HDFC Bank Shares Hit Three-Month Low After ADRs Slump Over 6% Overnight

The drop in the HDFC Bank shares also comes after the lender reported its Q3 business update.

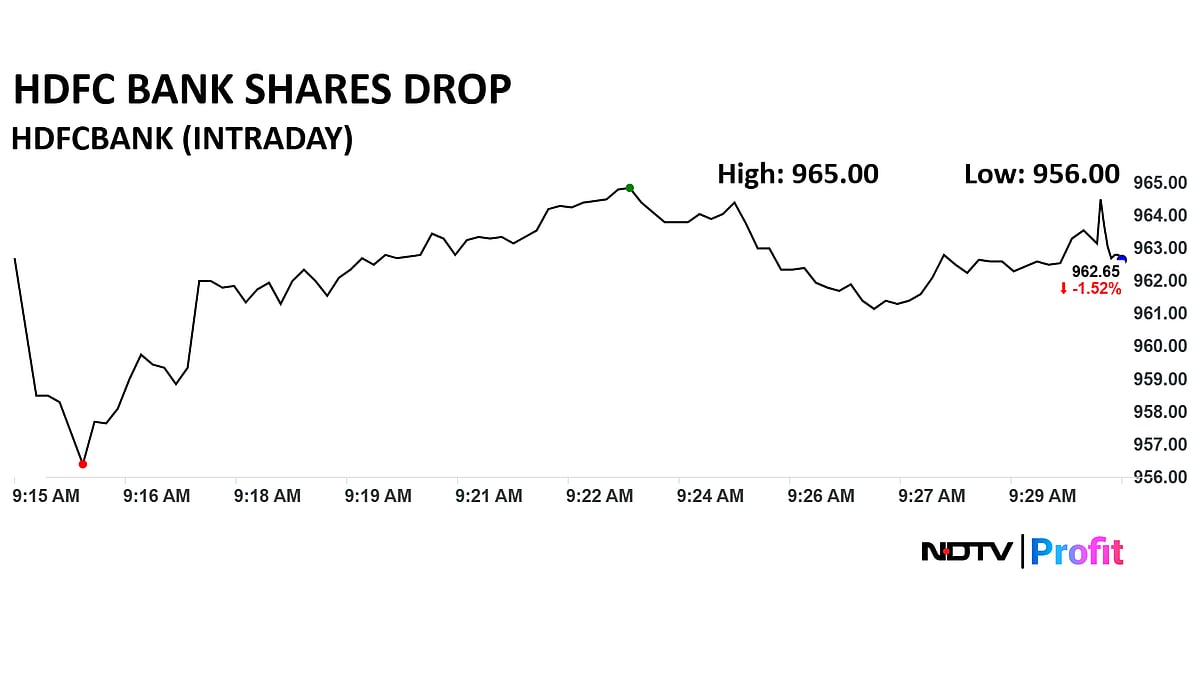

Shares of HDFC Bank dropped 1.51% leading to a three-month low with stock trading at Rs 962.85 apiece. On Monday, the stock closed at Rs 963.55 on the National Stock Exchange and on the BSE, while it opened lower on Tuesday at Rs 957.35.

The drop in the HDFC Bank shares appears to be the 6.33% crash in its American Depositary Receipts (ADR) overnight.

However, the fall in HDFC Bank shares also comes after the lender reported its Q3 business update. HDFC Bank registered a 12% increase in loan growth at Rs 28.44 lakh crore in the December quarter.

Total advances were Rs 25.42 lakh crore at the end of December 31, 2024, HDFC Bank said in a regulatory filing.

The lender reported a 12 per cent rise in average deposits to Rs 27.52 lakh crore, as against Rs 24.52 lakh crore at the end of the third quarter of the previous financial year.

The bank's average advances under management (advances grossing up for inter-bank participation certificates, bills rediscounted and securitisation/assignment) were Rs 28.63 lakh crore for the quarter under review, registering a growth of about 9% over Rs 26.27 lakh crore in the year-ago period.

HDFC Share Price Today

HDFC Bank Share Price Today

The scrip fell as much as 1.52% to Rs 962.55 apiece. This compares to a 0.12% decline in the NSE Nifty 50 Index.

Total traded volume so far in the day stood at 17.37 times its 30-day average. The relative strength index was at 51.83.

Out of 48 analysts tracking the company, 46 maintain a 'buy' rating, two recommend a 'hold,' rating and none maintain a 'sell' rating, according to Bloomberg data. The average 12-month consensus price target of Rs 1157.93 implies an upside of 20.1%.