HCLTech Ltd.'s share price rose to a record high as the company upgraded its revenue growth guidance for financial year 2025, after its second quarter results were in line with estimates. HCLTech has raised the revenue growth guidance by 3.5–5.00% in the ongoing financial year, compared to 3–5%, earlier.

HCLTech reported a net profit of Rs 4,061 crore, 4.33% higher than Bloomberg's estimate of Rs 4,237 crore.

India's third largest technology company outperformed in the July–September period, Nirmal Bang Institution said, because of overall beat on dollar revenue, margin, and new deal wins.

The brokerage upgraded the stock rating to 'buy' and gave a target price of Rs 2,172 per share, which implies a 17% upside from Monday's closing price.

However, stock has gotten mixed ratings from analysts after its second quarter results were announced.

HCLTech also reported revenue, operating profit, and margin in line with analysts' expectations in the second quarter.

HCLTech Q2 FY25 (Consolidated, QoQ)

Revenue up 2.86% to Rs 28,862 crore versus Rs 28,057 crore (Bloomberg estimate: Rs 28,637 crore).

Ebit up 11.82% to Rs 5,362 crore versus Rs 4,795 crore (Bloomberg estimate: Rs 5,111 crore).

Ebit margin up 148 bps to 18.57% versus 17.09% (Bloomberg estimate: 17.8%).

Net profit down 0.51% to Rs 4,237 crore versus Rs 4,259 crore (Bloomberg estimate: Rs 4,061 crore).

The company declared dividend of Rs 12 per share.

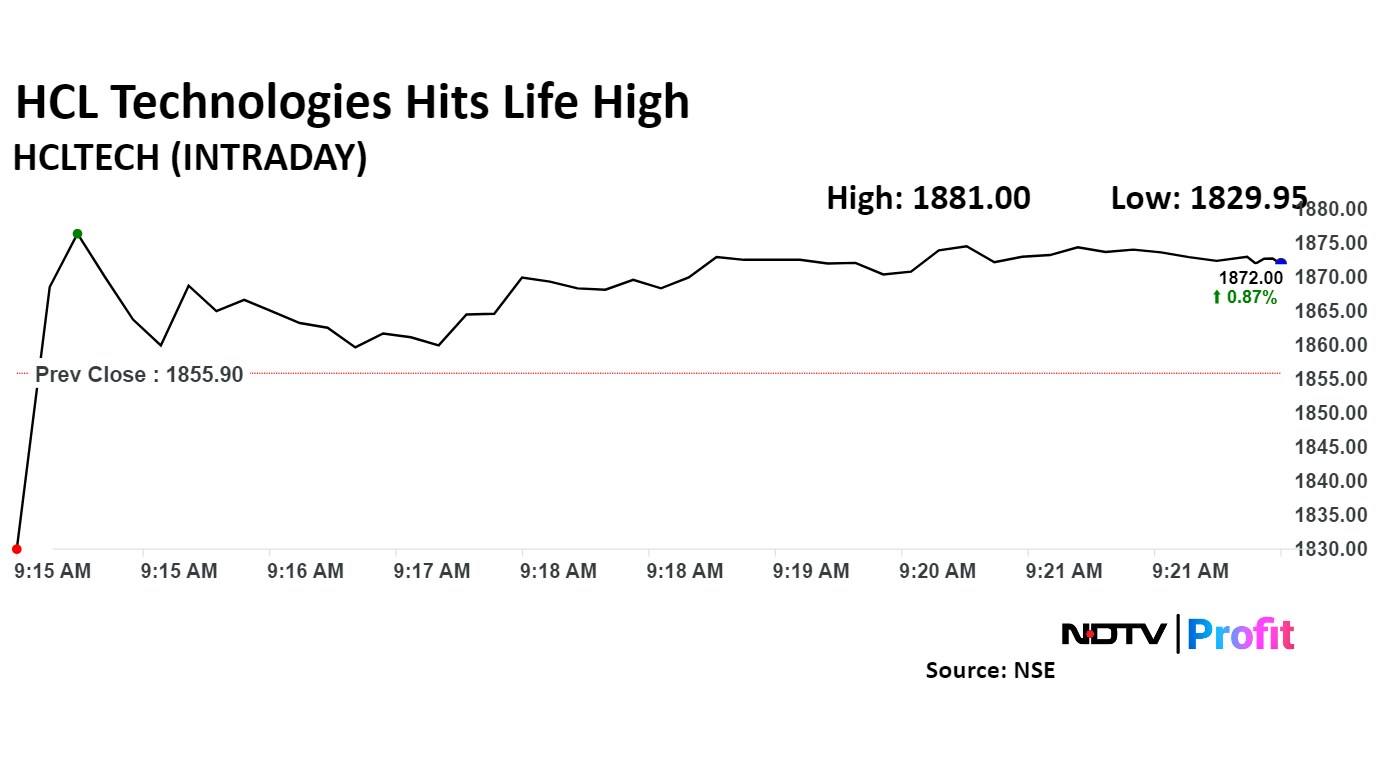

HCLTech Share Price Today

HCLTech share price rose 1.35%, the highest level since its listing on Jan. 6, 2000. They pared gains to trade 0.94% higher at Rs 1,873.35 per share as of 09:25 a.m., compared to a 0.24% advance in the NSE Nifty 50.

The stock has risen 47.57% in 12 months, and 28.2% year-to-date. Total traded volume so far in the day stood at 8.8 times its 30-day average. The relative strength index was at 70.77, which implied the stock is overbought.

Out of 43 analysts tracking the company, 19 maintain a 'buy' rating, 17 recommend a 'hold' and seven suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 1.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.