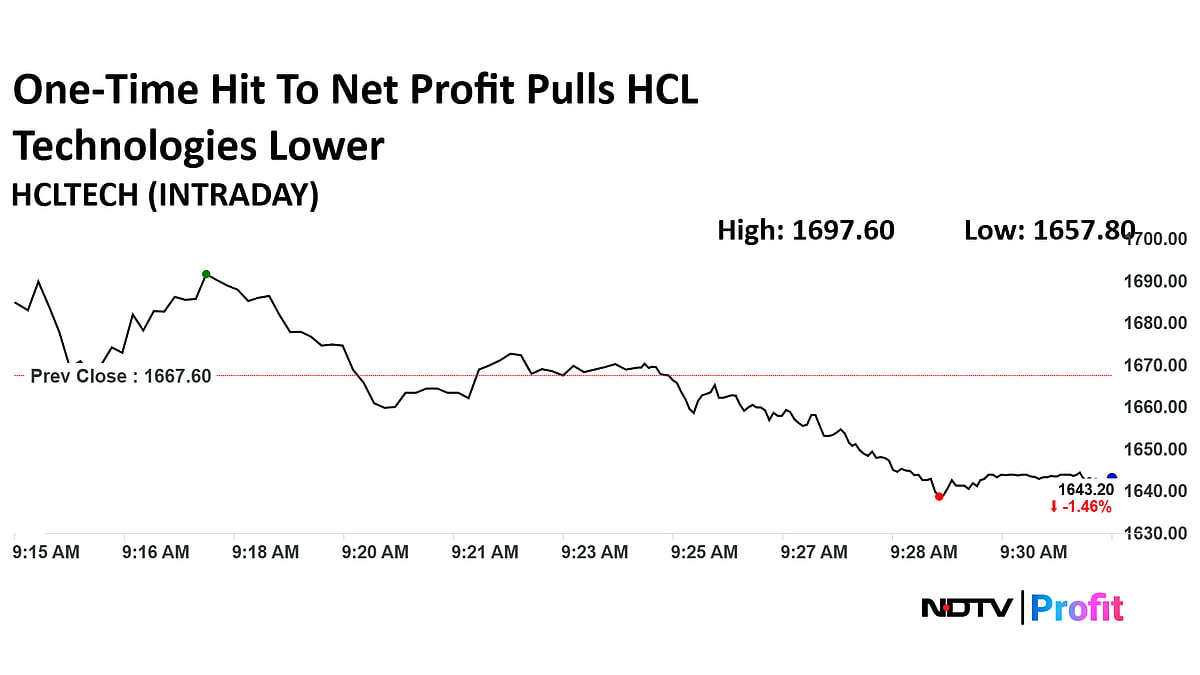

HCLTech Share Price Dips After One-Time Hit On Q3 Net Profit

The implementation of the New Labour Codes led to a one-time increase in employee benefit provisions, estimated at Rs 956 crore, according to the statement.

.%20(Photographer_%20Vijay%20Sartape%20_%20Source_%20BQ%20Prime)%2015_01_2023..jpg?auto=format%2Ccompress&fmt=avif&mode=crop&ar=16%3A9&q=60)

Shares of HCL Technologies Ltd. are in focus today, after the company's net profit fell sequentially in the third quarter of the current financial year due to a one-time impact of new labour codes.

The stock is trading over 1.6% lower, at Rs 1,639.90 apiece. It has also fallen nearly 18% in the past 12 months. Of the 47 analysts, tracked by Bloomberg, who have coverage on this stock, 23 analysts have a 'buy' call, 16 have a 'hold' view, and eight have a 'sell' call on the stock.

The IT giant reported a consolidated bottom-line of Rs 4,076 crore in the October-December period, compared to Rs 4,235 crore in the preceding quarter, according to an exchange filing on Monday.

HCLTech Q3 Results (Consolidated, QoQ)

Revenue up 6% at Rs 33,872 crore versus Rs 31,942 crore (Estimate of Rs 33,201 crore).

Net profit down 3.8% at Rs 4,076 crore versus Rs 4,235 crore (Estimate of Rs 4,702 crore).

EBIT up 14.2% at Rs 6,285 crore versus Rs 5,502 crore (Estimate of Rs 6,054 crore).

EBIT margin at 18.6% versus 17.2% (Estimate of 18.2%).

The operating margin included a 81 basis points impact of restructuring cost.

New Labour Codes Impact

The implementation of the New Labour Codes led to a one-time increase in employee benefit provisions, estimated at Rs 956 crore, according to the statement.

HCTech reported a nearly 20% quarter-on-quarter growth in revenue from its advanced artificial intelligence segment, reaching $146 million in constant currency.

The company’s order book expanded by 17% sequentially and 43% year-on-year, totaling $3 billion in the third quarter.

Among business units, HCLSoftware delivered the strongest performance with a 28.1% rise, while the IT services segment recorded a 1.5% increase on a QoQ constant currency basis.

Guidance Outlook

HCLTech has revised its full-year revenue growth guidance in constant currency terms to a narrower range of 4%–4.5%, compared to the earlier projection of 3%–5%.

The company has also upgraded its services revenue growth outlook to 4.75%–5.25%, up from the previous estimate of 4%–5%. Meanwhile, the EBIT margin guidance remains unchanged at 17%–18%, excluding the one-time impact of the new labour codes.