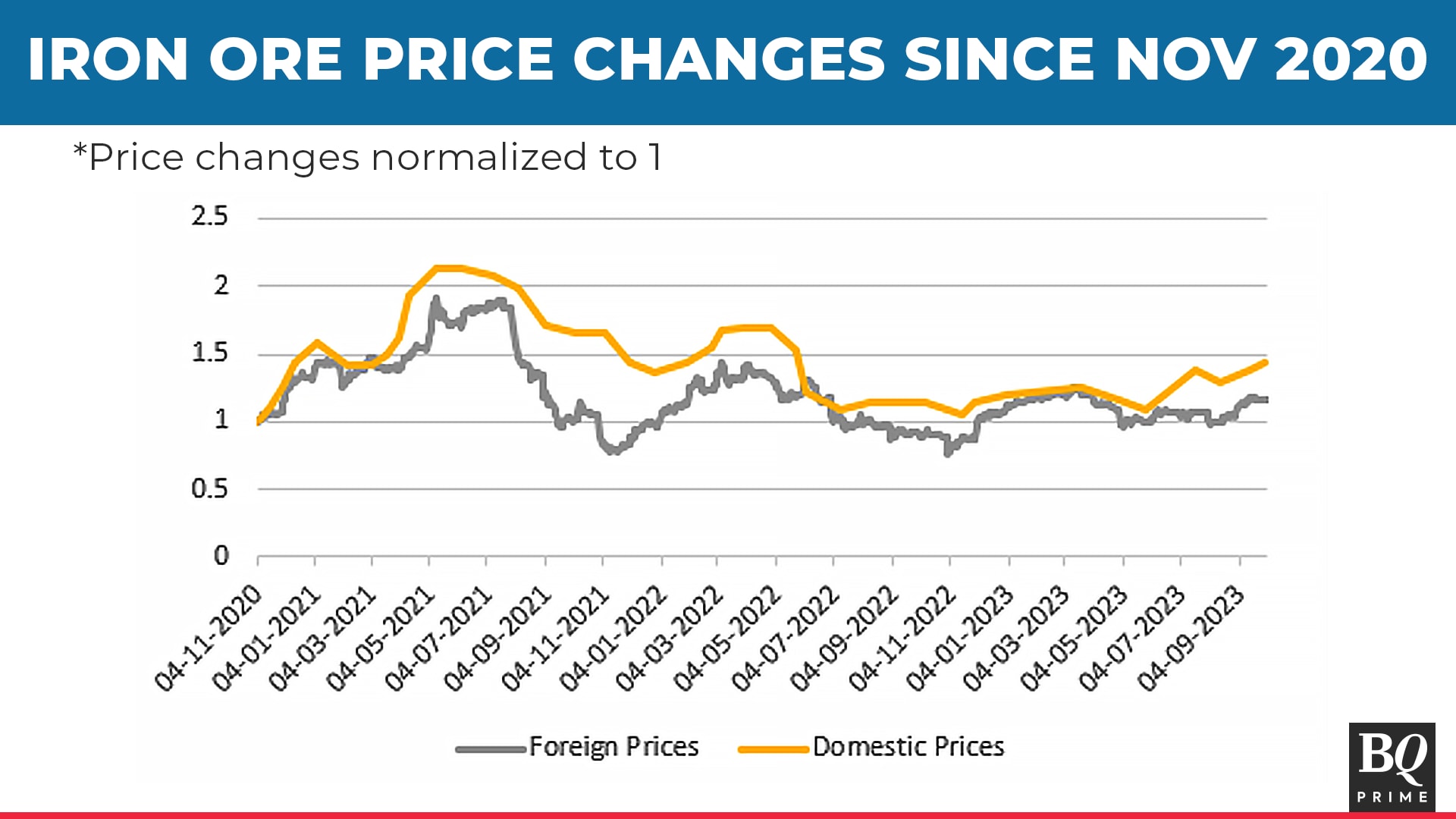

While NMDC Ltd.'s iron ore prices have risen by 12% since Aug. 15 to Rs 5,200 per tonne, it is important to note that their pricing mechanism changed after July 18 to include royalty, cess, other taxes and fees.

The inclusion of such costs contributes to 21–22% of the iron ore prices, as clarified by NMDC's management. Reducing the additional charges levied from the prices following July 18, the domestic price trend indicates a flattish trend from the highs noted in March.

Global markets have seen a surge of 26% in Chinese iron ore prices over the same period, currently around $130 per tonne.

Which Companies Will Be Impacted?

NMDC is poised to gain amid the increasing global iron ore prices, according to Tushar Chaudhari, research analyst at Prabhudas Lilladher Pvt.

This is attributed to the competitive advantage provided by the comparatively lower-priced domestic iron ores. However, the effects will be apparent only by the fourth quarter of the financial year due to the lagged impact on pricing, according to Chaudhari.

"If NMDC ramps up its production from Kumaraswamy mines, exports open up as an incremental avenue for growth. However, only if iron ore prices remain elevated, as 30% export duty would not benefit NMDC below $140 per tonne," the analyst said.

Metal players like JSW Steel Ltd. and Jindal Steel & Power Ltd., who depend on the Indian Bureau of Mines prices that are revised based on export prices, could bear the brunt of increasing costs, he said.

As of March 2023, JSW Steel obtained 41% of its iron ore needs from captive mines, while JSPL met 60% of its demand through its own mining operations.

Players like Steel Authority of India Ltd. and Tata Steel Ltd. will be insulated to an extent from the rising prices as they meet their iron-ore demands completely from their captive mines, he said.

Coking Coal Prices

Around 40% of the steel prices are attributed to coking coal, while iron ore prices account for around 15% of the total cost, according to Ritabrata Ghosh, vice president at ICRA Ltd. Hence, volatility in coking coal prices dictates the impact that follows on steel prices.

"However, (the) recent sharp uptick in coking coal prices can put pressure on margins from the fourth quarter unless global steel players are able to take price hikes," Chaudhari said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.