011123-2.jpg?downsize=773:435)

Share price of HDFC Bank Ltd. surged to an all-time high on Thursday. This follows a strong performance on Wednesday, when the stock gained 1.78%. The recent uptick in the stock comes as the bank continues to make strides in both its financial performance and customer outreach. The market cap of HDFC Bank stood at Rs 14.01 lakh crore when the stock hit all time high level.

The strong momentum in HDFC Bank's shares coincided with the launch of its Pragati Savings Account on Wednesday, an initiative aimed at addressing the banking needs of rural and semi-urban residents across India. This new savings account is part of HDFC Bank's broader strategy to expand its reach to underserved markets and cater to the diverse needs of India's vast population, Business Standard reported.

In addition to this, the bank announced a partnership with BigHaat, an agri-tech platform that empowers over 17 million farmers. Through this collaboration, HDFC Bank customers will receive exclusive discounts on farming tools, seeds, and fertilisers via BigHaat's online marketplace. The initiative also promises competitive pricing and access to high-quality agricultural products, further strengthening the bank's commitment to financial inclusion and rural development, BS said.

The stock's rally has been fueled by the positive sentiment around these initiatives, along with HDFC Bank's robust growth in its core business operations.

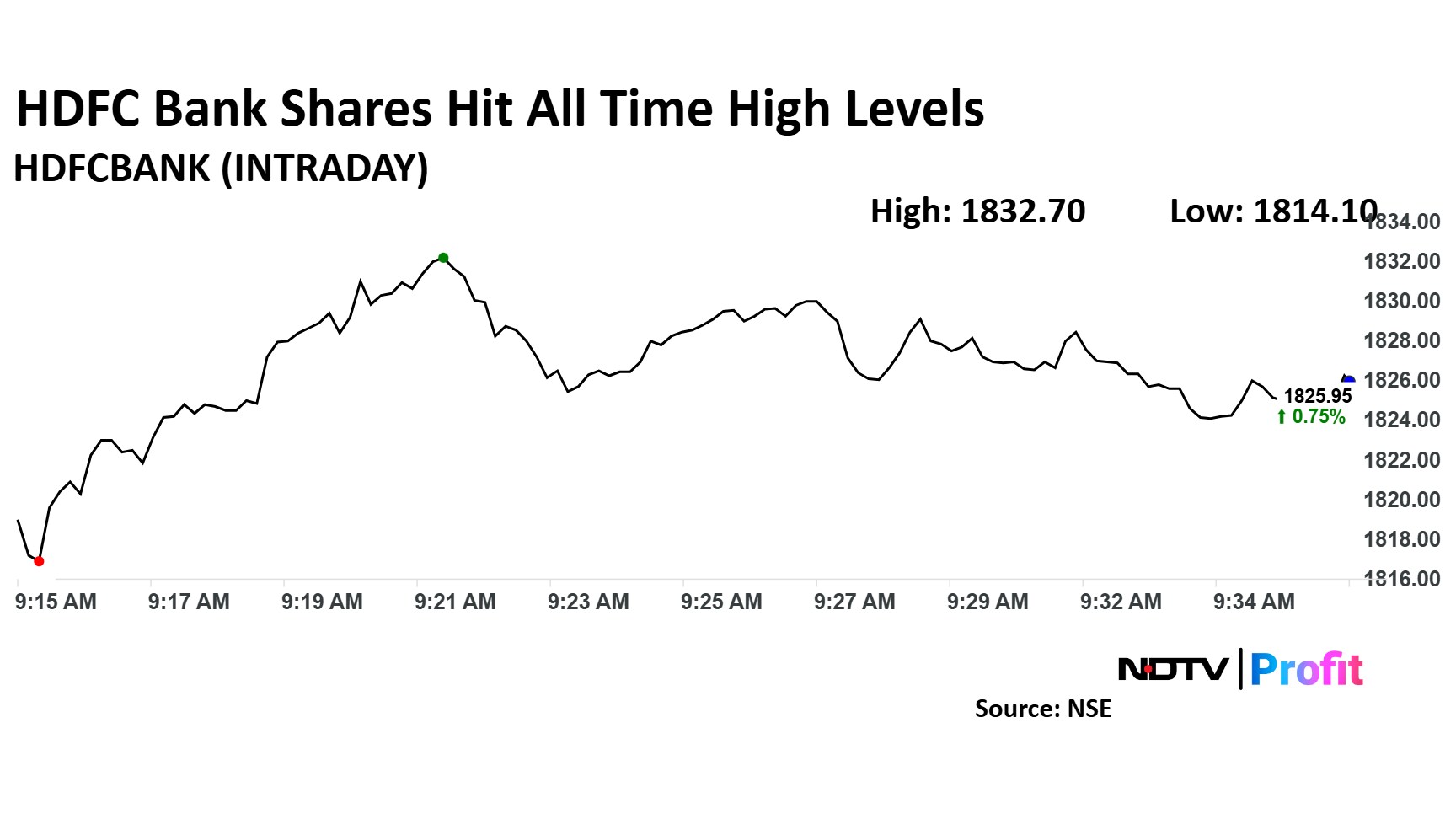

HDFC Bank Share Price

Shares of India's largest private bank rose as much as 1.13% to Rs 1,832.70 apiece. They pared gains to trade 0.95% higher at Rs 1,829.50 apiece, as of 09:33 a.m., compared to a 0.01% decline in the NSE Nifty 50.

The stock has risen 19.68% in the last 12 months. The relative strength index was at 67.53.

Out of 47 analysts tracking the company, 40 maintain a 'buy' rating and seven recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 7.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.