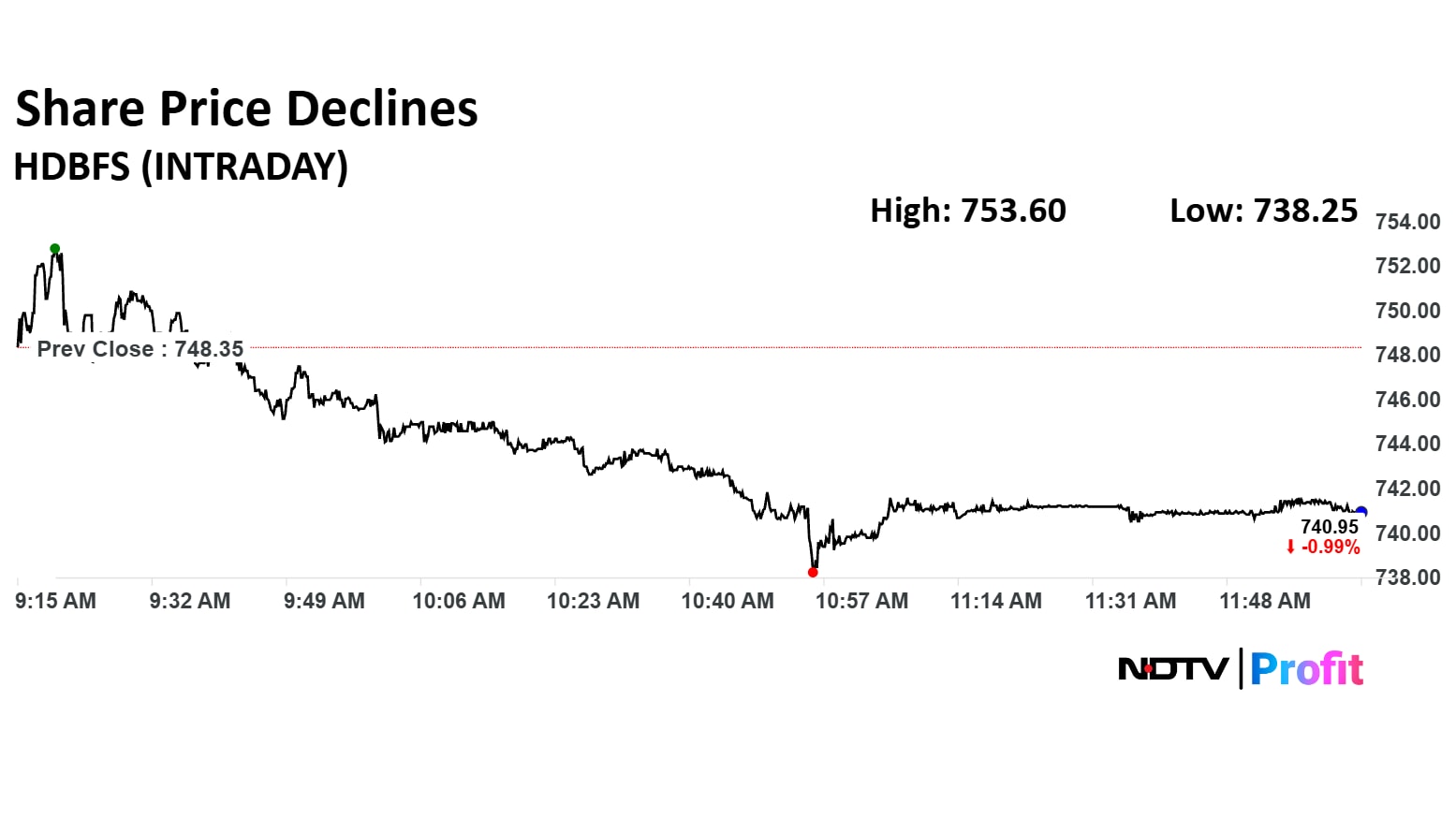

HDB Financial Services Ltd. found itself on thin ice on Monday after the newly listed company's stock went 1.4% below its IPO price of Rs 740 on August 4.

Troubles began for the company after it reported its first-ever earnings as a listed company on the exchanges on July 15, in which its gross and net non-performing assets both rose.

The Non-Banking Financial Company's IPO was met with heavy investor confidence, partly because it is the lending arm and a wholly-owned subsidiary of HDFC Bank. Another reason being that the Rs 12,000-crore IPO was the fifth-largest issue so far in India, following the public offers of Hyundai Motor India, LIC, One97 Communications (Paytm's parent), and Coal India.

The stock has declined nearly 12% since its results for Q1FY26 came out in which NPAs and credit costs inched up and provisions impacted profitability.

The NBFCs' Gross NPA ratio came at 2.56% versus 2.26%, up 30bps QoQ, and Net NPA ratio came at 1.11% versus 0.99%, up 12bps QoQ. Moreover, the bank's Credit cost was at 2.5% versus 2.4%, up 10bps QoQ.

The scrip fell as much as 1.35% to Rs 738.25 apiece. It pared losses to trade 1% lower at Rs 740 apiece, as of 12:07 a.m. This compares to a 0.43% advance in the NSE Nifty 50 Index.

It has fallen 11% since its listing on July 2. The relative strength index was at 27.

Only one analyst is tracking the company and they maintain a 'buy' rating, for the stock according to Bloomberg data. The average 12-month consensus price target implies an upside of 21.5%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.